Over the past few months, homeless accommodation landlord Home Reit (HOME) has lost over half of its value as criticism over the ethics and financial stability of its business model have reached fever pitch.

In October, a parliamentary committee called for a ban on the set-up of “profit-making schemes” using the same model that Home Reit uses. Yet, despite the implications of that report, the share sell-off did not begin in earnest until November when short seller Viceroy Research criticised the valuation assumptions behind Home Reit’s portfolio and its due diligence regarding its tenants. Home Reit dismissed Viceroy’s claims as “baseless and misleading” in a lengthy rebuttal the following week, but it did little to assuage investors who continued to offload shares.

The week after that, investors The Boatman Capital Research published an open letter calling for a change in Home Reit’s leadership as law firm Harcus Parker launched a legal challenge against the company over allegations it misled investors.

Home’s reply was to reiterate that the criticisms against it were “without foundation”, but in the same announcement it flagged up that it was bringing in a number of new people at a senior level and conducting a review of its due diligence in light of “investor feedback”. On 16 December, ShareSoc, a non-profit group representing private investors, launched a survey on Twitter, saying that it was considering supporting the legal case but wanted to “assess demand before deploying our resources”.

Many of the company’s critics reference issues the IC itself raised this August (The controversial Reit model delivering homes for the vulnerable', IC, 26 August 2022). An analysis of the full Home Reit tenant roster published in response to Viceroy’s allegations in November raises further questions.

But what are the criticisms of Home Reit’s model?

Home truths

Home Reit listed in 2020 and uses a lease-based business model to provide what is known as ‘exempt accommodation’. Home Reit owns 1,585 buildings across the country and signs long leases for those properties to its tenant roster of homeless accommodation providers. Those tenants are then responsible for the care of the vulnerable people living in the buildings – who can include the formerly homeless, abuse survivors, ex-service people and many other kinds of people in need of shelter.

The lease-based model is used by several other landlords, such as Civitas Social Housing (CSH) and Triple Point Social Housing (SOHO), which listed in 2016 and 2017 respectively. As the listing dates show, the model has only properly come into existence over the past decade.

Politicians, national homeless charities and financial experts have long worried that the model relies on accommodation providers who are mostly young and inexperienced, have thin balance sheets and share several apparent connections. They also worry that the arrangement is financially risky and could lead to a low-quality standard of care.

There are also concerns about the large profits the model reaps for the likes of Home Reit, and whether it is the best use of public money. Home Reit makes its profits by being the landlord of these properties and the rent for this type of accommodation ultimately comes from the councils that have a statutory duty to house the homeless and vulnerable people in their constituencies. Vulnerable people are able to use their state benefits to pay for rent on exempt accommodation – something they are usually not allowed to do.

Home Reit said local authorities using its services save money rather than lose it. It calculates that overnight shelters, B&Bs and hostels are “on average approximately 70 per cent more expensive than the accommodation that Home Reit provides”.

Still, not everyone is convinced by the model. In response to questions about Home Reit’s business, Crisis’ chief executive Matt Downie told Investors’ Chronicle in August that the homeless charity “has been concerned for some time about the worrying growth in unsafe, poorly managed exempt accommodation, and the role of some investment vehicles such as Reits in driving this”.

Crisis is not the only one concerned. In October, the Department for Levelling Up, Housing and Communities (DLUHC) select committee’s report on exempt accommodation said: “The lease-based model, which raised most concerns among those contributing to our inquiry, has its place in exempt accommodation, by enabling access to properties for decent providers who would otherwise not be able to purchase properties outright.”

“However, it can be exploited by those whose primary objective is to make huge profits at the expense of the taxpayer. We ask the government to set out how it will clamp down on those exploiting the lease-based model for profit and prohibit lease-based profit-making schemes from being set up.”

Such prohibition would ban the creation of profit-making entities such as Home Reit. It could also have implications for companies similar to Civitas and Triple Point – both of whose tenants have come under criticism from the Regulator for Social Housing (RSH) for non-compliance with its standards.

Civitas rejected any assumption that the DLUHC select committee’s call would impact its operations. “This has nothing to do with the business model pursued by Civitas, which provides specially adapted, lifelong homes, with high levels of specialist care, commissioned by local authorities, to adults with complex care needs,” it said.

Civitas added that it provides an average of 50 hours of care a week and, on the criticism of its tenants, said “all 10 housing association partners of Civitas who have reported 21/22 year-end financial results are in surplus”.

Triple Point said: "[We] remain committed to working with registered providers to deliver more homes to people with care and support needs throughout the UK. We welcome the oversight of the RSH that the registered providers we work with benefit from. Earlier in the year, we updated our investment policy to enable us to enter into more flexible leases and ensure that we are at the forefront of an evolving sector.”

