Entertainment giant Netflix (US:NFLX) is known as much for what it has destroyed as what it has built. The now monolithic streaming service-cum-entertainment-studio commands around a tenth of all television screen time in the US, but it was once a service for renting DVDs via the post. Few could have guessed in the early days it would displace Blockbuster DVD rental, once a staple of the high street and an essential part of the week for many families.

You can’t stay ahead forever, though, and in January Netflix’s letter to shareholders sounded an uncharacteristic note of fear over another upstart nipping at its heels.

Chief executive Reed Hastings wrote that the group lost more customers to online shooting game Fortnite than it did to prestige cable and satellite TV network HBO, broadening the field of competitors beyond those who produced TV shows and movies to include any form of entertainment that could fill screen time.

The success of Fortnite took many by surprise. It was first released in mid-2017 and now has 250m players. Revenues reportedly reached $2.4bn (£1.9bn) in 2018 – the highest ever for any computer game It is far from the only game out there, but Fortnite could represent the point when the wider world opened up to the potential offered by online games.

Now, the market looks set to become exponentially more appealing still. Tech giants such as Alphabet (US:GOOGL) and Microsoft (US:MSFT) have announced game streaming platforms, which will allow gamers instant access to games from anywhere with an internet connection. This, in turn, will make anyone with an internet connection a potential customer, with some arguing it increases the addressable market of gamers from around 250m today to 2.5bn.

Proponents argue it will do this by lowering the barriers to entry for gaming, while improving the quality of games broadly available. The current games market can be divided into simple, addictive mobile phone games that appeal to a broad audience, intended to be played for short amounts of time, and more complex, deeper games that require a console or specialised PC to play, and have a smaller but more dedicated following.

The promise of streaming is that it will offer high-quality gaming across any platform, without the need for specialised equipment. Instead of buying a PlayStation console and games, the likes of Stadia, Google’s forthcoming streaming offering, will allow people to play the same games across their PC, television, tablet and mobile devices with just a controller and a subscription. Gamers will be able to purchase games they want, but a growing library of games will be available at no extra cost.

By doing this, Stadia – and all streaming platforms – will allow people to access high-quality games at far lower cost by reducing the need for specialised equipment, while also offering drastically more advanced games than those currently available on mobile phones.

What’s more, streaming the games from a server, rather than downloading or purchasing physical copies, makes them immediately available. At present, even Fortnite requires a download to play. And gamers need to buy a console, a television and games, plus an internet connection if they want to compete online. Streaming potentially removes the need for everything but the internet connection.

The technology industries have a penchant for big promises, and investors would be right to question such claims. So will game streaming live up to the hype? And how can UK investors take advantage of the trend?

A new type of gaming?

In March this year, Google introduced Stadia, its video game platform that promises high-quality gaming across a range of devices with no download times. Broker Liberum said the announcement was an inflection point for the sector, “likely to mark the beginning of the video game streaming era”.

Others are planning to enter the sector, too. While many details are still unclear, Microsoft is working on a streaming platform known as ‘xCloud’, and a raft of others including Nvidia (US:NVDA), Sony (JP:6758), Nintendo (JP:7974) and even Amazon (US:AMZN) are working on streaming services in some capacity.

The impetus for doing so is clear – the number of global subscription streaming users doubled over the past two years, according to research by Morgan Stanley. The investment bank expects it to double again over the next three to five years.

