- Bitcoin is now an institutional asset

- Decentralised Finance 'DeFi' could revolutionise the internet

- Blockchain is a threat to Amazon and Microsoft

Like ground-breaking music, bitcoin has lost its mystique by going mainstream, but the early crypto pioneers have inspired a movement. The blockchain technology cryptocurrencies are based on promises to smash and remould the internet and the financial system.

The genie of coin speculation is out of the bottle and many retail investors will get burned. But behind a craze that at times resembles 17th century Dutch tulip bulb mania, the cool kids are working on breaking everything, democratising money and information in ways that will change how we bank, work, invest and play.

Stimulus payments for US households could light another rocket under cryptocurrency trading. Already people with no investing experience are piling into the myriad of coins and tokens across dozens of (not always regulated) exchanges, without knowing what the coins even do.

In many cases the answer will be “not a lot”, but those that end up winners in the new era of decentralised finance (DeFi) will capture an enormous prize, one that several large institutions have decided they want a stake in. Their enthusiasm, along with the public craze for non-fungible tokens (NFTs), is driving a virtuous circle of crypto adoption that is poised to set the real economy alight.

Bitcoin: the starting point

Bitcoin was invented in 2008 and went into use early the following year. Enthusiasts and economists have hotly debated whether it fulfils the core roles of money, which can be summarised as being a store of value, a medium of exchange and unit of account.

For Fabio Chesini, consultant at Gartner research: “The real question is: will bitcoin mature in a way to fulfil the three functions of money? This remains to be seen.”

A massive increase in institutional demand reflects the growing acceptance that bitcoin fulfils the first criteria; and indeed it is being used in portfolios as a hedge against inflation and a store of value.

“We see institutional investors coming from a long-term perspective as a hedge against monetary inflation,” says Phil Bonello, director of research at Grayscale Investments – which thanks to its oversight of the $36bn Bitcoin Trust (US:GBTC) is the world's largest cryptocurrency asset manager.

“The bitcoin use case is as a store of value," adds Bonello. "Investors like its scarcity and the community appreciates the pace and certainty of its development – they are confident bitcoin as an asset will be the same in 10 years as it is now.”

