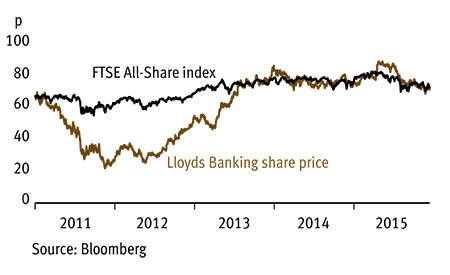

After several years of recuperation, we think 2016 will be the year that Lloyds Banking (LLOY) makes substantial steps towards rediscovering its old self: a stable, even boring, income stock. Analysts expect Lloyds to return as a decent income play, on the basis of its improved capital base, and powered by a domestic economic recovery. Such a fruition of Lloyds long and arduous post credit-crunch recovery could not be coming at a better time, as blue-chip UK income stalwarts are becoming increasingly scarce. No wonder investors are forming long queues for the government's promised public share sale.

- Strongly capitalised

- Resilient market share

- Growing dividend

- Government holding reduced

- PPI costs

- Top-line challenges

The Bank of England's (BoE) latest financial stability report, released last month, gives a good taste of the regulatory mood music. The conclusion was simple: "The UK banking sector has become more resilient in line with regulatory requirements." As evidence for this view it cited an average 13 per cent tier-one capital to risk-weighted assets ratio across the major banks. Given the BoE's relaxed stance, fund managers argue it is increasingly unsustainable for these companies not to return some excess capital to shareholders, and this could have a sizeable impact on share prices. At the current price, Lloyds' shares stand out as promising a particularly attractive forward dividend yield for what is an increasingly stabilised banking operation.

It is a good time to look back at how Lloyds got to this point. Seven years ago this week, Lloyds acquired HBOS - taking advantage of the melee of the financial crisis causing the UK government to waive ordinary competition concerns. The question to be asked today is whether it was worth it: clearly not for the bank's then shareholders, who have since suffered massive dilution and price falls. But on another reading the acquisition did exactly what it was intended to do - make Lloyds the largest retail bank in Britain by market share, and as a London-listed banking group second only by market capitalisation to the international group HSBC (HSBA).

Lloyds now looks in good financial health again. The BoE's 2015 stress test cemented it as one of the most strongly capitalised big banks. Its 13.7 tier-one capital ratio at the end of the third quarter was second only to Nationwide, while its stressed ratio of 9.5 was joint second with Santander - again behind Nationwide. The other listed players, Royal Bank of Scotland (RBS), Standard Chartered (STAN), Barclays (BARC) and HSBC (HSBA) all fared worse.

The ending of this long period of recuperation for Lloyds is expected to be marked by the government's departure from the scene, having already reduced its stake to below a tenth of the bailed-out group. The reduction of state involvement is welcome from a management perspective, while for would-be shareholders there is the potential for a public share sale which could ignite the kind of interest seen around the Royal Mail float. The government has said that come the spring it will offer everyday investors the ability to buy shares at a 5 per cent discount to the share price, as well as a bonus loyalty share on offer for those that hold 10 shares for a year (subject to a £200 limit).

The 5 per cent discount is tempting, but we don't think investors will lose out by getting in before then given the excitement the share sale could create. Indeed, the current price is below the government's 74p break-even price. And the option to see what allocation can be got in the share sale will still exist.

Unusually for Lloyds, there has recently been some positive regulatory news, too. At the Court of Appeal last month it won the right to redeem at par some 2009 enhanced capital notes, which broker Investec expects to provide an annual saving of at least £200m. What's more, the Financial Conduct Authority is considering a claims deadline for missold payment protection insurance (PPI) - particularly welcome news for Lloyds which was forced to set aside another £500m for PPI in the third quarter.

| LLOYDS BANKING (LLOY) | ||||

|---|---|---|---|---|

| ORD PRICE: | 71.57p | MARKET VALUE: | £51.1bn | |

| TOUCH: | 71.55-71.57p | 12-MONTH HIGH: | 89p | LOW: 69p |

| DIVIDEND YIELD: | 5.6% | PE RATIO: | 12 | |

| NET ASSET VALUE: | 59p | LEVERAGE RATIO: | 17 | |

| Year to 31 Dec | Total operating income (£bn) | Pre-tax profit (£bn) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 18.4 | -0.57 | -2.0 | na |

| 2013 | 18.8 | 0.42 | -1.2 | na |

| 2014 | 17.4 | 1.76 | 1.7 | 0.8 |

| 2015* | 17.6 | 3.34 | 2.5 | 2.3 |

| 2016* | 17.9 | 6.68 | 6.1 | 4.0 |

| % change | +2 | +100 | +144 | +74 |

Normal market size: 30,000 Matched bargain trading Beta: 0.66 *Investec forecasts | ||||