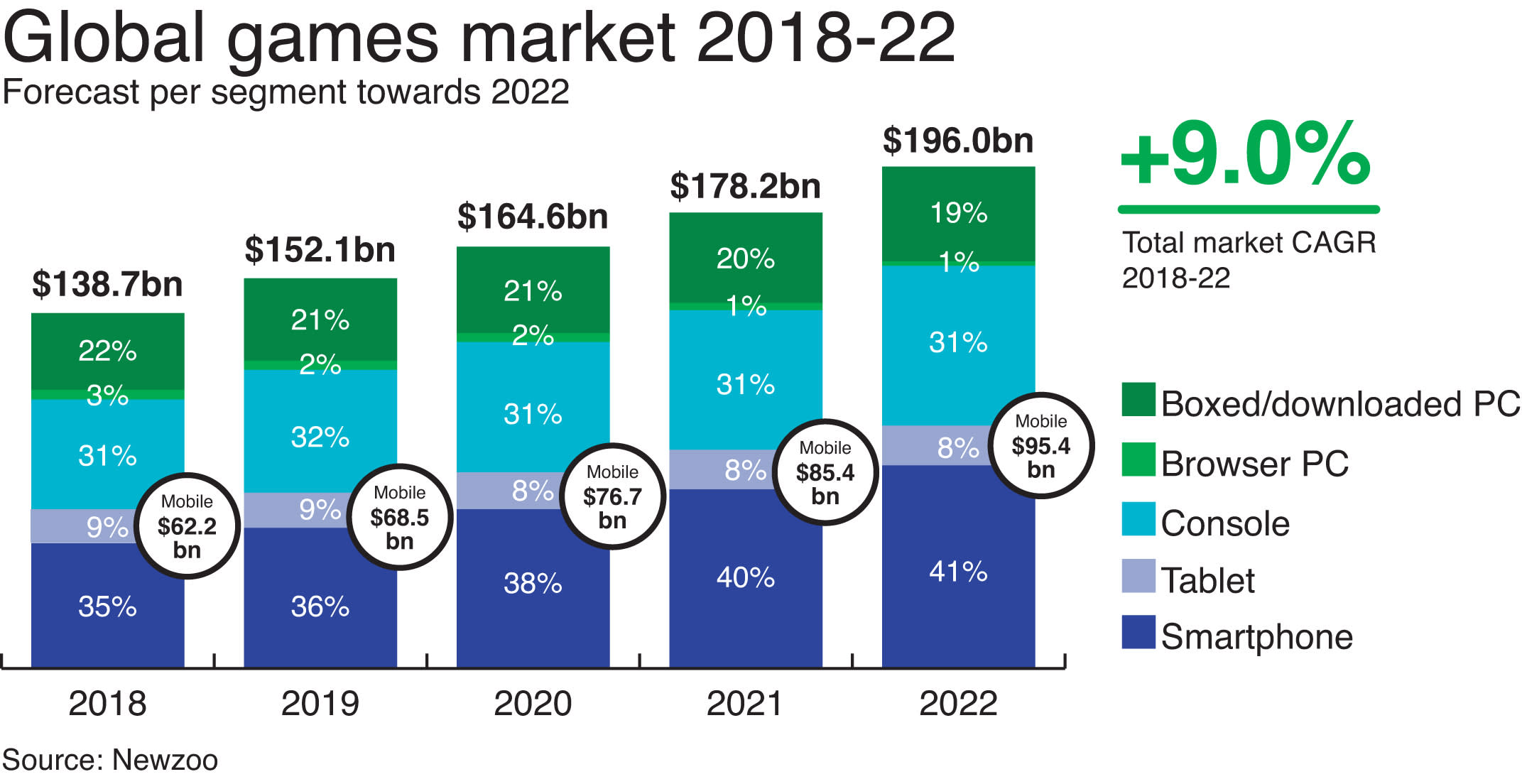

Concurrently, the games industry has grown rapidly as people have embraced new platforms. Data from market research group Newzoo calculated that the global games market was worth $70.6bn in 2012, of which 18 per cent was mobile gaming. It estimates the total market will be worth $152.1bn in 2019, with mobile gaming accounting for 45 per cent of that. What’s more, it estimates the total market will achieve a compound annual growth rate of 9 per cent between 2018 and 2022.

Video game streaming is – at least partly – a bet that these two trends will converge, and as subscriptions account for an ever-larger share of the global entertainment industry, people will increasingly use different platforms to consume the content.

Waiting on wifi

Given the potential for streaming to disrupt the console market, as well as the market for physical and downloaded games, companies such as Microsoft could end up cannibalising their existing businesses in these verticals. However, for all the talk of the disruptive impact of streaming, it is still constrained by some fairly pedestrian concerns. For all the high-tech images conjured up by the idea of ‘The Cloud’, this technology relies on standard telecoms infrastructure, such as cables and servers, to run. Streaming requires an internet connection, and a fast one at that. Stadia has a recommended minimum speed of 10 megabits per second (mbps), but speeds of 30 mbps and above are needed to get the most out of the platform’s capabilities, such as 4K picture quality and surround sound. The UK government is in the midst of a push to ensure all households in the country have access to a 10 mbps internet connection, and around 95 per cent of the country has access to such speeds now.

It is also unclear just how good the service will be at the minimum speeds. Already, committed gamers have access to high-quality games through consoles such as the PS4 and Xbox One, and it may be difficult to convince them to pay for streaming systems and subscriptions if they cannot be guaranteed a smooth service. Ed Thomas, principal technology analyst at data analytics group GlobalData, noted that so far very little is known about how well the systems will perform outside of the controlled conditions of a demonstration.

“We are talking about cloud gaming as though it is here right now,” said Mr Thomas. “I think we are still a year or more away from going to a Netflix-like service.”

A strong internet connection is especially important in gaming due to the interactive and competitive element. In addition to mbps, which measures how fast you can upload or download data, online games such as Fortnite rely on a fast ‘ping’ speed, essentially the reaction time of the internet connection. A slow ping speed can cause delays in response known as ‘lag’, a crucial problem in competitive games of skill.