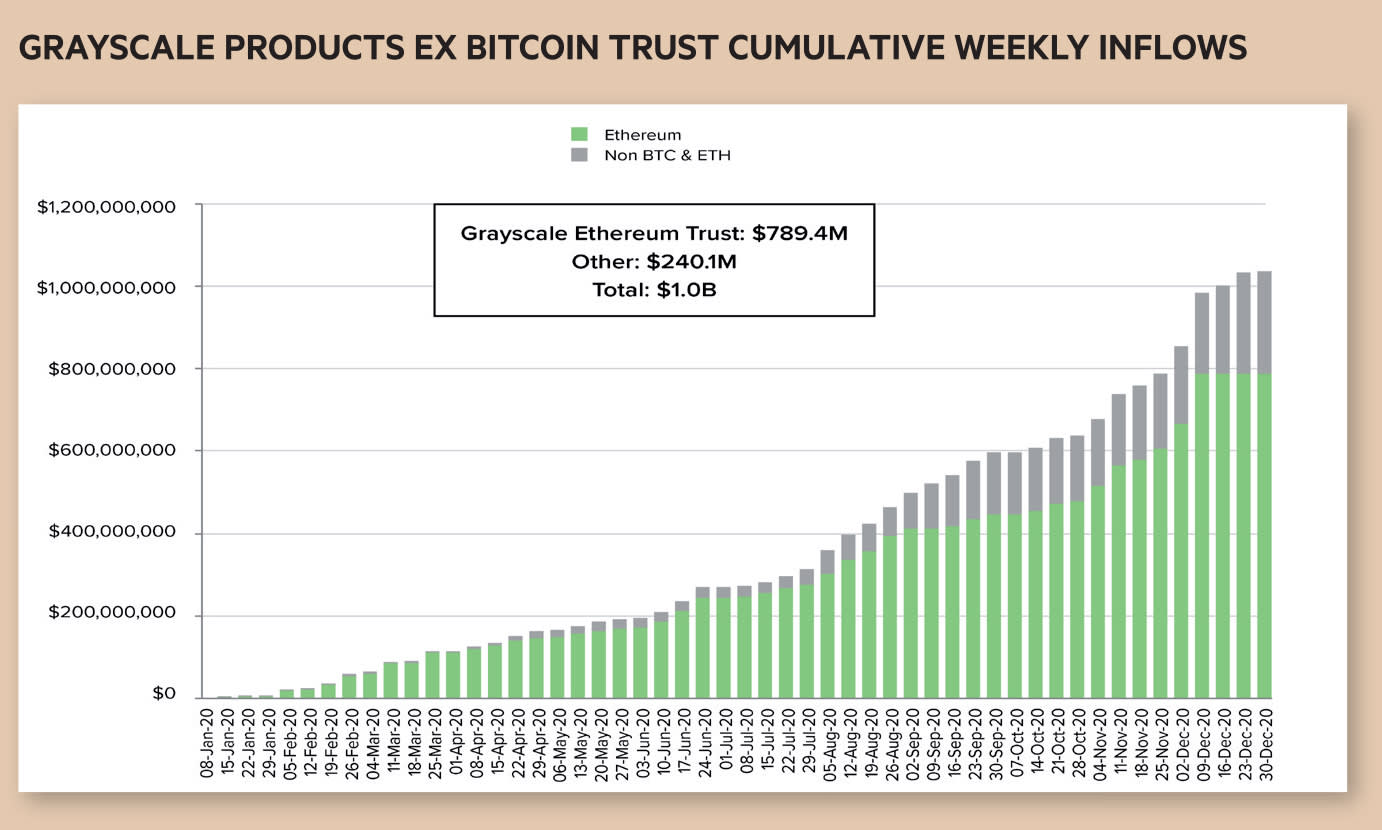

Source: Grayscale

Appetite has been immense the world over. On Deutsche Börse’s Xetra exchange there has been huge growth in a ground-breaking bitcoin exchange-trade note called BTCE and an Ethereum equivalent has been launched (although the UK regulator prohibits retail investors from buying them in this country).

“Average daily turnover on Xetra reached a record €49.7m in the first two months of 2021, an increase of more than 800 per cent over the previous year’s daily average,” says Josefin Altrichter of the Xetra and Deutsche Börse Venture networks.

Bitcoin provides a solution to investor portfolios thanks to its limited supply (only a finite number of coins can be mined) and the open but incorruptible ledger made possible by blockchain, a technology whose basics are worth recapping.

Cryptocurrency is a term derived from the use of data encryption each time coins are sent and received. A peer-to-peer network of computers record and verify all the details of transactions and create blocks of data which are added to a chain of other blocks on the ledger. It’s this process that gives the underlying technology its name.

Blockchain networks have their own unique sets of rules or protocols that distinguish them. Although there is perfect transparency that transactions have taken place, the identity of participants is hidden. Unique codes are used, which avoids making personal details public.

In bitcoin’s early days, these codes and similar security around the wallets in which coins are stored were taken advantage of by money launderers and drug dealers. Such stories haven’t been forgotten, but now blockchain monitoring solutions make nefarious activity far more difficult. It’s easy to trace transactions to bitcoin wallets and match them to IP addresses, so while personal details aren’t on display, it’s not the same as being anonymous.

Major financial institutions are clearly satisfied, and the bigger question marks concern bitcoin’s use as a medium of exchange and a unit of account in the real economy. Although becoming more widely accepted, the coin’s price swings against fiat currencies presents a potential headache for company treasury services.

Source: Grayscale

By accepting revenues in bitcoin and paying costs in dollars, Tesla (US:TSLA), for example, is diluting its status as a manufacturer of electric vehicles and battery technology. As Investors' Chronicle columnist Bearbull recently asserted, the volatility of bitcoin could make the impact of exchange rates so material to its profits that currency speculation becomes one of Tesla’s primary business activities.

Bitcoin enthusiasts would counter that the prime reason is to protect Tesla’s balance sheet from inflation in a way that is less cumbersome than holding, say, gold. Certainly, if enough businesses and asset managers continue to do the same, then not only will bitcoin’s price continue to rise, but it will expand its footprint and become ever more integral to the financial system. That would in turn improve it as a medium of exchange and even increase viability as a unit of account.

For now, Dale Kutnick, also of Gartner, views bitcoin as more of an instrument than a currency, but sees no problem in firms taking it as a medium of exchange if they can hedge their activity. “As long as you can translate it to dollars or euros on the other side, sure you’ll take it [bitcoin],” he says.

Others are more bullish: “Bitcoin is an institutional asset now, I think everyone agrees with that," says Vytautus Zabulis, chief executive of HFinance, a developer of technology to facilitate digital asset trading. “The question is the price. But if we look at the narrative that it’s the digital gold, it should cost $500,000.”

