- UBS global property index up 10.4 per cent in November

- UK, Europe, US, Singapore and Hong Kong equities could beat the market

Real estate investment trusts (Reits) around the world are dealing with several crises all at once. After almost 15 years of ‘free money’ from ultra-low interest rates, higher interest rates have been causing problems everywhere.

Issues are continuing to emerge as the year comes to an end. Austrian billionaire René Benko’s real estate empire collapsed in November, with European property executives saying he “gorged himself on cheap financing left, right and centre”. In the US, the news that Muddy Waters is shorting the Blackstone Mortgage Trust (US:BXMT), which provides loans to commercial real estate players in the US, Europe and Australia, has underlined the worries many now have about real estate debt. In China, mega developers Evergrande and Country Garden have spent most of 2023 teetering on the edge of bankruptcy due to concerns about their ability to repay loans, with little sign of a resolution in sight.

But for many, the outlook for 2024 looks better. In rising 10.4 per cent in November, UBS’s global listed real estate index posted its fourth best monthly performance since the 2007-08 financial crisis. That was driven by the expectation that interest rate rises are done with, and that policy loosening will arrive next year. Investors now expect the world's rate-setters to follow the path outlined by the Federal Reserve earlier this month, when the central bank forecast 75 basis points' worth of cuts to the Federal Funds Rate in 2024.

Falling rate expectations have not lifted all Reit boats equally, though; many Reits are still struggling and will continue to do so. Even the UBS index's improvement is the result of a handful of outperforming global equities, some of which we expect will do even better next year. Having outlined our long-term UK picks in this week's cover feature, below we select some of the global Reits that are best positioned to prosper in 2024.

Europe

As we discuss in this week's cover feature, the outlook for warehouse Reits is looking more positive once again. That is not just the case in the UK: one of UBS’s top Reit picks for Europe is self-storage landlord Shurgard (BE:SHUR). Like Segro (SGRO), it benefits from being the market leader as “the largest owner and operator of self-storage facilities in Europe by both number of stores and rentable space”. In its results for the first half of 2023, it posted an 8.4 per cent bump in net rental income, driven by increased demand for self-storage assets, which the industry attributes to increased customer awareness of the service and a growing need for storage space. Meanwhile, increased investor demand has driven up the value of Shurgard’s assets at a time when many other Reits' net asset values (NAVs) are falling.

Generally, while we are bullish on the asset class, we have questioned the sustainability and predictability of tenant demand for self-storage. However, one big bull point for Shurgard in this respect is its occupancy rate. Despite its rapid expansion, its buildings are 89 per cent let, which is well above both the European average of 78.5 per cent and figures for listed UK rivals Big Yellow (BYG), Safestore (SAFE), and Lok’n Store (LOK).

The US

There is also a lot of confidence in the US logistics market. As with the UK, the largest US Reit by market cap is a warehouse landlord, Prologis (US:PLD). The FactSet consensus analyst forecast suggests it will keep growing its net rental revenue over the next few years, even after a booming decade for the Reit and the warehouse market on which it relies.

However, while Prologis is probably the best pick for reliability, track record and scale, its price is hovering around two times book value, which means it is unlikely to soar from where it is in the medium term. For an undervalued contrarian pick with a higher return potential (albeit with more risk) we are bullish on office landlord Highwoods Properties (US:HIW). Much ink has been spilt on the demise of the US office market – JLL calculated earlier this year that a fifth of offices are empty compared with 7.5 per cent in Europe – but Highwoods offers a counterpoint to this narrative of doom and decay.