In practice, this means that data centres need to be relatively close to the players. So streaming companies may find the expansion of their services is ultimately constrained as they move outside of major urban centres. It is for this reason that Google and Microsoft, with their wide-ranging server networks and global presence, are early favourites to lead the platform race.

In the meantime, it looks too early to declare the death of the console. Indeed, Sony is working on its fifth-generation Playstation console, and in early June Microsoft announced it was developing a next-generation console known as Project Scarlett, which will include an optical disk drive for playing off-the-shelf games. Both consoles are likely to include streaming capabilities, allowing for a combined service while cloud-based services are being perfected.

Success will depend on two things: streaming providers need to be able to provide a good level of service to a large number of consumers, which will require considerable physical infrastructure. They will also need to have a wide range of high-quality content for consumers to engage with. For investors happy to buy US shares, Google, Microsoft and to a lesser extent Amazon (whose rumoured streaming service has not been confirmed) all offer a chance to access the trend, but for those who prefer to buy companies closer to home, the UK has a compelling array of home-grown game developers well placed to benefit.

Competition for content

As the ascendant streaming platforms seek to differentiate themselves with content – looking to score a big hit in the same way Netflix and Amazon Prime did with House of Cards and The Man in The High Castle, respectively – money is expected to start flowing to game development studios. In the UK, that means groups such as Codemasters (CDM), Frontier Developments (FDEV) and Team17 (TM17).

One downside to subscription-based services is that compensation can be more complicated – or simply lower – than the old-fashioned percentage of each unit sold, as has been seen over the years with the backlash against music streaming platform Spotify by artists who felt undercompensated.

Google and Microsoft have not yet made their compensation policies public, but racing game developer Codemasters recently announced that GRID, one of its titles, would be available on Stadia at launch. The company told Investors Chronicle it would earn a 70 per cent split of revenues from the platform. Online game store Epic Games – creator of Fortnite – lets creators keep 88 per cent of revenues. Analysts argue game development’s high barriers to entry should ensure developers can command decent remuneration from platforms competing for their output.

The subscription model also offers benefits over conventional sales. In recent years developers have increasingly relied on consoles’ internet connections to update games once they had been released, fixing problems, issuing updates and even creating downloadable additions to create an additional revenue stream. Frontier Developments, for example, follows a strategy it calls ‘nurture and grow’, where it continually expands and develops its existing titles. Its space exploration title Elite Dangerous was launched in 2014, but generated its highest level of revenues in the 2018 financial year due to continual development.

As streaming becomes more ubiquitous – especially as the roll-out of 5G internet makes fast connections more widely available – it is expected to make high-quality, blockbuster titles such as the Red Dead Redemption series more widely available to customers at lower cost.

David Braben, chief executive of Frontier Developments, said this would help new types of games to penetrate the mobile market. “Most mobile games are the sort you play for a few minutes,” he said. “The streaming services are very good for broadening the market.”

Mr Braben’s thesis, if correct, offers a secondary opportunity for UK investors. The scale of large blockbuster titles often means developers rely on outsourced developers and technical support services companies such as Sumo (SUMO) and Keywords Studios (KWS).

Such an expansion in the market will undoubtedly exacerbate what can already be a hits-driven business. Big US games publishers such as EA and Activision published disappointing results earlier this year, which management blamed largely on the success of games such as Fortnite stealing audience share. As the number of high-quality games proliferates to capture growing audiences, franchises and branding will become increasingly important for building and sustaining a competitive advantage.

This is where Codemasters is especially compelling. The developer focuses heavily on racing titles, with a number of successful franchises such as DiRT Rally, GRID and the F1 series. The racing genre is one of the best established in gaming, with a broad appeal due to the fact that the games are easy for new gamers to pick up and play, but difficult to master.

“At some point, the issue will be discovery,” said Frank Sagnier, Codemasters’ chief executive. “This is where branding is helpful… having a brand that means racing is important to us.”

Of course, in such a world nobody is better placed to compete than the platforms themselves. Just as Netflix has become a powerful studio in its own right, both Microsoft and Google have their own development studios. Platforms will tend to have better access to usage data than standalone developers, giving them a crucial edge when developing new concepts. However, Mr Braben was unconcerned by the prospect of having to face off against such powerful competitors, noting that Microsoft’s game studios have “happily coexisted with the games industry for years already”.

What’s more, as content is likely to be a key differentiator between platforms, developers may find they are attractive takeover targets. Microsoft’s acquisition record already provides evidence for this, acquiring eight game development companies since the start of 2018. The money is beginning to stream, and there’s little chance of anyone stemming the flow anytime soon.