Its role as digital gold is becoming established, but users have identified shortcomings to bitcoin. For example, some online consumers still demand the privacy to shield their IP address.

It’s a fast-moving space, with privacy coins such as Monero, Zcash, Dash, ZenCash and ZCoin popping up with new technologies. The technological trade-off between hiding and scale helps explain the different uses for various coins.

Big financial institutions may be uneasy about basing slices of their clients’ portfolios on more opaque systems that lack the required scalability and liquidity. For this reason, there is a divergence of networks.

Bonello thinks of cryptocurrencies in two buckets. The first is as a store of monetary value. Here, bitcoin is the clear leader. The second bucket is about experimentation and decentralisation of the real economy both in financial and non-financial industries.

“In the ecosystem, the digital gold is bitcoin,” he says. The aspect where other protocols are leading is in “the build-out of tech solutions [that are currently] represented in centralised alternatives”. The applications to build the decentralised economy require more openness on the network and so the solutions are necessarily different to what bitcoin is providing.

Ethereum and the decentralised finance (DeFi) revolution

Arguably, the most exciting aspect of blockchain’s future is the role it will play in decentralised finance (DeFi). Ethereum, which was launched in 2014, allows other users to build decentralised applications (DApps) on its blockchain, which has the potential to spawn a new financial eco-system as revolutionary as the internet itself.

The ether (ETH) coin that is native to Ethereum has limitations in its scalability and speed. This has spawned competitors, but the outlook is influenced positively by leveraging the phenomenal Ethereum network effect.

The adoption of DeFi will happen over the next two to five years, says Zabulis, who sees the craze for non-fungible tokens (NFTs) – a technology that has been popularised with trading of original pixelated artwork – as an important first step.

One of the big facilitators of the NFT boom has been a network called Flow, which has been big in the trade of NBA basketball album pixels. Ethereum is also huge in the NFT space with its protocol allowing aggregators and exchangers to build around a standard.

“NFTs are one of the first steps allowing people to interact with blockchain in a fun way," adds Zabulis, noting that some of the valuations of pixel images have reached thousands of dollars. “It’s already a bubble. But bubbles happen on technology that changes how we interact and do business.”

In other words, although the bubble in some NFTs will burst, blockchain will become mass market. This first adoption may be for fun, but it opens the floodgates for DeFi which Zabulis is convinced “will be massive". "Banks will need to look at that very carefully," he adds.

The changes are wide-reaching for all of finance. One of the reasons the squeeze on hedge funds shorting GameStop (US:GME) was stopped was the centralised nature of the financial system enabled retail investors trading on the Robinhood app to be stopped in their tracks.

This won’t be the case when all trading is done by DeFi channels. Put through a blockchain, there is no need for clearing houses and settlement periods. There will be an adoption phase, Zabulis admits, “but imagine, you can open your banking app and you can trade 24/7”.

Is this the most valuable innovation in the crypto industry?

Some of the most exciting innovations are created on the Ethereum network. These include Chainlink (LINK), which is a system built to integrate data sources on the blockchain to other data sources.

The system exists to combine off-chain data-like bank payments to on-chain smart contracts. In theory, this will transform cross-border payments by making transactions secure, cheap and instantaneous.

Traditional financial institutions including Barclays (BARC) are said to be won over and successful adoption of such technology could be material for bank investors. Anything that helps open new revenue streams and reduces costs is game-changing in an era when low rates inhibit net interest margins from traditional lending. It’s also an example of incumbents integrating fintech and swatting back the challenge from neo-banks.

Disrupting the disruptors: are Polkadot and Cardano Ethereum killers?

Crypto site Dailycoin has asked the question whether Ethereum and the ether coin, which itself emerged to address the deficiencies of bitcoin, could be disrupted thanks to its own Achilles heel – namely scalability and the cost or ‘gas fees’ of mining ether.

Mining is the process by which coins are released into the market. Bitcoin, for example, was founded with the stated intention of there being a finite supply and the coins are released as a reward for mathematicians solving complex algorithms. This is a big business and uses up a great deal of computer power, and controversially a lot of electricity, which sullies crypto technology as being environmentally damaging.

The rate of reward for miners depends on the challenge posed by the algorithms and the supply of the coins, but this can create a bottleneck. In the case of ether, the gas fees for mining that must be paid are prohibitive and that in turn creates cost issues for those using the coin.