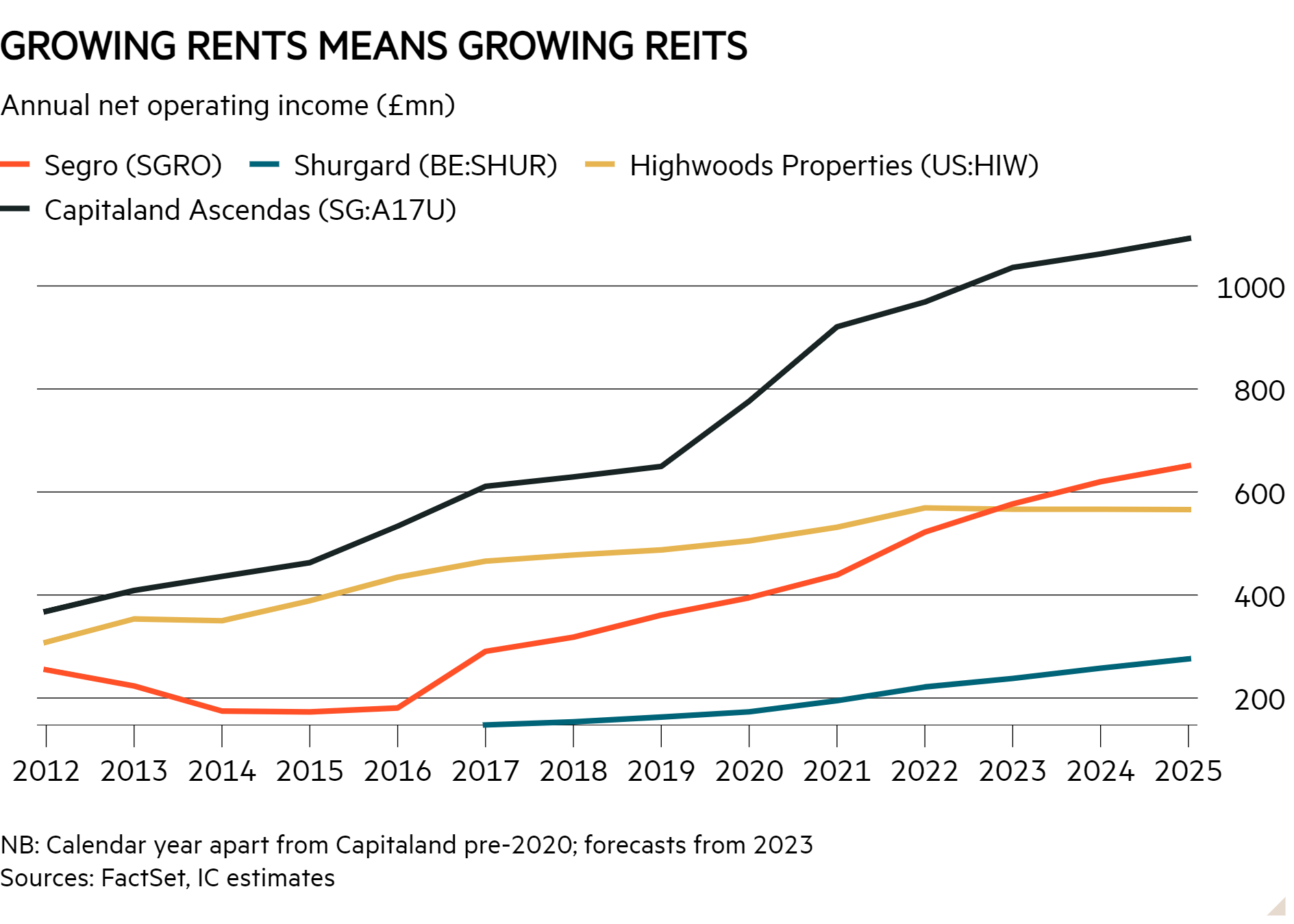

Over the past decade, it has gradually increased its net operating income (its rental income less operating costs but ignoring valuation changes and finance costs) from $353mn (£281mn) to $569mn, and even Covid has not stopped this trajectory. According to consensus forecasts from FactSet, the number will dip in 2023, drop further in 2024 and return to growth in 2025 and beyond before hitting $633mn for the 2027 calendar year.

