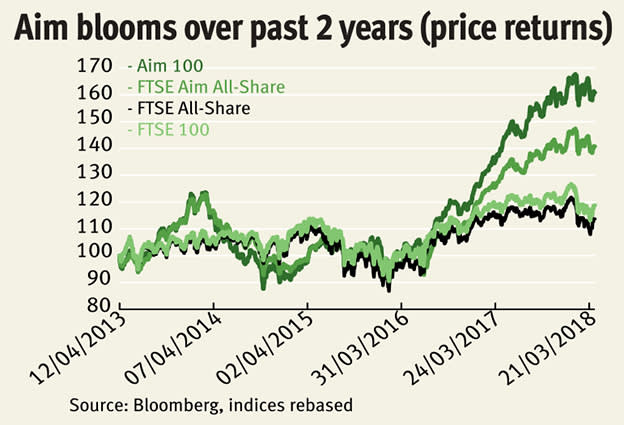

The Alternative Investment Market (Aim) is Europe’s longest running and most successful exchange for junior stocks, but its status as a fertile ground for smaller companies to raise capital hasn’t always translated into stellar returns for investors. Bigger has been (marginally) better for Aim investors; since 2005 (when data ifirst became available for the FTSE Aim 100 Index) annualised total returns for Aim’s larger companies have been 1.44 per cent versus 0.94 per cent for the FTSE Aim All-Share. Either way, shares listed on the junior exchange have done poorly, measured against the main market.

In the past two years, however, the troublesome adolescent has apparently bloomed and the size premium investors expect from smaller stocks is finally in evidence. In absolute terms, the Aim All-Share has made almost 45 per cent total returns (Apr 2016-18), easily beating 24 per cent from both the FTSE 100 and the FTSE All-Share. Of course, two years is not long enough to definitively say Aim has turned the corner, but there is cause for optimism. Academics Elroy Dimson, Scott Evans and Paul Marsh from the London Business School (LBS) see signs of Aim’s growing maturity in lower relative exposure to recent IPOs; a higher proportion of companies paying dividends; and there are now fewer listings of ‘fad stocks’. On that last point, the LBS team has gathered evidence that fad stocks (dot-coms, internet gambling, small resource and commodity stocks, and alternative energy) have done badly regardless of whether they were Aim-listed.

Also, some long-running assumptions about Aim no longer ring true. It’s certainly not dominated by junior resource stocks; the oil & gas sector plus mining stocks account for 11.3 per cent of capitalisation. The biggest sectors on Aim are consumer services (18.3 per cent), industrials (16.2 per cent) and technology (11.1 per cent). The recent outperformance of the FTSE Aim 100 Index – two-year total returns top 58 per cent – has in part been driven by continued success for its largest companies, which haven’t been resources stocks.

Of the four biggest companies on Aim one year ago, only Boohoo (BOO) has seen a negative annual change in its share price (-14 per cent). The top three in April 2017 have continued to enjoy rising share prices: Asos (ASC) up 17 per cent, Hutchison China MediTech (HCM) up 37 per cent (although it is some way off its high point at the turn of the year) while Fevertree (FEVR), up 73 per cent, remains a darling of the junior market.

Some Aim-listed companies are arguably no longer small-caps. The Numis Small Companies Index (NSCI), created by the LBS team, comprises the bottom 10 per cent of the main exchange by market capitalisation. There is also an NSCI Index including Aim companies that fall below the size cut-off. This only tends to rule out a handful of Aim stocks, but is still significant, with around 17 per cent market capitalisation of the Aim All-Share Index excluded.

Inferring some of the analysis conducted on the NSCI to Aim stocks of similar size, it is well worth keeping track of share price momentum before investing. In the past decade, momentum (where stocks that have risen continue to do so) has been the best performing return factor for NSCI stocks eight years out of 10. When analysing the investment case for companies in this report, readers should keep this in mind. A useful way to use our run-down of the Aim 100 is in conjunction with Algy Hall’s IC Alpha momentum screens, which include a regularly-updated screen devoted to Aim. Checking how the most interesting companies rank in the screens could help spot next year’s winners as, however compelling the fundamental investment proposition, the famous maxim “the trend is your friend” applies especially to small-caps.

For the first half of our Aim 100 analysis see below: