This includes retail prices, commodities and financial assets. Stock markets can act as a hedge against currency devaluation, the value of a company's stock matching exchange rate losses. It is not an accident that the stock indices of Argentina and Mexico set new record highs this year - as their currencies slumped to record lows. This is not always the case, though, as Istanbul's XU100 index is off 15 per cent this year despite the Turkish lira also moving to a record low 3.40 of the US dollar, while Russia's Micex index is at a new record high despite a 12 per cent appreciation of the rouble. A lesson that assumptions and correlations do not work all the time!

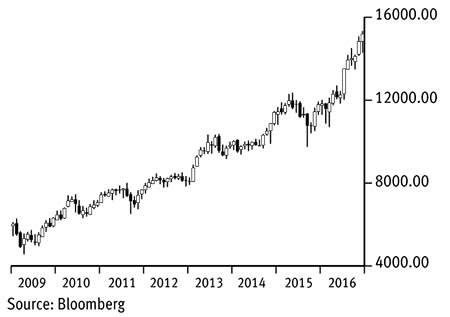

A reader asked me to look at four main indices in other currencies, ie not their own. I've used Bloomberg charts. First up the Dow Jones Industrial Average priced in sterling. Hard to believe, but the bull market that started in earnest in 1982 (at 800 points) recently hit a high at 15330. Over the past 14 months it has rallied a phenomenal 47 per cent, of which 19 per cent is down to the index itself and the other 28 per cent down to sterling weakness.

Dow Industrials in sterling

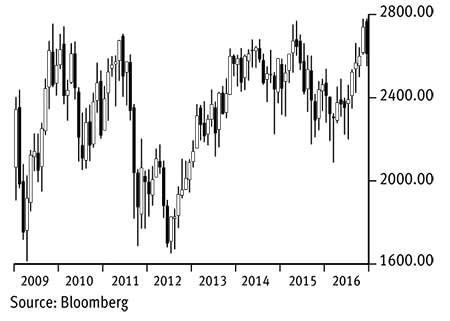

Looking at the Eurostoxx 50 index, its really big move was between 1991 and March 2000 when it rallied an unbelievable 573 per cent in euros, slightly less in pounds, as Europeans embraced the cult of the equity. Recently it has retested, and appears to have failed at the highs around 2750 (in sterling terms) which have capped since 2009's interim low. The recent retreat is down to sterling's small recovery against the euro (from €1.0940 to €1.1725). The chance of breaching resistance before year-end looks slim, suggesting that either the index itself will retreat or our currency will recover a bit more.

Eurostoxx 50 in sterling

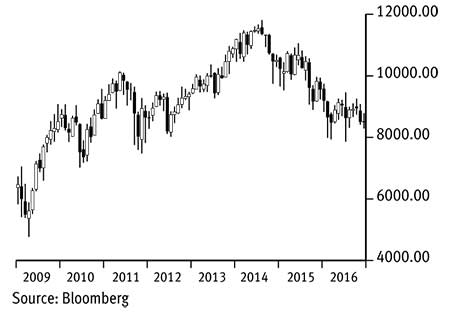

Over in the UK, we look at the FTSE 100 in US dollars. If anyone needed reminding, the index itself has been capped since the year 2000; cable's appreciation from 2001 meaning that in US dollar terms it did not peak until 2008 (at 14000). Now it's back down at a rather dreary 8000, swinging either side of here since 1999. It would therefore appear that the index itself is the more stable element of the equation and sterling the swing-o-meter.

FTSE 100 in US dollars

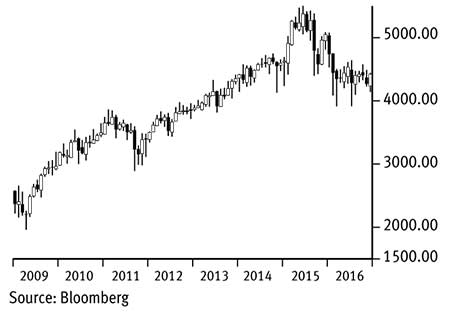

While setting a new record high recently, the euro-denominated FTSE 350 has struggled at 5550 since 2000. Its retreat since mid-2015 was caused entirely by the exchange rate moving down from €1.4400. Technically a break below 4000 suggests a drop to 3000, maybe currency-induced.

FTSE 350 in euros