- A gradual rise in near-term earnings multiple is justified, and masks further growth potential

- New acquisition should magnify operational gearing effect

- Current share price provides opportunity to buy in below institutional fundraising price

Excellent performance track record

Perfectly placed fund specialism

Consolidating industry

Important new acquisition

Favourite of top funds

Higher rating than peers

Potential limits to growth

In 2007, Warren Buffett was interviewed by Jack Bogle, the late founder of passive fund giant Vanguard. “A low-cost index fund is the most sensible equity investment for the great majority of investors,” the Sage of Omaha was quoted as saying. “By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals.”

This isn’t the last time the world’s most famous stockpicker has advocated passive strategies. In 2016, he told Berkshire Hathaway shareholders that his regular recommendation to “friends who only possess modest means… has been a low-cost S&P 500 index fund”.

Throughout this period, both Buffettand Bogle have been largely vindicated. Even Berkshire Hathaway’s liquid holdings have underperformed the S&P 500 over the past decade. Against this backdrop, active fund managers have struggled to attract positive flows of investor money, thereby adding to the pressure to outperform the market and keep ahead of rising costs and pressure on fees.

Indeed, over the past half-decade, investors would have been better off owning a standard global equities tracker than individual stocks in big active UK players such as Standard Life Aberdeen (SLA), Jupiter Fund Management (JUP) and even Schroders (SDR).

This makes the ascent of Liontrust Asset Management (LIO) all the more impressive. With its shares up 18 per cent so far this year, the group continues to cut through the headwinds facing its industry thanks to the excellent track record of its funds and a position as a leading UK-based recipient of flows to ‘sustainable’ mandates – perhaps the biggest theme in investing today. Neither driver shows much sign of slowing down, which is partly why we think an apparently rich rating actually masks strong prospects for years to come.

At 1,285p, the stock currently trades at15 times consensus forecast earnings forthe year to March 2022. That’s the same forward multiple the shares traded at the end of November 2019 (again for the then-subsequent financial year), when theshares were yet to break 1,000p. Wind theclock back to June 2018, when the stock changed hands for around 600p, and the rating was still just 14.

The point of this is not to highlight that the shares have been rising – though securing ten-bagger status in seven years is nothing to be sniffed at – but that rising prices do not inevitably lead to runaway valuations if investors can stay focused on a sensible time horizon.

That isn’t always easy, as our July decision to take profits at 1,400p a share indicates. On reflection, we think that call was hasty, even if the then forward earnings multiple of 21 (based on full-year forecasts) looked toppy for a sector that typically trades in the low-teens. Since then, not only has the stock settled back to 16 times the next 12-month consensus forecast – pretty much exactly midway in the five-year range – but operating momentum has stayed strong.

| Valuation | 5 year | |||

| Liontrust | Current | High | Low | Avg |

| P/E (LTM) | 51.3 | 60.6 | 14.3 | 29.5 |

| P/E (NTM) | 16.3 | 24.5 | 8.5 | 13.1 |

| P/BV | 7.8 | 13.3 | 4.0 | 7.2 |

| P/CF | 38.5 | 45.5 | 10.9 | 22.7 |

| P/Sales | 5.5 | 6.9 | 2.4 | 4.2 |

| Div Yld (%) | 2.6 | 4.3 | 1.9 | 3.0 |

| Source: FactSet | ||||

Flows and funds remain strong

This was typified by this month’s trading update for the half-year to September.During the period, Liontrust’s assets under management and advice rose 28 per cent to £20.6bn, in part due to the significant recovery in asset prices and investor sentiment from the end of March.

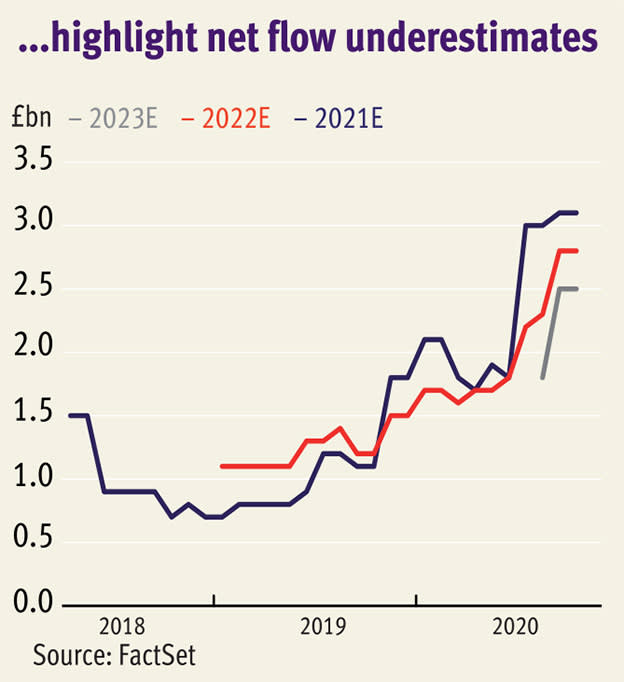

Encouragingly, both the first and second fiscal quarters were also positive for net flows, with retail investors accounting for £1.6bn of the £1.75bn in new money added to the group’s mandates in the first half of the year. This is especially impressive given DIY investors’ reputation as flighty market participants liable to overreact to recent asset price falls. We suspect this is a big reason for analysts’ serial underestimates of annual net flows, as the charts below highlight.