Home Reit’s use of the lease-based model also came under scrutiny after Investors’ Chronicle revealed in September that its tenant Circle Housing & Support had collapsed. The administrator criticised the “onerous” nature of the leases Circle had entered into, and many critics saw this as evidence of the weakness of Home Reit’s model.

Circle collapsed in July, but it was not until Home Reit published its full tenant roster in response to Viceroy’s report that it confirmed how Circle’s leases had been passed onto another of its tenants, One CIC – a practice that critics of the model worry does not remove the risk involved in taking on the long lease when the next company is similarly young and thinly capitalised. One CIC was registered in 2020.

Home Reit said it has “undertaken full initial and ongoing due diligence on One CIC, which has a highly experienced management team and strong operational model”.

It added: “The company is confident in the tenant’s capability to take on the property portfolio assigned from Circle Housing and as noted in our rebuttal dated 30 November the tenant had fully paid their rent as of 31 August 2022 (£3.0m for FY22).”

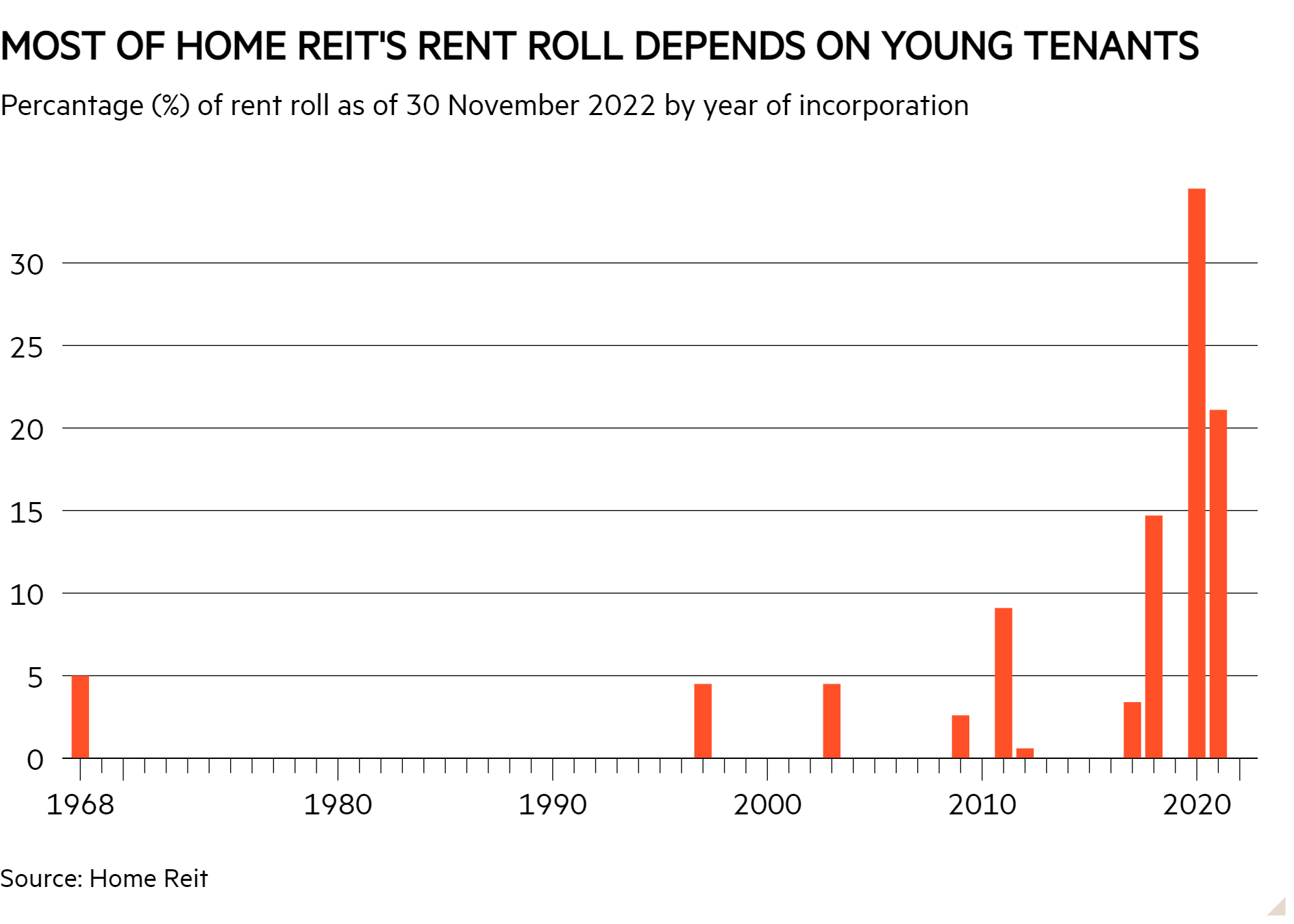

An analysis of the full Home Reit tenant roster only adds to the concerns around the strength of its tenants – especially with regards to their inexperience relative to Home Reit’s average lease length of 24.3 years. Out of the 28 tenants listed, 21 have been registered since 2017, 16 have been registered since 2020 and eight were registered in 2021. Critics say that leases of that length should be reserved for large organisations with a proven track record and a strong balance sheet.

Home Reit said: “They are young companies because this is a nascent sector which has been growing in size since the Homelessness Reduction Act 2017 was enacted in 2018,” adding that it “undertakes financial and operational due diligence on its tenants at the outset of any relationship, including a review of current operational capabilities and forecast business plan”.

The full tenant roster also reveals evidence of connections between Home Reit’s tenants, flagging concerns about the company’s lack of rent roll diversification. In total, 10 of the 29 tenants listed share some form of connection. Two share directors and the same address, three share the same directors, three more share the same former director, and another two share the same address.

| HOME AND FAMILY: MANY OF HOME REIT'S TENANTS SHARE CONNECTIONS WITH EACH OTHER | ||||

| Tenant | Percentage of rent roll | Contracted annual rent (£mn) | Incorporated | Connections with other tenants |

| Lotus Sanctuary CIC | 12.4% | 3.7 | Aug-18 | Share previous directors |

| Redemption Project CIC | 9.1% | 2.7 | Nov-20 | |

| Eden Safe Homes CIC | 2.2% | 0.5 | Feb-21 | |

| Supportive Homes CIC | 10.4% | 3.0 | Mar-21 | Share current address |

| Gen Liv UK CIC | 6.3% | 3.0 | Dec-20 | |

