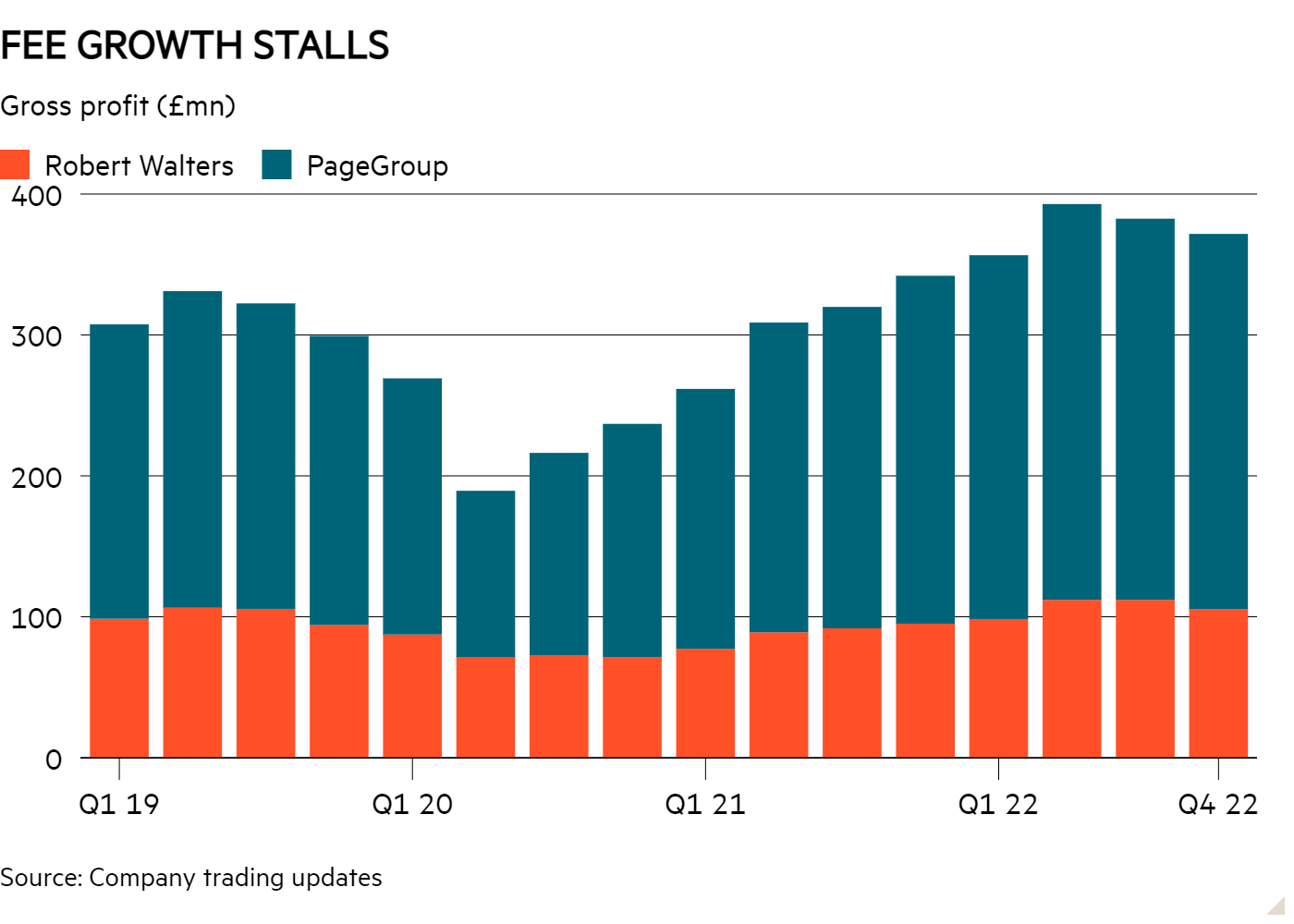

- Gross profit growth has slowed

- Businesses are seeking temporary staff

Recruitment giants have had a rocky start to 2023. In recent days, PageGroup (PAGE) and Robert Walters (RWA) have downgraded their full-year profit forecasts, warning that businesses are reining in their hiring plans and that candidates are shying away from changing jobs.

