Stock markets recovered as data shows the rate at which coronavirus is spreading outside China has fallen drastically. The FTSE 100 recovered strongly on Tuesday and Wednesday, following stabilisation on Asian and European bourses.

Outside China, the overall daily growth rate in cases of 2019-nCov is now around 4 per cent, the World Health Organisation situation reports show, which analysts at Shore Capital interpret as a sign the world is implementing lessons learned from the 2003 Sars outbreak. Crucially, to date, the target of preventing self-sustaining outbreaks internationally is being met.

Most of the 42,968 cases worldwide have occurred in China. Although this is more than the case burden of Sars at the same stage, encouragingly the rate of identification, the number of serious cases and the death rate are all declining. Shore Capital’s note cautions the virus has a long incubation period, meaning instances of new cases could be “lumpy”, but asset markets are responding positively to signs the crisis may not be as long or as damaging as first thought.

Jumping risk premiums present new opportunities

Cautious notes on asset allocation from a week ago are worth re-reading for ideas if the newsflow from China continues to improve. Société Générale’s Cross Asset Research team was clear it would not recommend adding risk to portfolios before the coronavirus situation stabilises. It may still be jumping the gun to suggest we’re at this point, but opportunities to play a recovery later in the year should be on investors’ watchlists.

While predicting the timing of recessions is difficult, the SG team advocates protecting against the possibility and US Treasuries are their sovereign bond of choice as a portfolio stabiliser. Although, when it comes to haven assets, they prefer gold to either the US dollar or Japanese yen.

The market was net short US Treasuries at the turn of the year and both a flight to safety since the coronavirus story broke and the rush of traders (who had expected the US economy to accelerate in early 2020) to cover short positions had combined to suppress yields.

SG also believes pessimism built in on Japanese equities should eventually provide a buying opportunity. “[Japanese equities] are no longer burdened by the risk of potentially fast Yen appreciation, which investors had been fearing previously.”

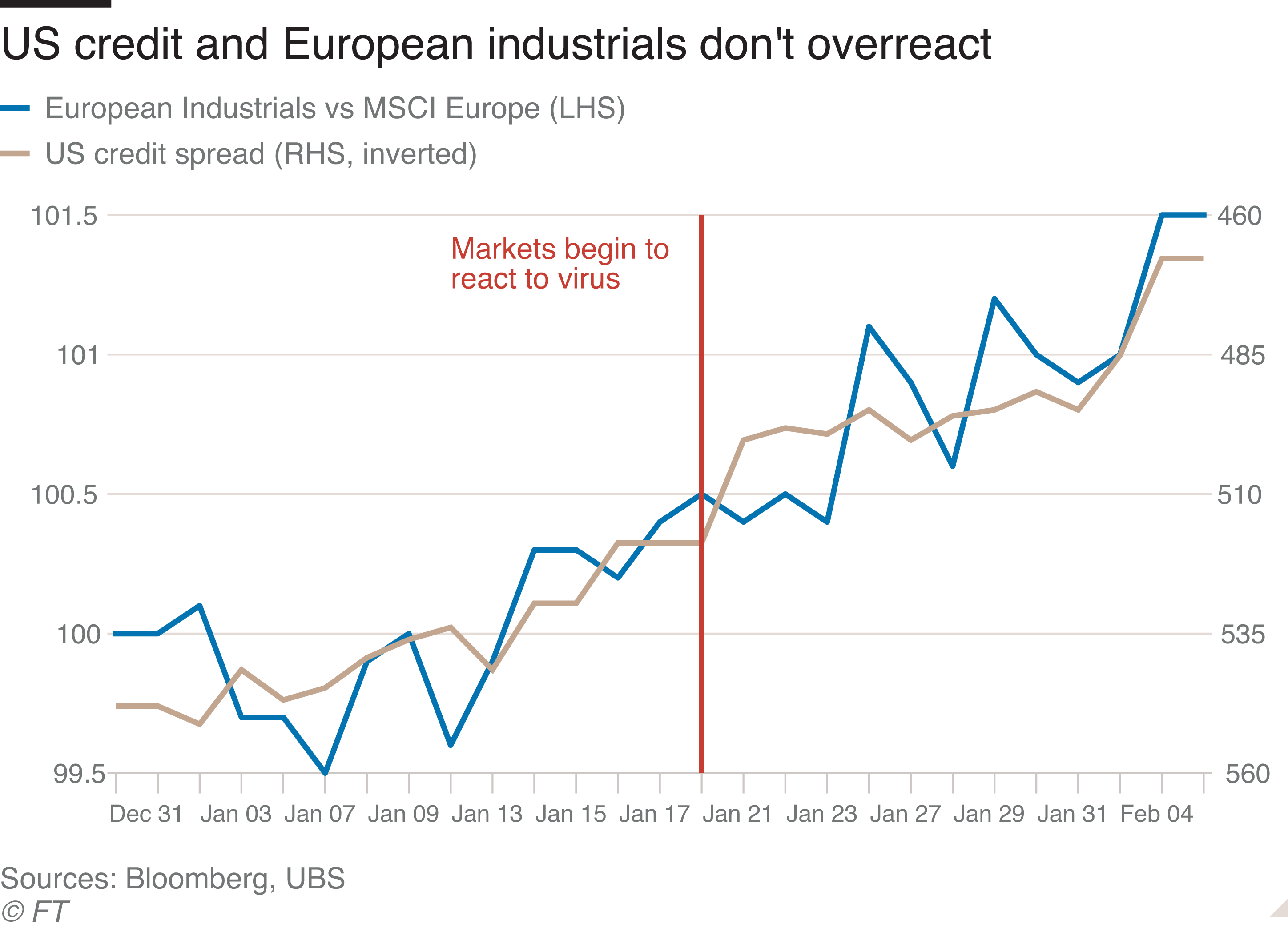

Volatility in other global equity markets could be driven by market makers’ hedging positions – although since Monday a fall in the VIX (Wall Street’s fear index) shows this risk is now unwinding. The reaction of some asset classes that one might expect to be prone to fear wasn’t that severe, as research by UBS shows. European industrial stocks didn’t underperform their benchmark and the weakest part of the US high-yield credit market held up.

European stocks that are exposed to China remain a risky trade, but they could come back strongly if the positive trends in containing the virus and evidence shows it is less deadly than first feared.

Deadly reminder of the power of narrative economics

No-one wants to come across as flippant when discussing an outbreak that has cost 1,018 lives (WHO Situation report, 11 February), but disease is a popular analogy for the contagion effect of damaging narratives in financial markets. Nobel Laureate Robert Shiller has looked extensively at the mathematics of contagion for his book Narrative Economics (2017), and made the link between the number of people susceptible, infected and recovered from a virus (as per disease theory) with the number of people susceptible to a narrative, prone to believing the story and those who have already started to discount it.

Fortunately, it seems that the rate of spread of coronavirus is falling and the death rate and number of serious cases isn’t rising as a proportion of those infected. This good news is feeding through to the narratives spreading in financial markets. To continue the analogy, fewer people now believe 2019-nCov will become a pandemic, and as asset markets recover, it is becoming apparent that those who had been panicked are no longer so risk averse.

Yet on a final cautionary note, the first part of the narrative equation remains. Hopefully a pandemic isn’t the trigger, but investors should remain circumspect in their portfolio positioning for asset markets’ next major adjustment.