While there have been some noteworthy moves (good and bad) from our Tips of the Year, at the half-year stage the overall performance is a bit of a non-event, with the tips showing a small negative return, and slightly behind the FTSE All-Share Index.

Tips of the Year half-year performance

| Name | TIDM | Total return |

| JD Sports Fashion | JD. | 29% |

| Babcock International | BAB | 18% |

| Entertainment One | ETO | 13% |

| Atlas Copco/Epiroc (£) | SW:ATCO/EPI | -2.4% |

| Relx | REL | -3.5% |

| Marston's | MARS | -10% |

| Phoenix Spree Deutschland | PSDL | -11% |

| Ferrexpo | FXPO | -37% |

| FTSE All-Share | 1.5% | |

| Tips of the Year | -0.3% |

Source: Thomson Datastream

The best-performing share of the six months has been sportswear retailer JD Sports Fashion (JD.). As hoped, the company has been rebuilding its reputation as a growth stock and is making a major move into the US market. Investors also seem to be warming to Babcock (BAB) again after pushing it to extreme valuation lows following warnings from many of its support services peers, although not Babcock itself. Entertainment One (ETO) has also put in a solid performance with its kids shows continuing to prove a huge draw and consolidation in the sector highlighting the value on offer.

Trade war worries have contributed to a lousy performance from iron ore and pellet company Ferrexpo (FXPO). These tensions are also a potential negative for our International Tip of the Year, Atlas Copco (SW:ATCOA), which has recently completed the demerger of its mining and civil engineering business, Epiroc. The negative total return from this tip in part reflects a marked weakening of the Swedish krona (the currency both demerged companies’ shares are denominated in). Trade tensions have also been reflected in a yo-yoing of the dollar, which has meant a bit of a rollercoaster ride for our old reliable tip, Relx (REL).

Our Income Tip of the Year, Marston’s (MARS), has also disappointed so far. While we continue to feel that debt, while high, is manageable, the market seems more concerned. Still, dividends continue to flow. Value investing unfortunately often requires patience and sometimes also disappointment.

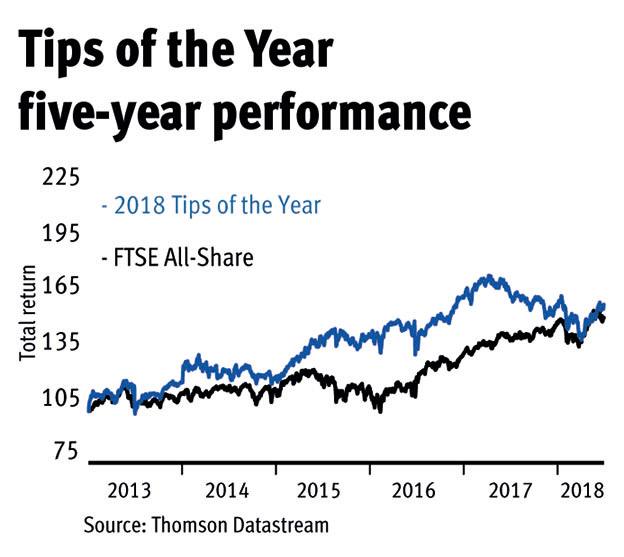

We’ll be hoping these tips can find more positive momentum on aggregate over the rest of the year. Over five years the Tips of the Year are still showing a cumulative total return ahead of the index, at 58 per cent versus 51 per cent. That said, factoring a 1 per cent annual charge would take the performance to just below that of the FTSE All-Share.

The table below gives a selection of fundamental data for the Tips of the Year as of the end of June, followed by updates of our current view (ordered from best to worst performing on a total return basis). All of the tips remain buys.

| Name | TIDM | Mkt cap | Price | Fwd NTM PE | DY | Fwd EPS grth FY+1 | Fwd EPS grth FY+2 | 3-mth chg fwd EPS | 3-mth momentum | Net cash/debt (-) |

| JD Sports Fashion | JD. | £4.3bn | 441p | 17 | 0.4% | 5.5% | 12.0% | 2.1% | 32.6% | £310m |

| Babcock International | BAB | £4.1bn | 818p | 10 | 3.6% | 2.4% | 3.6% | 1.2% | 18.0% | -£1,238m |

| Entertainment One | ETO | £1.7bn | 368p | 15 | 0.4% | 8.5% | 13.8% | -2.4% | 27.9% | -£432m |

| Atlas Copco AB | SW:ATCO A | SEK306bn | SEK261 | 20 | 2.7% | -4.1% | 7.6% | - | -29.2% | SEK369m |

