Share prices at the London-listed tobacco giants have struggled to gain traction for years as the secular decline in the number of cigarette smokers in key markets, an increasingly tough regulatory outlook, and the growth of environmental, social and governance (ESG) concerns have combined to dull sentiment.

Since February last year, there has also been the headache of what to do with operations in Russia, the fourth biggest cigarette market globally. British American Tobacco (BATS) confirmed earlier this month that it had agreed a deal to sell its Russian and Belarusian businesses, a move which will remove around 3 per cent of both revenue and adjusted profit from the income statement.

Despite such headwinds, very attractive cash returns are on offer. The forward dividend yield at British American Tobacco sits at around 9 per cent. While such a level can typically set the alarm bells ringing, there are good reasons not to take fright when it comes to a company that has grown its annual dividend for a quarter of a century and has chunky cash margins to support payouts.

Saying that, the non-renewal earlier this year of a £2bn share buyback programme raised investor eyebrows regarding the company’s position on the return of capital. But buybacks are expected to recommence shortly, with management guiding that “we will review and consider our objective to sustainably return excess cash to shareholders” once leverage sits in the middle of its target range. This is expected by the end of this year.

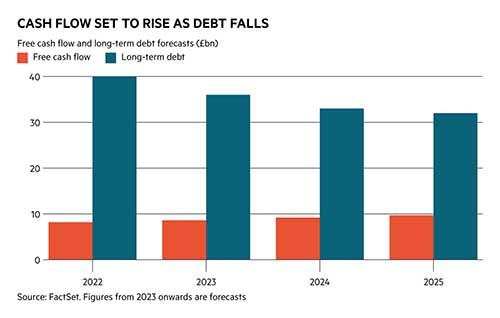

BAT's borrowings ballooned after the acquisition of US operator Reynolds American in 2017. But net debt (including lease liabilities) of 55 per cent at the latest balance sheet date looks manageable. Further falls are forecast in the coming years, which should help to improve sentiment.

The growth profile still suggests that the financial firepower is certainly there to support future payouts. The company forecasts that it will deliver around £40bn of free cash flow (before dividends) over the next 5 years.

Given the mixed outlook for traditional tobacco, progress with a pivot towards alternative products (such as vapour and oral) is an important support for future dividend growth. New categories revenue grew by 29 per cent in the latest half, with breakeven for the division approaching, and management is bullish about hitting its 2025 target of £5bn in annual sales. The move towards vaping products isn’t without complications, however, as the European Union’s ban on flavoured heated tobacco products (set to come into force on 23 October) demonstrates. Mooted bans on disposable vapes might be more beneficial for BAT, given its focus on the refillables market in countries including the UK.

Another payout risk to consider is the impact of the higher interest rate environment. Net finance costs rose by 13 per cent to £921mn in the latest half, and the company does have around £4bn of debt which matures in each of the next two years.

Based on noises from management, though, it looks safe to assume that dividends are still on a solid footing. Chief strategy and growth officer Kingsley Wheaton noted at a consumer staples conference in September that increased payouts are “something that I know a lot of our investors do care a lot about”. The company has reiterated its long-term commitment to pay out 65 per cent of adjusted profits as a dividend.

The dividend has grown at a compound rate of 5.5 per cent over a 10-year period. While expected growth rates are not as high as some of the increases made pre-pandemic, the FactSet analyst consensus for dividends per share to increase by at least 4 per cent in each of the next three financial years is certainly nothing to be sniffed at.