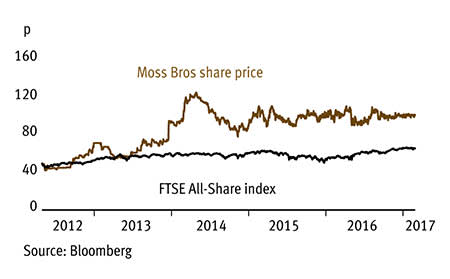

The high street is becoming a tougher place to compete, with consumers tightening purse strings and making more of online. But we feel clothing retailer and hire business Moss Bros (MOSB) is set to continue to buck the gloomy trend and has a 'flexible' store base that should help it deal with any challenges. Indeed, the company achieved a 20 per cent surge in profit for the year to the end of January, which was underpinned by growth in both like-for-like sales and gross margins. The generous full-year dividend also increased by 6 per cent thanks to the business's cash generation and alluring net cash position. Those numbers speak for themselves, and while the market grows nervous about consumer confidence in the UK and the second-half outlook, we see good reason to stay bullish about Moss Bros.

- Good margin protection

- Cash position

- Encouraging like-for-like growth

- Bumper dividend yield

- Possible second-half margin pressure

- Impact of late Easter

First, the group's top line has good momentum. Full-year retail like-for-like sales grew 6 per cent, with online sales up 15.7 per cent. Web-based sales now represent 11 per cent of the total. Retail gross margin also increased from 56.4 per cent to 58.6 per cent, which was driven by a combination of more disciplined markdown and promotional activity and a close eye on costs. For the current financial year, retail like-for-like sales growth of 4.3 per cent for the first seven weeks sits comfortably ahead of analysts' full-year forecasts. What's more, Moss remains hedged against foreign-exchange rates for the remainder of the spring/summer season, which should help it deliver further margin improvement.

That said, margins could face more pressure in the latter part of the year as management looks at targeting more competitive price points. A later Easter has also delayed the start to the wedding season for the hire business. The number of orders booked - a key metric for hire - was off 1 per cent year on year at the last count. But by the time the company reports half-year results, bosses believe these timing issues will have reversed out. And, overall, the hire business did well last year despite facing tough comparisons with strong prior 12-month trading. Bosses say there's been good demand across all ranges in 2017-18 so far, while options such as the 'Tailor Me' service - the group's new fast, alterations package - are expected to keep the momentum going as the board works to reinvent the hire side.

At a time when investors are increasingly focused on shop lease liabilities due to nervousness about the growth of online retail eroding the value of physical store estates, Moss Bros is revelling in the 'flexibility' of its 127-unit estate. The average lease length across the store portfolio is only 56 months and the board is targeting improved lease terms on renewal of a 10-year term with a tenant-only break clause at year five.

Further growth can also be expected from the online business and internationally. The new, fully device-responsive website only went live in the second half of last year, but mobile and tablet sales already represent 43 per cent of total e-commerce sales. The hire website is also gaining traction, with wedding customers often beginning their purchase online before completing it in store. The group's online capabilities enhance its international reach as well. Last year local websites were launched in Australia, while two stores in the Middle East were piloted via a partnership with Retail Arabia.

| MOSS BROS (MOSB) | ||||

|---|---|---|---|---|

| ORD PRICE: | 100p | MARKET VALUE: | £101m | |

| TOUCH: | 98-101p | 12-MONTH HIGH: | 111p | LOW: 89p |

| FORWARD DIVIDEND YIELD: | 6.5% | FORWARD PE RATIO: | 17 | |

| NET ASSET VALUE: | 37p | NET CASH: | £19.5m | |

| Year to 28 Jan | Turnover (£m) | Pre-tax profit (£m)* | Earnings per share (p)* | Dividend per share (p) |

|---|---|---|---|---|

| 2015 | 115 | 4.6 | 3.6 | 5.3 |

| 2016 | 121 | 5.9 | 4.6 | 5.6 |

| 2017 | 128 | 6.9 | 5.2 | 5.9 |

| 2018* | 133 | 7.2 | 5.6 | 6.2 |

| 2019* | 138 | 7.6 | 5.9 | 6.5 |

| % change | +4 | +6 | +5 | +5 |

Normal market size: 3,000 Matched bargain trading Beta: 0.26 *Peel Hunt forecasts, adjusted PTP and EPS figures | ||||