There's a current review by the Prudential Regulation Authority into the credit quality of banks' new lending, while the monster's other head, the Financial Conduct Authority, is looking over its rules and guidance on how credit providers make sure customers are worthy of it.

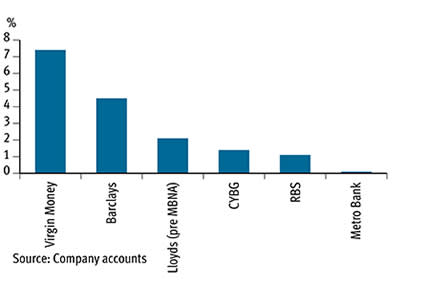

All this is creating disquiet about how a couple of listed retail banks have chosen to grow their personal loan books in a low interest rate environment. Let's start with Virgin Money (VM.). A big part of this retail bank's growth story has been the expansion of its credit card business. That hit £2.7bn at the end of the first quarter, close to its £3bn target and a big chunk of its overall customer loans and advances (see table, comparing end-2016 figures).

Credit cards as proportion of customer loans and advances

Virgin has come in for a few questions over how it accounts for credit cards that have an initial interest-free period. Banks have to state in their accounts an amortised cost of a financial asset, such as a loan, and then allocate for the period the interest income - or interest expense - depending on its performance. To do this, they calculate an 'effective interest rate' (EIR) that discounts the expected cash flows, including fees and attendant income, but excludes credit losses.

Virgin models future cash flows up to seven years from the point of origination, so often going beyond the promotional period. This means they have to "estimate customer behaviour, including card balance, transaction activity, repayment profiles and post-promotional retention rates based on previous customer experience".

If that sounds fairly flaky, I'd agree. Spreading the matched income and costs past the point at which customers start to incur a higher rate makes the lender a hostage to fortune. Some banks may internally model what kind of additional profits they would make from inactive customers, but baking them into the EIR could come back to haunt them. Last year, Virgin's audit committee spent "considerable time" understanding this methodology, per its annual report. That's no surprise.

The company's side of the story is that customer indebtedness is lower than the UK average, it has behavioural data going back to 2003, there are other transfer fees to consider (real money) at the outset, and 70 per cent of accounts keep transacting and incur additional interest during the promotional period.

Lloyds Banking Group (LLOY) has also turned up the risk dial with a move towards higher-margin consumer lending, including zero-rate balance transfer cards. "Lloyds is among the most cyclically-exposed UK banks," argue Berenberg analysts, contrasting it with Royal Bank of Scotland's (RBS) decision to grow its mortgage book at the expense of margins. Meanwhile, CYBG (CYBG) also saw its lending margin squeezed in 2016 by lower unsecured personal loan pricing as zero-rate cards proliferated.

Lloyds has bought the MBNA credit card business, which brings its own zero-rate products among its £7bn in assets. Still, the bank has said it is more prudent than some rivals, and it is therefore is less likely to suffer from a move towards purely cash accounting. Elsewhere, its Black Horse motor finance business grew by a fifth - organically - in 2016, with balances up to £15.6bn at the year-end. It also launched a personal contract purchase product for caravans and motorhomes. Such finance is another area of focus for regulators.

The concern is that Lloyds and Virgin Money could be growing in just the wrong places at just the wrong point in the cycle. The former's board spent "considerable time" last year considering the risks and other issues surrounding the MBNA acquisition. A profit focus in the short term can leave a lender chasing risky business. If credit card losses turn out to be back-end loaded, against a backdrop of worsening consumer credit, there could be tears before bedtime.