The Covid-19 pandemic has left the world facing one of the worst economic crises since the Great Depression. It has sent shockwaves through the global labour market as working hours collapse, companies freeze new hires and effectively place large portions of their workforce on hold through government subsidised retention schemes.

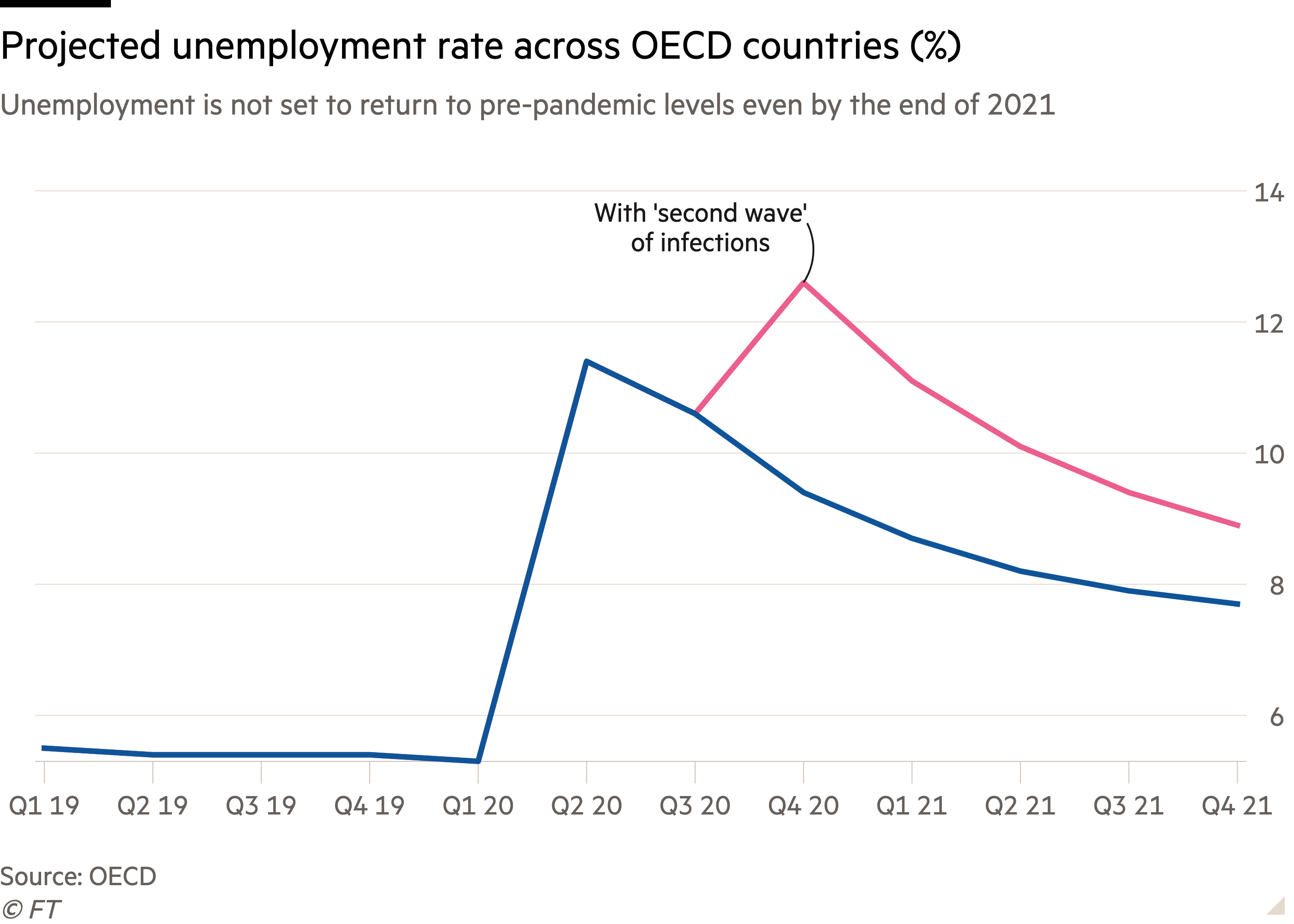

The Organisation for Economic Co-operation and Development (OECD) estimates that the impact on the jobs market has been 10 times larger than during the initial months of the global financial crisis. It projects unemployment in OECD countries will reach nearly 10 per cent by the end of the year – up from 5.3 per cent in 2019 – and does not expect a recovery until after 2021.

The turmoil in the global jobs market is reflected in the latest updates from the UK-listed recruiters. Robert Walters (RWA) warned back in April that its second quarter would be more challenging as more countries went into lockdown. Indeed, the three months to 30 June saw gross profit plunge by just over a third year-on-year at constant currencies, to £71m. This was a considerable acceleration from the 11 per cent slump in the first quarter. Reflecting the global nature of the pandemic, all geographic regions experienced a similar decline in percentage terms.

There have been pockets of resilience. “Anything to do with technology – cybercrime, fintech, all of those areas – are highly sought skill sets and in demand,” says Alan Bannatyne, chief financial officer of Robert Walters. “Medical and pharma have also been hotspots.”

The group had already scrapped its final dividend for 2019 to preserve cash, and the typical response of recruiters to more difficult economic conditions is to prune headcount – Robert Walters curtailed its workforce by 5 per cent in the second quarter to 3,734. By cutting management pay and asking employees to voluntarily reduce their working hours, it has shrunk its cost base by almost a fifth. It is now sitting on £119m of net cash (excluding lease liabilities), up from £86m at the December year-end.

Over at rival PageGroup (PAGE), the pandemic has proved more troublesome. Gross profit almost halved in the three months to 30 June, tumbling by 48 per cent at constant currencies to £118m. This is versus a 12 per cent decline in the first quarter. Unlike Robert Walters, some regions were hit harder than others. The UK – which accounts for 11 per cent of the total – saw gross profit shrink by over 60 per cent to £14m.

The domestic picture remains grim. According to the latest KPMG and Recruitment and Employment Confederation (REC) report on the UK jobs market, hiring activity for permanent and temporary positions continued to contract in June, albeit at a slightly softer rate than in April and May. Bear in mind that while Covid-19 is the protagonist right now, Brexit could compound pressures on hiring decisions as we approach our exit date from the European Union.

It wasn’t all bad news for Page. While Hong Kong was weighed down by both coronavirus and social and political turbulence, the picture in mainland China improved – gross profit was only down 17 per cent year-on-year in June versus a 27 per cent decline for the second quarter as a whole. Germany also outperformed the rest of Europe thanks to demand from the technology sector.

Page has taken similar actions to reduce costs, trimming its headcount by 8 per cent in the quarter, cutting salaries and using government assistant schemes. The final 2019 dividend was chopped in April. It reduced its cost base by 21 per cent in the second quarter and aims to eke out a further 10 per cent of savings by the end of September.

Excluding lease liabilities, the group has also bolstered its net cash position to £156m. While it has received approval to access £300m from the Bank of England’s Covid corporate financing facility, it doesn’t currently believe it will have to tap this resource.