Jet2 (JET2) has gone through a number of transformations in its relatively short history. The Aim-traded company started life as a Guernsey-based airline, set up in the 1970s to fly fresh flowers to the UK’s mainland. It was bought by former RAF stunt pilot Philip Meeson in 1983, who first grew it into a general cargo airline. It launched its first low-cost passenger service between Leeds Bradford Airport and Amsterdam in 2003.

- Strong customer demand

- Greater focus on high-margin package holidays

- Trusted and established operator

- Lowly valuation

- Departure of long-standing chair

- Climate change risk

Jet2 is now the UK’s third-biggest airline behind easyJet (EZJ) and British Airways, and flew more than 16mn passengers in its 2023 financial year (management doesn't count Ryanair (IE:RYA) or Wizz Air (WIZZ) as direct rivals, as they're not UK-based). Jet2 mainly hops between Mediterranean beach resorts in the summer and ski slopes in the winter, with city breaks a year-round trade. It is set to open its 11th UK base at Liverpool John Lennon Airport this month.

Its activities were severely curtailed at the height of the pandemic (passenger numbers dropped by 91 per cent between March 2020 and March 2021) and the company cut around a fifth of its workforce. However, it said a decision made in late 2021 to retain more than 8,000 staff allowed it to bounce back quickly. It didn’t cancel a single flight during the 2022 summer season, when many competitors floundered.

This meant passenger numbers in the year to 31 March 2023 were already 10 per cent higher than pre-pandemic levels and have continued to increase since. In a trading update last month, the company said capacity this summer will increase by 12.5 per cent on last year.

