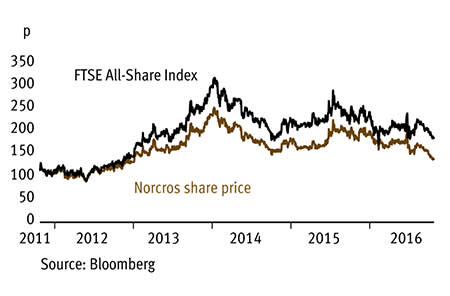

Spot the odd one out; profits at shower and bathroom accessories specialist Norcros (NXR) have nearly doubled in the past three years, the dividend is up over 50 per cent, and from a peak in September 2014, the share price has nearly halved. This leaves the shares priced at five times forecast earnings and offering a nearly four-times covered prospective yield of over 5 per cent this year.

- Bumper, well-covered yield

- Currency headwinds easing

- Acquisitions performing well

- Pension recovery plan agreed at marginal extra annual cost

- Reported pension deficit likely to increase

- Mixed trading conditions in the UK

Clearly, investors are spooked. The list of bogey men includes a large and fast-rising pension deficit, mixed trading in the UK exacerbated by Brexit angst, currency headwinds and a decline in cash conversion last year. All this does little to foster faith in Norcros's acquisitive-growth strategy. However, on closer inspection, we think there are reasons to be sanguine.

Last year the pension deficit rose by £12m to £56m and falling bond yields mean it's likely to be higher when interims are released on 17 November. However, comfort comes from a recently agreed 10-year plan that increases Norcros's annual recovery payments by only £400,000 to £2.5m-plus CPI. Furthermore, the scheme is mature with two-thirds of members already pensioners with an average age of 77, so pension payouts should already be peaking.

Falling public sector spending and a weak DIY market have led to a 5 per cent fall in first-half UK like-for-like sales, although sales linked to new build and housing transactions remain strong. More importantly, though, the success of the three noteworthy acquisitions over the past three years should help mitigate concerns. For example, bathroom accessories specialist Vado, bought in March 2013, has delivered 10 per cent sales growth a year and operating profits growth of 23 per cent a year. Last year's acquisitions of shower accessories specialist Croydex and kitchen accessories group Abode are also doing well. Meanwhile, other parts of the business are benefiting from self-help and UK underlying operating margins jumped from 9.2 per cent to 10.6 per cent last year.

There's also cause for cheer about the group's South African business, which accounts for half of sales on a constant currency basis. The rand's weakness has masked strong underlying growth over recent years, but this has started to go into reverse. First-half revenue rose 8 per cent or 10 per cent on a constant currency basis, and last year margins were up 120 basis points, to 5.6 per cent.

The group remains on the acquisition trail and is sticking by its 2018 sales target of £420m. The strong performance by Vado and Croydex means the group's underlying return on capital employed of 18.3 per cent already outstrips a target of 12 to 15 per cent. Acquisitions and a drop in cash conversion due to stock-building to support the growth of Vado, Croydex and South Africa, meant net debt rose from £14.2m to £32.5m last year. However, this has now dropped to about £28m and a £100m debt facility provides plenty of acquisition fire-power.

| NORCROS (NXR) | ||||

|---|---|---|---|---|

| ORD PRICE: | 138p | MARKET VALUE: | £85m | |

| TOUCH: | 138-140p | 12-MONTH HIGH: | 208p | LOW: 137p |

| FORWARD DIVIDEND YIELD: | 5.7% | FORWARD PE RATIO: | 5 | |

| NET ASSET VALUE: | 78p* | NET DEBT: | 68% | |

| Year to 31 Mar | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 219 | 14.6 | 28.0 | 5.1 |

| 2015 | 222 | 15.8 | 21.1 | 5.6 |

| 2016 | 236 | 20.4 | 24.6 | 6.6 |

| 2017** | 259 | 22.3 | 27.0 | 7.3 |

| 2018** | 268 | 23.7 | 28.7 | 7.8 |

| % change | +14 | +16 | +17 | +18 |

Normal market size: 1,500 Matched bargain trading Beta: 0.06 *Includes intangible assets of £44.7m, or 73p a share **Numis forecasts, adjusted PBT and EPS figures | ||||