That growth is hardly stratospheric, but it looks reliable considering the landlord’s past performance and the consistency of the occupancy rate over the past decade, during which time it has sat at around 90 per cent. Highwoods' secret to succeeding where many US office landlords are struggling has been to focus on the so-called ‘flight to quality’ by building top-of-the-range office space in underserved markets. All office Reits claim they do the same, but Highwoods' numbers show it walks the walk.

Yet the market has not valued the company accordingly. It trades at a premium to book value, but the 20 per cent mark-up is much lower than the average 60 per cent mark-up for the average S&P 1500 Reit. Its debt-to-equity ratio is also lower than the US average, and so is its net debt to Ebitda ratio, which is the preferred debt metric in the US. This gives it more wiggle room to spend on capex and development than many of its US peers.

The big bull point for Highwoods, though, is its dividend yield. With growing net operating income and a dividend yield of 9.3 per cent, the seventh highest among S&P 1500 Reits, Highwoods offers increasing shareholder payouts alongside the potential for the business to grow.

True, the dividend is forecast to flatline for a couple of years due to the questions around the office market and the economy. However, at this price, the payout on offer is still generous. More importantly, cash flow per share covers the plentiful dividend, and that is set to continue.

Singapore

Despite being barely half the size of London, Singapore is home to one of the world’s best real estate investment trusts. The island nation’s “first and largest listed business space and industrial Reit”, Capitaland Ascenda (SG:A17U), owns a mix of warehouses, offices and data centres across Singapore, Australia, the US and western Europe.

The Reit’s diversification is its strength. The global logistics boom has helped it over the past decade, and a move to large data centres and an increase in the number of life science tenants in its buildings are likely to help it over the next 10 years. Net operating income has more than doubled from S$409mn (£243mn) in 2013 to a FactSet consensus forecast of S$1.04bn for this calendar year, with further growth predicted over the next few years. Meanwhile, its occupancy rate has gradually ticked up from a lull of 87.6 per cent in 2016 to 94.6 per cent at the end of last year.

The Reit’s rent-roll surge has not been at the expense of a shareholder payout. Its dividend yield for last year came in at a respectable 5.77 per cent, although there are a couple of caveats. First, the dividend has not grown much over the past decade and is not predicted to in future, either. Second, for those with the capability to hold the shares directly, it should be noted that this is an illiquid stock. Around 10,000 of the S$12.5bn market cap company’s shares trade on a typical day. For comparison, the smaller Landsec (LAND) records 40 times that amount, at around 400,000 traded on an average day.

Hong Kong

For investors looking for more liquidity, a higher dividend yield, a forecast of growing shareholder payouts and a big discount to net asset value, albeit with a large slice of risk, Sino Land (HK:0083) is worth consideration. Hong Kong, where the company owns most of its assets, has been through a bruising period. Mainland China’s brutal crackdown on the territory's democratic freedom, a coronavirus pandemic, and the rise of working from home have drained the region's investment and leasing activity. Meanwhile, the concern that the mainland Chinese real estate crisis could spill over into Hong Kong has damaged market sentiment, too.

The upshot is that, even for the highest-quality Grade A Hong Kong office space, the vacancy rate has risen to 12.3 per cent as companies cancel their leases and rents slump. Sino Land's net rental income sank 19 per cent between 2019 and 2023.

As with Highwoods in the US, buying into Sino Land is a contrarian bet, in this cas on the recovery of the Hong Kong real estate market. It is arguably a riskier bet, but the potential rewards are bigger, with Sino Land trading at less than half its net asset value. And Sino Land has more room to manoeuvre than Highwoods. As it is not a Reit, the company has been able to make money for its shareholders through asset sales, having gradually reduced its residential land bank over the past five years. These sales, rather than declining rent in its commercial assets, are where the company makes the bulk of its revenue.

Its latest results for the year to 30 June suggest the strategy may work. Despite the net rental income drop, the value of its assets ticked up, and the fall in earnings per share was marginal. Over the coming years, consensus forecasts from FactSet predict earnings per share will continue to increase, and its dividend will rise, too. It is a punt, but at this price the potential upside is worth considering.