| Epiroc AB | SW:EPI A | SEK109bn | SEK94 | 20 | - | - | - | - | 0.0% | -SEK1,282m |

| RELX | REL | £32bn | 1,623p | 19 | 2.4% | 3.9% | 6.5% | -0.2% | 9.7% | -£4,775m |

| Marston's | MARS | £630m | 100p | 7 | 7.5% | -1.3% | 5.2% | - | -1.4% | -£1,703m |

| Phoenix Spree Deutschland | PSDL | £348m | 345p | 132 | 1.9% | - | - | - | -1.2% | - |

| Ferrexpo | FXPO | £1.1bn | 183p | 4 | 6.8% | -14.5% | -31.0% | -5.5% | -26.3% | -$403m |

Source: Thomson Datastream

Growth Tip of the Year: JD Sports

Six-month total return: +29%

A key element of our tip on JD Sports Fashion (JD.) was the group’s international potential, so the recent completion of a $558m (£396m) acquisition of US group Finish Line has underpinned our hopes. The size of the deal will push the group into a small net debt position (compared with net cash of £300m at the end of the last financial year) but it should add more than 40 per cent to the top line. It will also mean that more than half of JD’s total revenue will come from overseas.

The acquisition should also strengthen JD’s relationship with key sporting brands such as Nike, which, according to broker Shore Capital, accounts for almost three-quarters of Finish Line’s sales. The deal will also allow JD to transport its multi-channel business model across the Atlantic for the first time. Initially, around 30 Finish Line stores will adopt the JD Sports fascia, but if this goes well the entire estate could be converted. It’s unsurprising, therefore, to hear chairman Peter Cowgill describe the acquisition as “a momentous step” in the group’s history. With the shares priced at only 15 times forward earnings, we remain buyers. HR

Contrarian Tip of the Year: Babcock International

Six-month total return: +18%

We made Babcock (BAB) our Contrarian Tip of the Year based on the view that despite the market tarring it with the same brush as struggling outsourcing peers, such as Capita and Serco, its specialist focus made it a different beast. Half a year on, and our assessment looks to be holding up.

The shares started the year poorly, with tough conditions in the oil and gas sector and the slow mobilisation of a contract with the Ministry of Defence leading management to warn on revenue. However, encouraging full-year results seem to have restored some confidence, with strong earnings growth arising from trading at the nuclear and aviation divisions. Importantly, given investors’ concerns about outsourcers’ balance sheets and ability to generate cash, Babcock’s net debt has been declining and new accounting rules that have hit other outsourcers will have little impact on Babcock’s reporting. We believe the substantial de-rating of the shares to multi-year valuation lows prior to our tip means considerable upside remains if Babcock continues to deliver. TD

Takeover Tip of the Year: Entertainment One

Six-month total return: +13%

The value of entertainment assets has continued to rise in 2018 as Walt Disney (US:DIS) and Comcast (US:CMCSA) clamour to get their hands on content producer 21st Century Fox (US:FOX). The share price of Entertainment One (ETO) has been caught up in the charge, spiking 23 per cent since the group announced its annual results at the end of May.

It’s hardly surprising content producers are doing so well. Disney has offered to pay 13.6 times historic adjusted cash profit for Fox. Based on the same valuation, EOne’s shareholders would be offered a 41 per cent premium to the current share price.

Meanwhile, Netflix (US:NFLX) is halfway through an $8bn (£6.1bn) investment project into original content. Maintaining that level of spending to keep enticing new subscribers will be tough – buying an existing, high-quality content producer could be a better option and we think EOne fits the bill.

Operationally, EOne continues to perform well, particularly in its family division. Here, revenue in the year to March 2018 rose 56 per cent thanks to enduring demand for Peppa Pig and new-found love for PJ Masks. With eight more children’s TV shows currently in development, there is plenty in the pipeline for deep-pocketed media peers to want to get their hands on. MB

International Tip of the Year: Atlas Copco/Epiroc

Six-month total return: -2.4%

Atlas Copco AB (SW:ATCOA) duly completed the planned spin-off of its mining equipment interests in June, with the resultant entity Epiroc (SW:EPIA) entering the market as prospects for suppliers to the extractive industries are on the rise following the retracement (and in some cases ‘stabilisation’) of commodity prices. Obviously good news for shareholders in the original enterprise, who gained exposure to Epiroc in proportion to their existing shareholding, but what did the split mean for the engineering rump?