Momentum at Robert Walters slowed in the three months to 31 December 2022, with gross profit – often referred to as net fee income – rising by 8 per cent year on year, compared with18 per cent the previous quarter. It was a gloomier story at PageGroup, where gross profit grew by just 3.5 per cent year on year, compared with14 per cent in quarter three.

Robert Walters’ eponymous chief executive said the macroeconomic backdrop became “increasingly uncertain as the quarter progressed, resulting in a softening of recruitment activity levels across many of the group's markets”. The slowdown looks to have been sharper than management teams expected.

Robert Walters now expects profits for the year to 31 December 2022 to be “slightly below current market expectations”. Analysts at Jefferies predicted that consensus EPS estimates would fall by 10-15 per cent in response to the update. Meanwhile, full-year operating profit at PageGroup is now due to reach £195mn, compared with £204mn forecast in October.

Some areas of the labour market are more robust than others, however. Temporary recruitment is still growing strongly, as businesses seek out flexible options. At PageGroup, gross profit from temporary placements jumped by 18 per cent between October and December, while income from permanent placements dipped by 0.8 per cent.

This is not a particularly favourable dynamic for the largest recruitment groups, which generate between two-thirds and three-quarters of fees from permanent placements. However, it should help smaller companies such as SThree (STEM), which makes most of its revenues from contract work.

SThree – which is due to publish its full-year results on 30 January – could also benefit from its focus on science, technology and finance. US tech giants are now cutting swathes of jobs (see page 10), but PageGroup said its own technology business “continued to deliver standout results, up 35 per cent”, while Robert Walters said “financial services, commerce finance and technology recruitment activity levels held up” in the UK, despite the bleak economic backdrop.

Productivity problems

The biggest problem facing recruiters is not fee rates. On an earnings call, new PageGroup chief executive Nicholas Kirk said wage inflation is still running “somewhere between 4 and 5 per cent” in the UK and the US. Meanwhile, people are being offered pay rises of between 10 and 15 per cent to move jobs. This is lower than the “froth” seen in the firsthalf of 2022, when some workerswere offered pay rises of over 30 per cent to move positions, but is still decent for a company that typically receives a percentage of a candidate’s agreed salary.

The challenge is generating fees in the first place. PageGroup warned that candidate and client confidence was “deteriorating towards the end of the quarter” and that businesses were taking longer to make decisions. Candidates are also “more reluctant to accept offers”. As a result of this, productivity – measured by PageGroup as gross profit per fee earner – tumbled by 12 per cent compared with 2021.

The situation has been made worse by internal hiring sprees at recruiters. Total headcount at PageGroup was 9,020 at the end of 2022, compared with 7,763 in 2019. The tight labour market also encouraged Robert Walters to take on more staff, and headcount exceeded pre-Covid levels by around 6 per cent last year.

The situation is now starting to unwind. At Robert Walters, headcount peaked in November and declined in December “reflecting the more challenging market conditions”. PageGroup noted a similar decline. Analysts are keen to know whether lay-offs are on the horizon, but for now companies are relying on churn.

“Natural attrition is currently running for us at a relatively low rate, but could be in very high 20s or low 30s depending on the market, which would allow us to drop our fee earner headcount,” PageGroup’s Kirk said. ‘We expect our headcount to drift a little bit as we go into next year.”

It’s not all bad news. Both companies achieved record profit figures in 2022, albeit lower figures than they had originally hoped for. They also remain very cash-generative. Robert Walters had £96.4mn of net cash on its balance sheet at Christmas, while PageGroup had £131mn. Dividends should still be forthcoming, therefore. Indeed, Kirk told analysts he “would fully expect that we would be making a supplementary return of some magnitude to shareholders later on this year”.

Canny investors, however, willnot count their chickens beforethey’ve hatched.