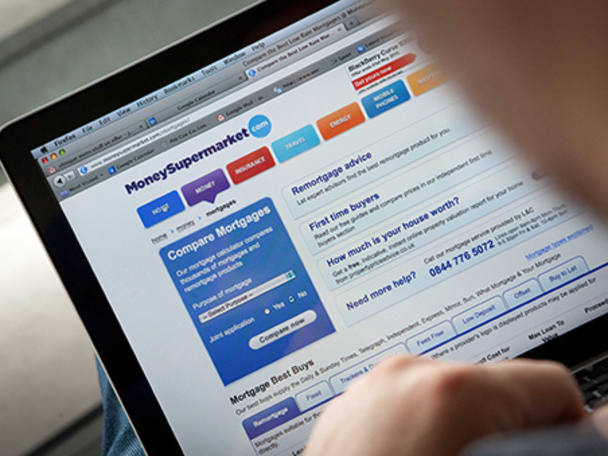

Moneysupermarket.com (MONY) shares were knocked after the price comparison website issued a subdued third-quarter (Q3) update on its insurance and money segments.

Home services in the nine months to 30 September were 40 per cent ahead of last year, having made gains of 21 per cent in the third quarter against last year’s comparable period. But money revenues contracted by 5 per cent over Q3. The segment “underperformed due to the continuing challenges in product availability'' the company said, as supplier appetite for new customers was limited. Insurance, meanwhile, “grew in a subdued premium environment despite some volatility in our natural search rankings,” with third quarter growth standing at 3 per cent. Moneysupermarket.com shares fell by as much as 9 per cent in morning trading.

Peel Hunt forecasts adjusted full-year pre-tax profits and earnings per share of £119.6m and 18p respectively for the December year-end, followed by £133.7m and 20.1p in 2020.