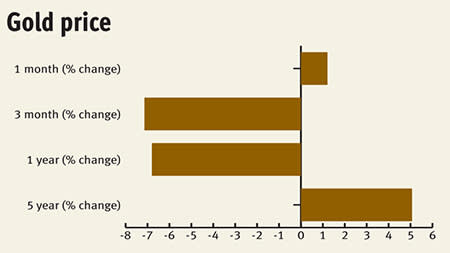

At $1,201 an ounce, the gold price is still bumping along around the average all-in cost rate. But a Greek default could drive the price up towards the $1,400 mark, according to new research from Capital Economics. However, any gains in the gold price from near-term instability must be weighed against the continued dampening effects of ultra-low interest rates, which draw capital flows into US debt, propping up the greenback, along with its negative correlation to the gold price.

What the analysts at Capital point out is that the market appears to be pricing in an eleventh-hour deal or accounting wheeze to save the Greeks. Maybe so. After all, EU mandarins would be rather keen to stave-off a humiliating climb down on the single currency. The odd thing is that talk of 'contagion' subsequent to a 'Grexit' has been relatively subdued this time around. Bond yields in peripheral eurozone economies, such as Portugal and Spain, haven't followed Greek sovereign debt higher as they did during the 2012 eurozone debt crisis. No doubt this is largely due to the ECB unleashing a €1.1 trillion (£787bn) monetary stimulus program, although there are also now more back-stop options in place for member economies. The trouble is, if the Greeks were forced out of monetary union, it sets a precedent. The mere possibility of an exit would encourage currency traders to start betting heavily against the euro if, and when, another member state has trouble refinancing its debt - don't forget the Portuguese economy is still labouring under a debt-to-GDP ratio in excess of 120 per cent.

IC VIEW:

Rather than the prospect of a Greek default, it's conceivable that gold prices could receive support from an unlikely source - the effect of continued oil price weakness on gold's key market, India. The Indian government increased strictures on gold imports in a bid to shore-up the country's balance of payments figures. But India's trade balance has improved substantially due to the slump in crude prices (India is a big net importer). As a consequence, Delhi could ease some of the existing conditions, paving the way for a step-up in gold imports.

Emerging from the slick

Assuming you haven't done so already, perhaps you're considering offloading your equity positions in keeping with May's time honoured dictum. Now, however, might not be the time to walk away from oil and gas stocks. Indeed, a renewed tilt may well be in order given the contraction in price-to-book ratios across the sector - well, consideration of another tilt, at any rate.

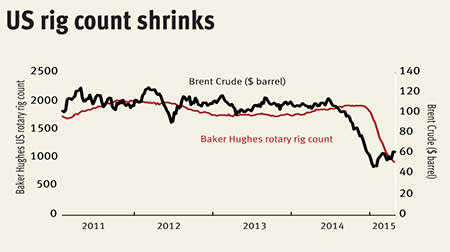

The broader sector has fared abysmally since midway through last year. And the existing glut in world crude markets could eventually be exacerbated by a thawing in relations between Tehran and Washington. But a pullback in US shale production in March, coupled with an accelerated fall in the rig count across the Atlantic, has raised hopes that the global supply/demand balance could soon narrow. This presupposes that normal market dynamics are the primary determinant of crude oil prices - itself a contentious proposition.

Nevertheless, recent comments by Ian Taylor, chief executive of global energy trader Vitol, suggest that crude oil prices may well have bottomed out - with a mid-range estimate of $60 a barrel projected for the second half of 2015. The view was backed up by comments from industry leaders at the World Economic Forum on East Asia.

Contango starts to narrow

There are certainly signs that crude prices could stabilise, if not register modest gains through the remainder of this year. Last July, when crude oil was trading at around $105 a barrel, the premium on spot prices over long-dated contracts started to evaporate. Eventually the market moved into contango - where crude oil deferred under contract fetches a lower price than the existing rate. The good news for producers is that the wide contango-spread seen at the start of 2015 has begun to narrow.

It's no secret that oil price shocks tend to generate a bipolar response. But many recent comments on long-term pricing for the industry have been overly bearish, particularly in view of projected growth in demand from emerging markets. Analysts still hold firm to the view that global oil demand is set to climb by a fifth over the next two decades.