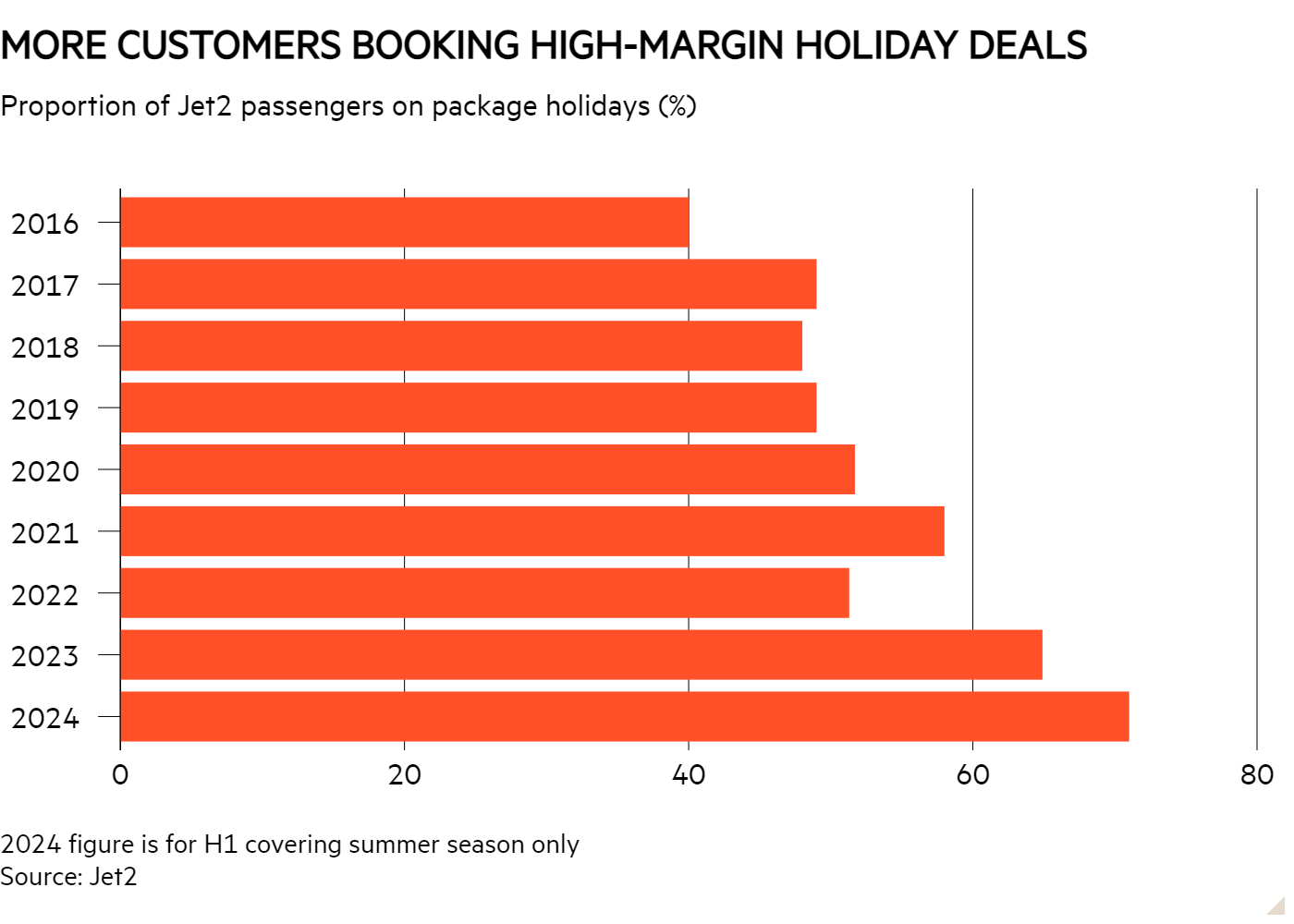

Encouragingly, a greater proportion of its customers are also flying on package deals arranged by its holidays arm. The proportion of Jet2 customers on a package deal has grown from 40 per cent in 2016 to 65 per cent in the 2023 financial year, rising to 71 per cent last summer.

Revenue from package holidays has grown from 38 per cent in 2014 to 80 per cent last year, according to FactSet. And although the company doesn’t divulge earnings by segment, it says it makes a higher margin from holiday customers.

The average ticket price for flight-only deals was £100.28 last year, while the average package holiday cost £761 – but it is proportionally cheaper for Jet2 to deliver the latter. With flights, it incurs the cost of running its network of bases and its fleet. For hotels, it generally agrees deals with owners, which allows it to scale more easily to reflect demand.

This model has its upsides and its downsides when compared with the industry as a whole. German tour operator TUI (TUI) owns flights and hotels, therefore has considerably higher overheads but takes a bigger cut of the profits if they are all sold. It also has complete control over its product.

At the other end of the spectrum, online travel agencies such as Booking Holdings' (US:BKNG) Booking.com, Expedia (US:EXPE) and the UK’s On The Beach (OTB) earn huge gross margins because they don’t incur any of the operating costs of the holidays they sell, but they have little to no control over quality or inventory.

Jet2 wasn’t the first airline to adopt a hybrid model (Virgin has been in the holidays business since the 1980s) but it’s been hugely successful at it. Its market share has jumped from 8 per cent in 2017 to 21 per cent last year, when it overtook TUI to become the UK’s biggest tour operator.

Indeed, Jet2’s resilience and skill has been thrown into relief by the struggles of its peer group. Former market leader Thomas Cook and charter airline Monarch have both gone bust.

Potential turbulence

Jet2 is forecasting pre-tax profit before currency movements of between £510mn and £525mn this year, which would be almost double its pre-pandemic peak and an increase of more than 30 per cent on last year. Cash is also abundant, with net cash (excluding leases) rising by 46 per cent to £1.82bn in the first half of FY2024.

And yet over the past 12 months, Jet2’s share price has only edged up by 5 per cent. Little wonder, then, that it recently popped up on the IC’s Alpha screen looking for UK Aim companies offering growth at reasonable price.

The lack of enthusiasm for the shares relates to concerns about risks, of which there are admittedly a few. An obvious one is that the aforementioned Philip Meeson stepped down as executive chair last year. Although not technically its founder, Meeson has been the driving force behind the business for four decades.

Alongside the key person risk of losing such an influential figure, Meeson retains an 18 per cent stake in Jet2. He offloaded more than £40mn-worth of shares between November and December 2022, and it is possible that there will be further sales, which in turn would weigh on the share price.

The succession risk appears to have been well managed, though. Chief executive Steve Heapy had already been in place for three years by the time of Meeson’s departure and had been with Jet2 for more than a decade before that, having joined in 2009 to grow the holidays business.