Analysts at JPMorgan make the point that the remaining Atlas Copco business makes over 60 per cent of operating profit from its aftermarket and service franchise. Not only is this double the sector average, but the nature of the product mix drives “the high aftermarket share”. The broker also highlighted the group’s “balance sheet optionality”, which basically means it’s still sufficiently cashed-up to fund acquisitions “at multiples below its own”.

The strategic rationale for the deal – and its timing – is justified by the steep rise in Epiroc’s order intake from its locales, particularly the Middle East and South America, but we agree with JPMorgan’s assessment that the underlying characteristics of Atlas Copco and its dominant market positions will continue to drive “outsized returns”. At SEK256 (£21.64), Atlas's shares are trading 13 per cent below the broker’s target price based on an enterprise value representing 14 times operating profit. Buy. MR

Old Reliable Tip of the Year: Relx

Six-month total return: -3.5%

Media and publishing giant Relx (REL) had a terrible start to 2018 as dollar weakness weighed on revenue expectations and improving bond yields soured sentiment towards so-called ‘bond proxies’. By mid-March the group’s shares were down 17 per cent.

But trading in the same period has been unceasingly solid. February’s full-year results revealed revenue and adjusted pre-tax profit up by 4 per cent and 6 per cent, respectively, in the 2017 financial year and April’s annual meeting trading update confirmed that growth has continued into 2018. The group has also decided to simplify its structure by folding its Amsterdam-based arm into its UK operations.

More importantly, the risk and analytics business continues to accelerate as it capitalises on the global opportunity for data management. We think that more than offsets concern for the education publishing business, which has come under pricing pressure in Germany. MB

Income Tip of the Year: Marston’s

Six-month total return: -10%

The first half of 2018 has not been kind to Marston’s (MARS). Snowy weather at the beginning of the year wiped around £3m off half-year profits, according to chief executive Ralph Findlay. On a more encouraging note, sales in brewing were up 79.2 per cent to £169m thanks to the boost from the Charles Wells Beer Business (CWBB) acquisition. Like-for-like sales at Marston’s taverns improved by 2.9 per cent, but destination and premium venues fell 1.8 per cent.

Marston’s high debt level may have also weighed on sentiment, but we remain reassured by the level of asset backing and are encouraged by the fact that net debt (adjusted for property leases) was down to 4.8 times underlying cash profit in the first half compared with five times a year earlier. Meanwhile, fixed-charge cover was flat at 2.6 times and operating cash flow improved by 6 per cent to £63.3m, supporting a maintained 2.7p half-year dividend.

Marston’s fell out of the FTSE 250 during the six months, which will have added to share price weakness. We still think the focus on premium pubs and brewing put Marston’s in a good position. In the short term, the pub group may also get a World Cup trading boost. Buy. JF

Value Tip of the Year: Phoenix Spree Deutschland

Six-month total return: -11%

The only thing that hasn’t moved higher at Phoenix Spree Deutschland (PSDL) is the share price, which means that at 340p, its shares trade at a 16 per cent discount to forecast net asset value (NAV).

True, there isn’t much in the way of a dividend, but when 2017 results were announced in April the NAV total return in 2017 was 53 per cent, thanks to a combination of higher rental income and rising property valuations.

Focused on the residential market in Berlin, the chronic imbalance between supply and demand remains acute. New lettings were achieved at an average 40 per cent premium to passing rents. And while this sort of growth cannot continue forever, the fact remains that capital values remain well below replacement cost. This suggests rents must advance significantly before it becomes financially viable to bankroll new construction. And with such value embedded in the portfolio, the shares are still looking cheap. JC

Recovery Tip of the Year: Ferrexpo

Six-month total return: -36%

So far, recovery pick Ferrexpo (FXPO) has traded more like a relapse of the year. We’ve not heard much from the Ukrainian miner, processor and seller of iron ore pellets and such calm may have unnerved investors mindful of a planned 65-day shutdown of production in the second quarter. But pellet price premiums are reported to have held firm above robust iron ore spot prices, the hryvnia has stayed steady against the dollar, and a supposed avalanche of fresh global supply has been held back by mine outages and strikes.

Added to this, first-half production matched guidance, and there’s been no reversal of the steel market’s focus on productivity and preference for high-quality sources of iron ore. Why then, is Ferrexpo trading at four times this year’s expected earnings? The most likely conclusion is that pellet premiums will soften in 2019 and 2020, although it’s still hard to square this with Ferrexpo’s current trading multiples and options for its capital.

JPMorgan, which is neutral on the stock, still expects $947m (£717m) of net earnings between 2018 and the end of 2020. By that point, the broker expects a net cash position of $316m. Those projections assume a steep 20 per cent cut to the dividend this year, which would still give a yield of 5 per cent. Buy. AN