Research from Colin Cieszynski at CMC Markets looked at the performance of several international indices last lunar year (of the monkey), then compared it with the average performance for that sign using data going back to the 1960s. While not the most profitable sign, which goes to the year of the pig and then monkey, we can expect decent returns for the rooster. For example, FTSE on average puts on 10 per cent, S&P 500 12 per cent, and the admittedly very volatile Hang Seng 36 per cent.

Turning back to China, its data are unreliable - all of it - so the only thing we can go by are market prices. This lies at the very core of technical analysis, which posits that everything everyone knows right now about the value of a freely traded instrument is contained in its current price. Those buying and selling might even be the very same people who are tweaking the data - usually to conform to state plans.

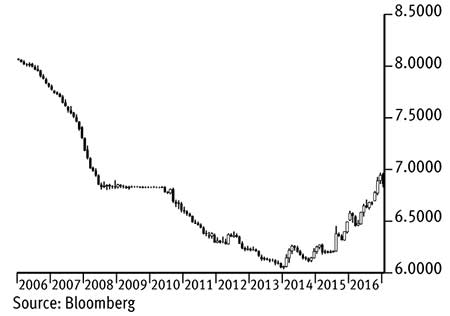

First look at the chart of the value of mainland yuan against the US dollar. An experienced eye can tell immediately that this is a managed exchange rate, not a freely floating one. From 2005 it appreciated from 8.0000 yuan per dollar to 6.8500 in 2008 - an attempt at toning down US rhetoric about it being a 'currency manipulator'. Stabilising through the financial crisis, it was then allowed to appreciate further to a record 6.0400 at the very beginning of 2014 - at which point the authorities decided that enough was enough. Matching the pace and extent of the previous move it has now reversed in a perfectly symmetrical rounded base. We currently favour a period of stability at what seems to be an acceptable equilibrium level around 6.8500.

Mainland yuan per $

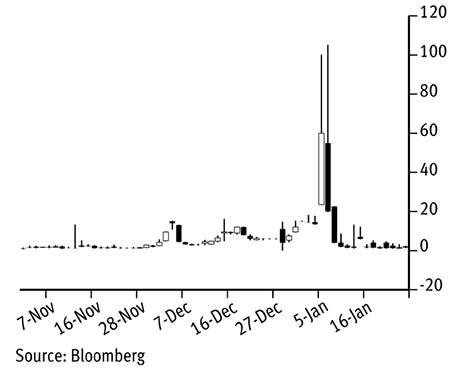

Battling to control the exchange rate around here for the past two months, strains have appeared in the mainland money market (so often a feature over the year-end, which in China is from late December all the way through to the end of the lunar New Year holiday). Demand for overnight cash soared - and remains well bid today, so much so that reserve requirements on several large banks have recently been eased. The overnight lending rate, used heavily by shadow banks for everyday funding as they don't have sufficient deposits, soared to around 80 or 90 per cent a year, exacerbated by the People's Bank of China's attempt at curbing their increasingly risky lending.

Overnight yuan lending rate

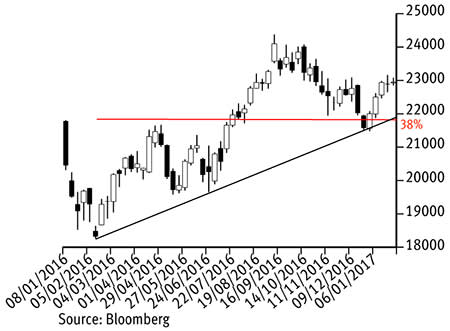

The effect rippled through to Hong Kong's interbank offered rates, which might be partly to blame for the correction lower in the Hang Seng index during the fourth quarter of 2016. The drop stopped at long-term trend-line support and the rally that dominated last year might well continue at least during the first half of the coming one.

Hang Seng index

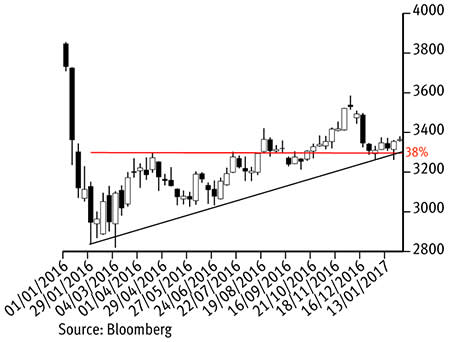

Notice how similar the chart for the CSI 300 index (top 300 shares in Shanghai and Shenzhen) looks, reminding us how close the ties between these two now are.

Wishing my friends and colleagues in China, Hong Kong and Taiwan a very Happy New Year.

CSI 300 index