There’s clearly also some nervousness around demand, given cost of living pressures and the potential for a price war – low-cost airlines have all been on plane-buying sprees as they attempt to grab more market share.

Rivals have been running into difficulties, however. Ryanair chief Michael O’Leary has been warning that passengers are likely to face higher prices this summer, given that plane delivery and engine reliability problems are constraining capacity.

Boeing is pushing back deliveries to Ryanair, while some Airbus planes fitted with Pratt & Whitney’s geared turbofan engines (GTF) face recalls for inspections. Wizz Air had 33 aircraft grounded in January while their GTF engines were inspected.

Jet2 has encountered no such issue, with five new Airbus planes powered by CFM engines delivered on schedule and six more due over the next 12 months.

Moreover, consumer confidence in the UK seems to be picking up as real incomes rise. Heapy said last month that load factors – otherwise known as 'bums on seats' – on Jet2 planes for this summer's bookings were 1.5 percentage points higher than last summer, despite the planned capacity increase.

What’s more, the proportion of Jet2 customers booking package deals has climbed yet again to 77 per cent.

“Whilst recognising that there are many demands on consumer discretionary incomes, we believe that our customers cherish their time away from our rainy island and want to be properly looked after throughout their holiday experience,” Heapy said.

Heating up

That last point is also pertinent when weighing up another big risk: climate change. Jet2’s holidays business focuses on southern European resorts where heatwaves are becoming more frequent. Last year, thousands of customers were caught up in wildfires on the Greek island of Rhodes, as well as flooding in Skiathos. These, plus a one-day failure of the UK’s air traffic system, cost the company £14mn in profits.

Climate change clearly increases the risk of extreme weather events but Jet2 has argued that the impact on its business could be both positive and negative. Demand for leisure travel to some resorts could be reduced, but other destinations may become more popular, it said, with some seasons potentially lengthening.

“Although it did impact profits, the events in Rhodes last year supports our view that ATOL-protected packaged holidays are increasingly seen as an attractive alternative to DIY holidays,” said Andy Gray, co-manager of the Artemis UK Special Situations Fund, which initially bought a stake in Jet2 as part of an emergency financing deal put together in the early days of the pandemic in May 2020.

“With reps on the ground Jet2 quickly organised evacuation flights and were on hand to look after customers in evacuation centres,” Gray said. He cites the positive company reviews received through the likes of Which? and Trustpilot as evidence of a strong customer ethos.

Customer perception is clearly helped by the fact that Jet2's holidays are cheap, and the same should be true for investors. The shares trade at under eight times forecast earnings, and all 11 of the analysts tracked by FactSet think they are undervalued. And although easyJet poses a potential threat as it moves into the holidays market, it is starting from a long way back.

Jet2’s established role as the market leader has been years in the making and, as a well-regarded operator, it should prove difficult to dislodge.

| Company Details | Name | Mkt Cap | Price | 52-Wk Hi/Lo |

| Jet2 (JET2) | £3.06bn | 1,426p | 1,445p / 960p | |

| Size/Debt | NAV per share* | Net Cash / Debt(-) | Net Debt / Ebitda | Op Cash/ Ebitda |

| 472p | £1.82bn | - | 171% | |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | CAPE |

| 8 | 0.9% | 10.4% | 63.1 | |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 8.4% | 16.2% | 16.2% | 13.4% | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 6% | 3% | 16.5% | 4.1% | |

| Year End 31 Mar | Sales (£bn) | Profit before tax (£mn) | EPS (p) | DPS (p) |

| 2021 | 0.40 | -372 | -167 | 0.0 |

| 2022 | 1.23 | -383 | -147 | 0.0 |

| 2023 | 5.03 | 381 | 127 | 9.7 |

| f'cst 2024 | 6.27 | 523 | 174 | 12.4 |

| f'cst 2025 | 7.10 | 545 | 182 | 13.3 |

| chg (%) | +13 | +4 | +5 | +7 |

| source: FactSet, adjusted PTP and EPS figures | ||||

| NTM = Next Twelve Months | ||||

| STM = Second Twelve Months (i.e. one year from now) | ||||