Rentokil (RTO) has come a long way since the era of former chief executive Sir Clive Thompson, known as ‘Mr 20 per cent’ for his commitment to increase EPS by a fifth every year. Rapid expansion and over-diversification created a sprawling conglomerate and the collapse of an overambitious growth strategy saw the shares drop below 40p in 2008. The group has since slimmed down to three business lines – pest control, hygiene and ‘protect and enhance’ – shedding non-core divisions such as its parcels delivery business for just £1 in 2013.

Non-cyclical growth drivers

Fragmented markets

North American potential

Multiple growth opportunities

Premium valuation

Margin drop

The rehabilitated Rentokil has attracted interest from top investors and is the third-largest holding of the Royal London Sustainable Leaders Trust, which ranks in the top 10 per cent of UK equity funds for performance over the past three and five years. The manager of this ethical fund, Mike Fox, calls the $20bn global control sector an “exceptional industry”. Structural drivers fuelling demand for these services include urbanisation, rising workplace and food regulations, and climate change creating conditions for pests to thrive. Rentokil is well positioned as the number one player in 50 of its 80 markets and its pest control activities accounted for almost two-thirds of continuing revenue and 69 per cent of adjusted operating profit in the first half of 2019.

Pest control sales rose by 11 per cent at constant currencies to £818m in the six months to 30 June, aided by the group’s investment in hi-tech innovation such as real-time infrared rodent monitoring. While first-half adjusted operating profit margin held steady at 16.5 per cent, it has trended down from 18.8 per cent in 2015 to 17.6 per cent in 2018 due to acquisitions and strong growth in lower-margin areas.

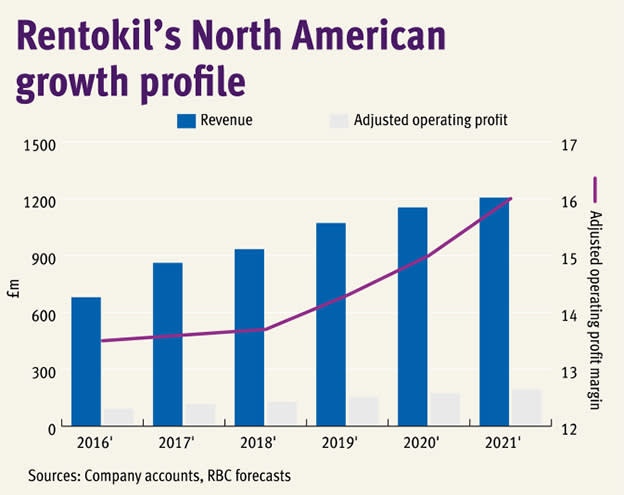

Around 90 per cent of Rentokil’s revenue comes from outside the UK. North America is its largest operating region and the biggest pest control market, home to half the world’s estimated 40,000 pest control companies. The group aims to generate $1.5bn of revenue from the region by the end of 2020, with an 18 per cent adjusted operating profit margin by the end of 2021. The timing of its IT transformation means margin improvement will appear closer to 2021.

Rentokil is known for its appetite for acquisitions, but broker JPMorgan calculates the group’s three-year organic growth rate in pest control was superior to competitors Rollins (US:ROL) and Terminix between 2015 and 2018.

By buying smaller, independent players, Rentokil is able to increase the density of its branches, lowering costs and improving productivity. Having spent £121m on acquisitions during the first half of the year, the group intends to spend over £250m for the full year. Acquisitions contributed to a £288m increase in net debt in the first half to £1.4bn, although more significant was recognising £184m in lease liabilities following changes to international accounting rules. Rentokil is divesting its 17.8 per cent stake in a workwear and hygiene joint venture with Haniel for €430m (£362m) which should bring the ratio of net debt down from 2.6 to 1.9 times cash profit (Ebitda).

| RENTOKIL INITIAL (RTO) | |||||

| ORD PRICE: | 471p | MARKET VALUE: | £8.7bn | ||

| TOUCH: | 471-471.1p | 12-MONTH HIGH: | 486p | LOW: | 328p |

| FORWARD DIVIDEND YIELD: | 1.1% | FORWARD PE RATIO: | 31 | ||

| NET ASSET VALUE: | 46.5p* | NET DEBT: | 165%** | ||

| Year to 31 Dec | Turnover (£bn) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) | |

| 2016 | 2.17 | 252 | 10.6 | 3.37 | |

| 2017 | 2.41 | 287 | 12.1 | 3.88 | |

| 2018 | 2.47 | 308 | 13.0 | 4.47 | |

| 2019** | 2.71 | 338 | 14.2 | 5.00 | |

| 2020** | 2.82 | 360 | 15.1 | 5.32 | |

| % change | +4 | +7 | +6 | +6 | |

| Normal market size: | 5,000 | ||||

| Beta: | 0.34 | ||||

| *Includes intangible assets of £1.6bn, or 86.5p a share | |||||

| **Includes lease liabilities of £215m | |||||

| ***JPMorgan Cazenove forecasts, adjusted PTP and EPS figures | |||||