Trouble in Rio

It was another bad news week for Rio Tinto (RIO). The Serious Fraud Office has launched an investigation into the Australian mining giant regarding suspected historic corruption by the company, “its employees and others associated with it” in the Republic of Guinea. Last year, Rio reported itself to the fraud agency after discovering emails dating back to 2011, which related “to contractual payments totalling $10.5m (£8.1m) made to a consultant” involved in the Simandou iron ore project. An internal investigation by the commodities giant also led to the resignation of Rio’s long-serving legal and regulatory group executive Debra Valentine and the suspension of energy and minerals chief executive Alan Davies.

Goodbye leaseholds

Government proposes ban

Leaseholds on new-build houses could become a thing of the past if government proposals come to fruition. Communities secretary Sajid Javid said the plans – which will be subject to an eight-week consultation – would affect future sales, excluding very few exceptional circumstances such as houses that have shared services. Mr Javid said around 1.2m houses were leasehold in England and were rising rapidly, “exploiting home buyers with unfair practices”. Plans to set ground rents, which have increased significantly in recent years, to zero levels will also be subject to public consultation.

Acacia’s woes worsen

Tax bill issued

Acacia Mining (ACA) is finding it increasingly hard to operate in Tanzania. Despite strong production, a ban on unrefined gold is leading to big cash outflows and could soon force the closure of the Bulyanhulu mine. Since then, matters have worsened. First, the group was accused of taking a “militarised” approach to mine security by UK charity Rights and Accountability in Development. A day later, the Tanzanian government handed Acacia a $190bn tax bill, for what authorities claimed were undeclared sales, plus interest. Shares in the gold miner closed at 233p on half-year results day, but had sunk a further 30 per cent when we went to press.

Emissions eradicated?

End in sight

New diesel and petrol cars and vans will be banned in the UK from 2040, under proposals by environment secretary Michael Gove. The measure is part of the government’s air quality plan, which will make all new cars fully electric within the next 25 years. Local authorities will also be given funds for a range of measures, including changing road layouts or encouraging residents to use public transport.

Alphabet’s numbers

Google still growing

Reported numbers fromGoogle’s parent company Alphabet (US:GOOGL) were knocked by the $2.7bn (£2.1bn)fine imposed by the European Commission earlier this year. Half-year pre-tax profit fell28 per cent to $3.5bn, which sent the shares down 3 per cent on the day of the results announcement. Ignore the fine though, and the world’s biggest company is still beating expectations. Revenues were up bya fifth as both the Google search engine and YouTube continue to attract a growing proportion of the global advertising market.

Toyota’s 2020 vision

Any old ion

Reports have emerged that Toyota is close to a major breakthrough in electric car technology. The Japanese auto giant has reached the “production engineering” stage of development for a solid-state electrolyte battery, both smaller and lighter than the lithium-ion varieties currently in widespread use. The new technology could be in electric vehicles as early as 2020 with the potential to significantly boost the total charge capacity and extend the range of electric vehicles. Engineering such a battery at a realistic price point has been a challenge for manufacturers, so investors would do well to monitor Toyota’s progress.

Buy-to-let up

Credit demand growing

Despite market nerviness around the buy-to-let market following the increase in stamp duty last April, credit demand seems to be holding up for a challenger bank Paragon (PAG). Buy-to-let lending was up 2 per cent during the first nine months of the year, surpassing the £1bn mark. The proportion of professional landlords in the pipeline has risen to 70 per cent of the buy-to-let total during the third quarter, up from 62 per cent at the start of the year. Perhaps in a sign of relief, investors sent the shares up 5 per cent on the day of the announcement.

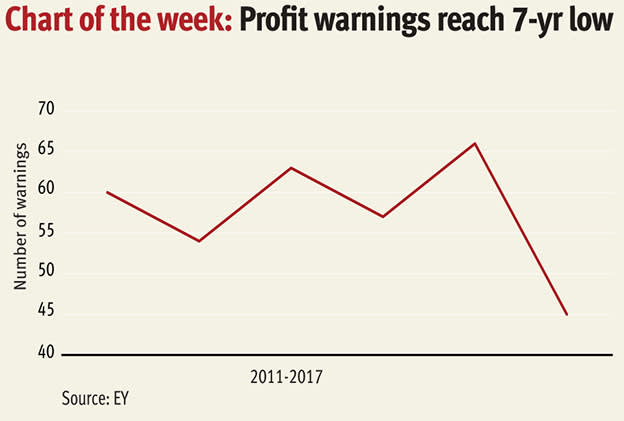

UK main market companies issued 45 profit warnings during the second quarter of this year – the lowest level in seven years. This was down from 66 warnings put out by FTSE groups for the same time during 2016 (see chart), according to research by EY.

However, analysts at the professional services group caution: “Earnings forecasts have dipped and the economy’s relative outperformance has enabled more companies to meet expectations.”

FTSE general retailers issued seven profit warnings, the highest number of any sector during the period.