Having more than tripled its assets under management to £7.5bn in just three years, the group’s sustainable investing team has been a particular success story. And in a show of the increasing investor interest in a field that PwC forecasts will triple in size in Europe in the next five years, a recent virtual conference run by the division was attended by around 450 wealth managers.

Chief executive John Ions sees the trend as evidence of an increasing number of savers and investors “engaging companies and helping to deliver a cleaner, safer and healthier world for the future”. Given this wave of capital is invariably looking for the best-performing funds, it helps that Liontrust’s teams have a truly enviable track record, with 80 per cent of its ‘Sustainable Future’ funds sitting in the top quartile relative to their benchmarks on a one, three and five-year basis.

| Outperformance: proportion of Liontrust funds in top-quartile ranking | |||||

| Fund theme | Number of funds | Since launch | 5-yr | 3-yr | 1-yr |

| Economic advantage | 4 | 100% | 100% | 100% | 75% |

| Sustainable future | 10 | 60% | 80% | 80% | 80% |

| Global equity | 14 | 57% | 46% | 57% | 43% |

| Cash flow solution | 2 | 50% | 0% | 0% | 0% |

| Source: company, Financial Express to 30 Sep as at 5 Oct, bid-bid, total return, net of fees, primary share classes | |||||

An excellent reputation in a fast-growing field is a powerful thing for asset managers, whose largely fixed cost bases mean they are often beneficiaries (and sometimes victims) of operational gearing (profits rising faster than sales). Liontrust could soon receive an extra boost on this front once its £75m acquisition of Architas UK investment business from Axa completes next month. The purchase will boost assets by £5.8bn and – more importantly – expand fund distribution among financial advisers.

In good company

One of those to back the deal was Keith Ashworth-Lord, the chief investment officer at Liontrust's largest shareholder, Sanford DeLand, whose Buffettology Fund has been periodically building its holding since first buying a stake in November 2011 when the shares were at 70p.

“Then, as now, one of the main attractions was the superior performance of its funds,” he told us via email. “We like the culture of the business... we also like the way that it has managed to put on assets under management throughout the Covid panic.” Within the Buffettology Fund – whose selection of UK stocks uses the renowned US investor’s principles – only Games Workshop (GAW) has provided a greater contribution to outperformance.

Neither is Mr Ashworth-Lord the only shrewd active manager to have increased his fund's stake in 2020. While some of the larger purchases this year have come from tracker funds such as BlackRock Advisors and Vanguard buying in as the group rallied into the FTSE 250, others including Majedie Asset Management and Unicorn Asset Management both began building holdings in the wake of the stock market crash in the spring.

Prospective investors should reflect on the potential limits to Liontrust’s expansion, too. For one, the group will either need to increase the number of its funds, or expand the size of individual funds, if it is to continue growing. That might eventually be a problem, given the evidence that suggests larger funds struggle to beat their benchmarks. As most active managers find out sooner or later, a couple of years of underperformance can devastate efforts to attract new money.

Sustainable investing could also run into obstacles: questions over methodology, corporate window-dressing or subsequent underperformance could one day mean the investing world looks back on ESG as a passing fad.

On both counts, we are doubtful. For one – and to tempt fate by contradicting Mr Buffett’s claim – it is not clear that passive funds can easily replicate the two investing themes in which Liontrust specialises. Put simply, picking stocks for their strong and durable competitive advantages or sustainable practices requires a level of discrimination and screening that no-thought trackers will struggle to match. This also helps underpin our view that a cultural shift has occurred among investors, who are genuinely asking more from their portfolios than to just make money.

Whether or not you share that conviction, it’s worth asking yourself whether you would bet against a company with such strong momentum. Our answer would be no.

Last IC View: Sell, 1,400p, 8 Jul 2020

| Liontrust Asset Management (LIO) | |||||

| ORD PRICE: | 1,285p | MARKET VALUE: | £705m | ||

| TOUCH: | 1,283-1,287p | 12-MONTH HIGH: | 1,495p | LOW: | 678p |

| FORWARD DIVIDEND YIELD: | 3.8% | FORWARD PE RATIO: | 15 | ||

| NET ASSET VALUE: | 161p* | NET CASH: | £35.5m** | ||

| Year to 31 Mar | Turnover (£m) | Pre-tax profit (£m)*** | Earnings per share (p)*** | Dividend per share (p) |

| 2018 | 77 | 27.2 | 42.4 | 21.0 |

| 2019 | 85 | 29.9 | 46.6 | 27.0 |

| 2020 | 107 | 38.1 | 56.6 | 33.0 |

| 2021*** | 140 | 49.6 | 66.5 | 39.0 |

| 2022*** | 178 | 63.9 | 83.8 | 49.0 |

| +27 | +29 | +26 | +26 | |

| NMS: | ||||

| BETA: | 1.2 | |||

| *Includes intangible assets of £58m or 105p per share | ||||

| **Includes lease liabilities of £7.6m | ||||

| ***Numis forecasts, adjusted PTP and EPS figures | ||||