It’s safe to say that things are not going well in China. While the rest of the world struggles to embed disinflation, China has gone one step further and managed to fall into deflation. Youth unemployment is increasing, and as ever with China, its property market, seemingly built on sand, is giving policymakers a headache. The problems just do not seem to end for the world’s second-largest economy. And unfortunately, China’s economic troubles are never confined to its borders and even UK investors are affected.

The fall into deflation, where prices start to fall, brings risks of an economic spiral. Consumers and businesses have no urgency to spend, as things could be cheaper tomorrow. In July, prices fell by 0.3 per cent compared with the previous year. Luckily, economists expect this to be temporary, but it’s never a good sign for an economy and really shows the disastrous effect of over-supply following the end of lockdown.

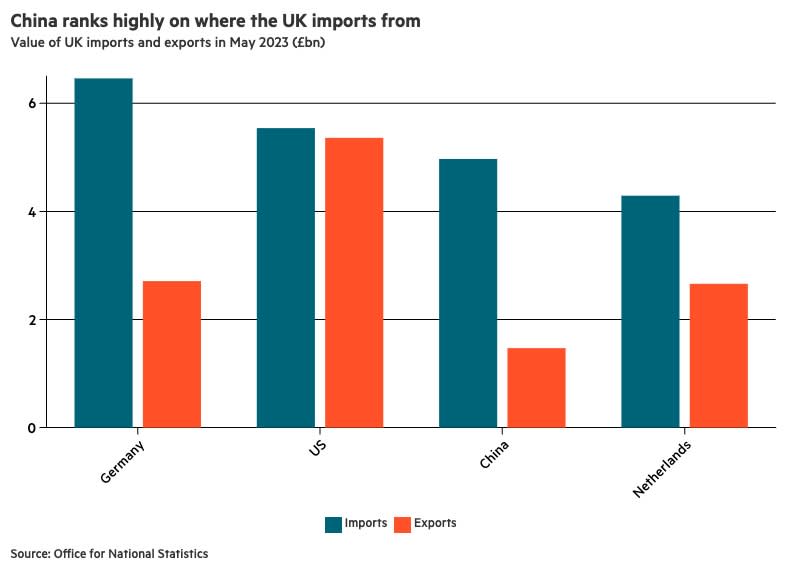

On the face of it, this could be a good thing for consumers at home. Total UK imports from China amounted to £69.5bn in the 12 months to the end of March 2023, according to the Office for National Statistics (ONS). This makes China the UK’s fourth largest trading partner. An argument could be made that cheaper Chinese could even help the UK’s own battle with inflation with Chinese goods helping domestic companies reduce input costs. However, the positive effects will be minimal given the UK’s inflation has been driven by food costs and wages, and the impact of producer prices is waning.

But, the flipside of this is that there there is also an increased risk of a drop in Chinese demand for UK exports. China ranks seventh out of all the UK’s export partners, official figures show. Victoria Scholar, head of investment at Interactive Investor, points out: “As a key trading partner, a softening Chinese economy is likely to have a negative impact on China-sensitive businesses listed in the UK such as Burberry (BRBY), Prudential (PRU), and miners such as Antofagasta (ANTO) and Anglo American (AAL).”

As Scholar points out, it’s bad news for the luxury goods market. If Chinese consumers are less economically secure, exporters will likely feel the strain. China had been the catalyst for sales for the likes of Burberry but also LVMH (FR:MC), which owns labels like Dior and Louis Vuitton.

Trading places

China also faces the conundrum of reduced incentives to invest. In a deflationary environment, the value of money increases over time, meaning that prices of goods and services are decreasing. This can lead to businesses delaying spending and investment, expecting prices to fall further. As a result, investors might hold off on investing in new projects or ventures, which in turn slows down economic growth. This will hurt China’s regional trading partners.

Scholar adds: “China is the largest trading partner to countries such as Japan, South Korea, Vietnam and Taiwan with its own economic weakness likely to have knock-on negative reverberations for these countries due to softening trade flows and slower economic activity.”

Solid foundations?

Country Garden, one of China’s largest developers, was unable to make coupon payments on its US dollar-denominated bonds earlier this month. Its latest profit warning said that half-year losses could reach $6bn, and the company suspended trading in some of its bonds. At the same time Evergrande, another property giant, has filed for bankruptcy.

China’s property sector has been the foundation of its economic growth, accounting for 30 per cent of the country’s economic output. Chinese property developers are failing to repay debts, which could mean that the crisis could spill over to other parts of the economy. Suppliers and small and medium-sized companies in construction will feel the contraction. And while overseas investors account for less than 5 per cent of Chinese shares and bonds, according to Natixis, the property sector accounts for more than half of global new home sales and home building. A continued slump could hurt global growth.

But this ongoing crisis is part of a much broader issue. Susannah Streeter, of Hargreaves Lansdown, says: “What we are seeing, as fears about the fragility of the real estate sector take hold, is growing expectations of falling demand from China for commodities and metals. This is having an effect on the share price of big international mining companies listed in London.”

Once heralded as an unstoppable economy, China has much to do to turn things around. A proposed stimulus package will not solve all of its problems.

Policymakers need to think of creative ways to bolster confidence in the property sector and stop the economy from falling further into deflation. Cutting interest rates is a start but still not enough. Streeter says: “So far, the support in lowering borrowing rates has underwhelmed, so hopes are being pinned on further interest rate cuts, an increase in government spending and more balm to help soothe the bruised property sector.”