The accompanying table demonstrates the slide in price-to-book ratios since midway through last year. Like any metric, it's useless in isolation - the challenge, of course, is to work out which companies are now undervalued simply because of the sector-wide movement, rather than those that have been weighed down by specific issues. If a stock is trading at less than its book value (or has a P/NAV of less than one), it points to one of two things: either the market believes the net assets are overstated, or the company is earning a poor (perhaps even negative) return on its assets.

| (%) Price change - June 2014 | PE ratio | Div yield (%) | Market cap (£m) | P/NAV June 14 | P/NAV April 15 | |

| Cairn Energy | -12.9 | na | na | 1,032 | 0.53 | 0.58 |

| Nostrum Oil & Gas | -18.7 | na | 3.2 | 1,171 | na | 1.91 |

| Ophir Energy | -33.3 | 26.7 | na | 1,138 | 1.2 | 1.01 |

| Premier Oil | -48.4 | na | na | 884 | 1.23 | 0.71 |

| Soco International | -55 | 63.2 | na | 603 | 2.06 | 0.93 |

| Tullow Oil | -54.1 | na | 1 | 3,658 | 2.16 | 1.37 |

| BG | -3.5 | 15.2 | 1.5 | 40,855 | 1.81 | 2.1 |

| BP | -6.8 | 35.4 | 5.1 | 88,246 | 1.07 | 1.19 |

| Royal Dutch Shell 'B' | -15.7 | 16.4 | 5.5 | 134,563 | 1.36 | 1.18 |

| Amec Foster Wheeler | -24.9 | 11.8 | 4.6 | 3,646 | 3.5 | 1.83 |

| Hunting | -29 | 8.9 | 3.4 | 894 | 1.29 | 0.95 |

| Petrofac | -26.7 | 9.6 | 4.7 | 3,156 | 3.26 | 2.54 |

| Wood Group (John) | -12.1 | 10.6 | 2.5 | 2,675 | 1.74 | 1.58 |

| Source: Thomson & Reuters | ||||||

The new Silk Road

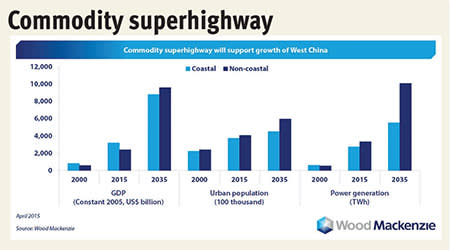

The slump in prices for bulk commodities and base metals is primarily linked to reduced assumptions on long-term industrial demand from China. But a recent report from Wood Mackenzie's Principal Asia Economist, Cynthia Lim, suggests that we may have become overly pessimistic about growth prospects in the People's Republic.

The report highlights the determination of China's policy-makers to forge a new 'commodity superhighway' to link the country's eastern and western regions, onwards to central Asia and beyond. The coastal regions of China have essentially been the nation's growth engine over the past 25 years. But the coastal provinces will have to upgrade their industries to value-added sectors, as service sectors within the economy expand. It is planned that much of the existing heavy and secondary industries will move inland, aided by central government policy designed to promote the flow of capital and people. Demographics certainly support China's 'Go West' policy, along with historic precedent set in the Occident.

IC VIEW:

The scale of the transfer is potentially colossal; it is estimated that power generation in the central and western regions will almost triple over the next 20 years. What this means for primary industries in the west is currently impossible to quantify, but one suspects the inland expansion will generate new opportunities for natural resource producers.

Basket cases - emerging trends

Copper support ebbs

The Shanghai Composite Index hit multi-year highs in April in expectation of further stimulus measures from Beijing, while Japan revealed its first trade surplus in three years. Encouraging signs, one would think, for key industrial inputs such as copper. But investors are now turning away from the metal following the February rally. Prices were up nearly 10 per cent in the two months to the end of March, but speculators started to cut their net long positions in copper midway through last month.

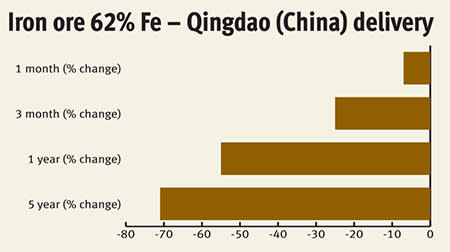

BHP defers Port Hedland works

However, analysts are now reassessing their medium-term projections on iron ore prices in the wake of BHP Billiton's (BLT) decision to defer a project to reduce bottlenecks at Australia's Port Hedland, the world's biggest bulk export terminal. This effectively holds back forward capacity, and it may convince other miners to follow suit.

Radiation exposure

Prices for uranium ore went into freefall following the Fukushima Daiichi nuclear disaster in 2011. But prices are up by a third since June 2014, as public perception toward the industry undergoes a period of rehabilitation. The rollout of next generation reactors in China has gathered momentum as the nation moves away from coal-powered electricity generation in a bid to improve air quality. And plans are even afoot to reactivate at least some of Japan's reactors later this year. True, some countries, most notably Germany, have pulled the plug on nuclear power, but there are currently 71 reactors under construction worldwide, which will increase generating capacity by around a fifth. It's also worth noting that fuel supplied to reactors from decommissioned nuclear weapons has all but dried up. If, as we think, that the market has passed an inflection point, now could be a good time to plug into a nuclear renewal.