Key Characteristics:

- Very wealthy investors

- Desire for additional income from investments

When you’re an investment millionaire then how you manage your wealth is down to your personality. Some people may continue with the more aggressive asset allocation from our £251k to £1m model, if they feel comfortable peak-to-trough market falls won’t affect their lifestyle. Some wealthy investors may decide to take even more risk if they don’t need to draw capital from the portfolio for years at a time.

This strategic asset allocation model has been designed with retired investors in mind. They have the wealth to maintain risk and growth in their portfolio, but don’t need to be too aggressive. At this stage, wealth should be about minimising effort and allowing time to focus on everything else life has to offer.

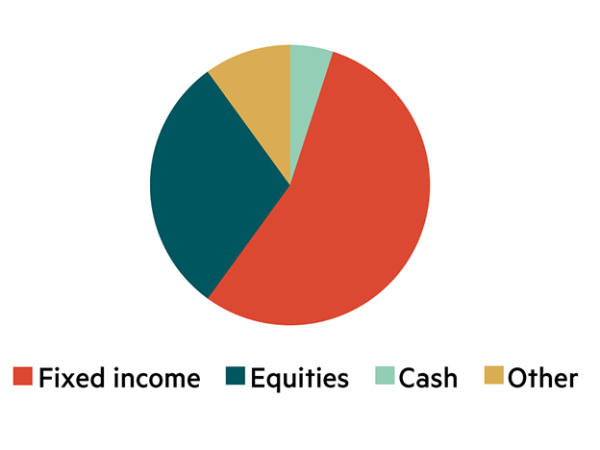

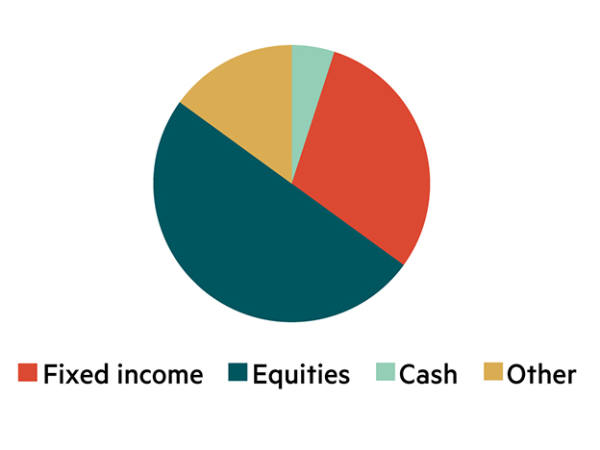

Investors with over £1m don’t need such a high percentage of the portfolio in cash. Holding 2 per cent in cash means at least £20,000 at the lower end of the range anyway. Aside from any uninvested money in your portfolio, you should always have a separate cash pot set aside for emergencies. We’re also assuming that investors at this stage in their lives have paid off their mortgage.

There is more fixed income exposure in this model than in the £251k to £1m allocation, reflecting the desire to reduce the size of peak-to-trough falls in portfolio value when equity markets sell off. A higher allocation to alternative assets (‘Other’) is also made. This is to diversify equity market risk, although these investments are risky themselves and correlation patterns do change. However, the liquidity risk of alternative assets is much less problematic for a large portfolio – it is less likely a fire sale will be needed to raise cash suddenly.

Pick stocks if you enjoy it, but mostly just relax

Keeping your equity allocation in a selection of good funds that give you exposure to themes and geographies is a great and relaxed way to invest. If you do choose to hold individual shares, think about how they work in your portfolio and why holding them directly suits you better than holding them indirectly through funds.

Stick to the size rule – no one individual stock holding should be worth more than about 5 per cent of your total allocation to shares (so no more than 2-and-a-half per cent of a portfolio based on this strategy in one stock); it’s also not worth wasting time with anything less than £5,000 per holding. That gives you an idea that stockpicking to implement a more risk moderate asset allocation like this, is worthwhile once you’re over £2m in total portfolio assets. It just gets too much to manage otherwise.

Many Investors' Chronicle readers are committed investors and take the time to manage more companies in their portfolios. There is greater flexibility managing your own portfolio of shares and the ability to use tax allowances for disposals. As we said at the outset, a lot of how you choose to manage a portfolio of this size is down to your personality.

Also, if you really enjoy the intellectual stimulus of researching companies and trying to find the odd multi-bagger stock, it is fun to set aside a pot of fun money within the equity allocation and make some more speculative investments in smaller companies. Although, you should be sure that this is money you are comfortable taking the occasional big hit on as you will make bad calls on small companies from time to time.

And if you are retired and thinking of passing on your wealth to future generations, remember there is inheritance tax (IHT) relief available on some companies listed on Aim. But if you do decide to have a flutter, check that it’s the government’s portion of your legacy that you’re risking and not your kids’.