| Big Help Project | 9.1% | 3.9 | Feb-11 | Share current directors |

| GC Community Council | 5.0% | 2.4 | Nov-68 | |

| Dovecot and Princess Drive Community Association | 4.5% | 2.0 | Jul-97 | |

| N-Trust Homes CIC | 1.1% | 0.6 | May-20 | Share current directors and current address |

| Select Social Housing CIC | 0.5% | 0.3 | Jan-21 | |

| One CIC | 8.3% | 3.0 | Jun-20 | Took on Circle Housing & Support's leases after its collapse |

| Sources: Home Reit, Companies House, and Charity Commission. | ||||

Home Reit said: “There is nothing unusual in these arrangements. The company believes that charitable focus on homelessness is an undersupplied and underfunded area in the UK.”

“For smaller charities, it is common practice to share senior-level expertise, administrative support functions and office space, which drives a reduction in operating costs, allowing them to focus resources on the vulnerable people they support. Home Reit believes that this organisational approach is currently conducive to helping the greatest number of vulnerable people.”

Despite its assurances, the fear that Home Reit’s critics have is that its push for profits and its dependence on young, thinly capitalised tenants with shared connections ultimately leads to a bad outcome for the vulnerable people living in its buildings. Evidence submitted to parliament in January this year by charity Women’s Aid said accommodation provided by Home Reit’s largest tenant, Lotus Sanctuary, in Middlesbrough for women with complex needs was poor quality, located in a dangerous area and did not provide enough care.

“For accommodation to be safe, it must be delivered alongside wrap-around support and care services to those with additional support needs,” Women’s Aid added in its submission.

Lotus Sanctuary refuted all the claims made by Women’s Aid. It said that it undertook a thorough assessment of the area prior to acquiring the building, alongside consulting with the local authority. It added that the local authority approved the premises and currently places referrals who are in need in the building.

When speaking to Investors’ Chronicle in August, many charities echoed the concerns raised by Women’s Aid around the lack of “wrap-around support” in the buildings operated under the type of model Home Reit uses. Because of the long length of the leases, the thin capitalisation of the companies and profit-making from Home Reit as the landlord at the top, the worry is that there is not much money left to provide the complex care needed for the vulnerable people living there.

Campaigners and the DLUHC select committee are calling on the government to make changes in this sector, but the wider question is around how the UK’s vulnerable should be housed. Unless the government matches its tighter regulation of this nascent sector with the development of more social housing, many of Britain’s homeless and vulnerable will have little choice but to continue to make use of the likes of Home Reit properties.