Few sectors are beset by such irrationality and extreme sentiment as industrial mining. A year ago, supply for many base metals was tightening, and demand well supported by broad economic growth. Twelve months on, and supply remains tight, but the reality of underlying demand growth has been entirely overwhelmed by the impact of the US-China trade war, and the implications for the planet’s largest consumer of raw materials.

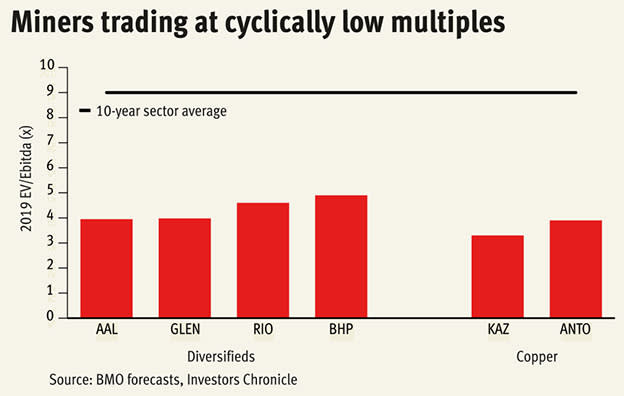

Seen through the lens of the short-term futures curve, the future is either golden, or terrible. Look to the share prices of the largest stocks in this patch – such as Rio Tinto (RIO) and Anglo American (AAL) – and you will see highly cash-generative companies trading on an enterprise value to cash profits multiple of less than five (see chart, below). Move further down the food chain to the equally high-margin copper group Kaz Minerals (KAZ) or Ukrainian iron ore pellet producer Ferrexpo (FXPO) – and you will see stocks in bargain territory, and multiples that suggest imminent bankruptcy.

It’s worth stating that, unlike the last major downturn, none of the stocks in the table below faces real existential questions. In fact, most boast very resilient balance sheets. So what’s up? The first thing to note is the strength of the US dollar, and the general weakness this has brought to commodity prices. It’s also worth presupposing that this negative sentiment could persist for much of the year ahead. In other words, mining stocks have been hit by a general lack of optimism, and an outlook analysts at BMO Capital Markets sum up as a “lack of demand catalyst air pocket”.

But the inherent cyclicality of commodities means the market cannot stay flat indefinitely, and 2019 should provide plenty of catalysts for share price moves either way.

Those moves could begin in March, which BMO sees as a pivotal period for commodities and general macroeconomics, and which will “set the scene for the rest of 2019”. And no, it isn’t Brexit that the bank’s commodity analysts have in mind, but the impact of a pause to tightening of US monetary policy, the end of the tariff-hiking ceasefire between the US and China, and what BMO describes as “the first tangible Chinese economic metrics after Lunar New Year”.

The other China question set to weigh on mining equity valuations is the country’s approach to industrial growth, and whether infrastructure spending could once again ramp up. This would naturally provide strong demand for industrial metals, although the jury is out on the size of any potential stimulus package. What is missing from this time last year is a booming shadow banking credit market, which has gone into reverse following heavy state intervention. But demand from the world’s largest resource consumer could still be propped up by a combination of tax cuts and a programme to fast-track the issuance of hundreds of billions of dollars-worth of local government bonds. Added to this, a potential pivot from the 'Made in China 2025' plan towards industrial self-reliance could ironically increase demand for steel ingredients, as the country reduces its import reliance on construction and agricultural equipment.

Despite their importance, fiscal stimuli won't drive the headlines for the largest miners this year. In 2019, we think those could come from an uptick in M&A activity, as extreme caution and a preference for shareholder returns give way to more aggressive strategic manoeuvres. BHP’s (BHP) stake-building in Ecuador-based copper-gold explorer SolGold (SOLG) could be instructive here, particularly as the largest miners have long-term bullish views on the red metal. At $2.57 per pound, copper now trades at a 20-month low.

| Name | Price (p) | Market cap (£m) | 12-month change (%) | Trailing PE | Forward PE | Dividend Yield (%) | Last IC View |

| Anglo American | 1,790 | 25,148 | 1.99 | 9.4 | 9.4 | 2.09 | Buy, 1,677p, 26 Jul 2018 |

| Antofagasta | 823.6 | 8,119.52 | -18.01 | 18.3 | 14 | 4.25 | Buy, 756p, 25 Oct 2018 |

| BHP | 1,600.4 | 33,801.57 | -0.41 | 10.8 | 11.9 | 4.27 | Hold, 1,620p, 21 Aug 2018 |

| Evraz | 459.1 | 6,626.42 | 23.05 | 4.3 | 6.2 | 11.07 | Hold, 554p,10 Aug 2018 |

| Ferrexpo | 202.7 | 1,193.14 | -34.66 | 4.9 | 5.4 | 2.5 | Buy, 195p, 3 Jan 2019 |

| Glencore | 290.25 | 40,558.63 | -28.69 | 8 | 8.5 | 4.93 | Hold, 323p, 8 Aug 2018 |

| Kaz Minerals | 535.6 | 2,400.73 | -42.06 | 6.2 | 6.3 | 0.0018 | Buy, 585p, 17 Aug 2018 |

| Rio Tinto | 3,897 | 49,662.92 | -2.68 | 9.9 | 11.2 | 5.81 | Hold, 3,999p, 1 Aug 2018 |