Alternative coins aim to solve these problems. EOS was the first, but it failed to live up to its self-billing as an ‘Ethereum killer’. Two other coins are more of a threat. Polkadot (DOT), founded by Gavin Wood, who was part of the team that launched Ethereum, is a direct challenger for network payments and its technology runs higher transaction volumes.

Cardano (ADA) is a blockchain that uses a more flexible protocol and has potential to integrate blockchains through the efficient and low transaction cost proof of stake algorithms.

Both Cardano and Polkadot boast better transaction speeds and potential for scalability than ether, which makes them better solutions for real-world payments. The real power of Ethereum is its network, however, and the roll-out of the 2.0 version is expected to iron out some shortcomings. Its place at the heart of what its backers see as the coming DeFi explosion could be very significant, even if there are better coins and protocols for some payment and e-commerce functions.

There are pitfalls, however, and 2021 has already provided a case study. At the back end of last year, the coin often ranked the third-largest by market value was XRP, which is associated with the widely adopted Ripple payment protocol. In January, the Securities and Exchange Commission (SEC) in the US sued Ripple for selling XRP as a security without the correct registration.

Should investors give newer technologies a wide berth? One could point out the regulator’s intervention has come about thanks to the rate of cryptocurrencies’ adoption and their rising systemic importance. Confusion over XRP’s status – is it a payment currency or a security? – just goes to highlight that types of usage can proliferate as coins become popular.

Giving Amazon and Microsoft a dose of their own medicine

Some of the new networks and coins are being adopted by specific sectors. The TRON network, a decentralised operating system based on the TRX cryptocurrency, has been championed by the entertainment sector and content creators – it is largely supported by the likes of Samsung and Netflix.

Grayscale Investments, which manages cryptocurrency investment funds, has just launched new products that focus on other decentralised applications. These include trusts for Basic Attention Tokens (which reward gamers), a trust to play chainlink and another that gives institutional investors exposure to Decentraland, a platform where NFT trading on digital land assets is taking place.

In a major development for the non-financial economy, the coins two other trusts are based on – Filecoin and Livepeer – potentially drain some of the economic moats that have made the likes of Amazon (US:AMZN) and Microsoft (US:MSFT) so insanely profitable.

Filecoin is a decentralised storage of file data providing an open protocol between renters and providers of data storage that anyone can use. This could be seriously disruptive for the centralised cloud server providers such as Amazon and Microsoft that dominate this market currently.

Livepeer does something similar for video and communication networks, which have also been a huge source of growth for big tech firms during the pandemic. Open protocols for routing and streaming will be transformative for work and entertainment purposes.

Gaming is another growth industry with requirements for micropayments and fast transactions. It spawns its own spin-off blockchain developments, which has seen the development of assets such as Litecoin (LTC).

Litecoin is a fast and affordable crypto that surged in price, largely thanks to the popularity of the decentralised Litebringer game – an LTC-powered role-playing fantasy game. Advantages of the coin listed include its speed, which is reported to be four times faster than bitcoin. From an environmental standpoint, it is also less resource-intensive.

‘Non-fungible liquidity’ no longer an oxymoron

To Zabulis, the fun factor surrounding NFTs has a crucial role in the mainstream adoption of blockchain and cryptocurrency technologies. The landmark $69.3m sale of a jpg work by the artist Beeple at Christie’s this month will also have captured the public’s imagination.

Along with showy examples and a bubble in assets such as digital sports cards, there is wider import for the real economy and financial system as blockchains make non-fungible assets divisible and tradable (liquid) for the first time.

If an asset is non-fungible it can’t be copied or exchanged like-for-like. A bitcoin, a physical currency note, or a bar of chocolate is fungible because it can be lent or given and replaced with an exact replica. Buildings and artworks are unique. Non-fungible tokens (NFTs) are a secure way of selling title to such assets, whether they are digital or physical, on a blockchain.

Another big innovation is that NFTs can themselves be divided into units of value in a process known as tokenisation. These tokens have an intrinsic value as they represent a portion of the value of a unique heterogenous asset.

Tokenisation unlocks the value of non-fungibles so just a portion of their worth can be used as payment or collateral in a loan or agreement. Combined with the proliferation of fungible assets on the blockchain, we have the signs of an open, secure, and collateralisable decentralised monetary system.

Central banks want to crash the party

There remains a need and desire for fiat currency equivalents, however. The US dollar remains the global reserve currency and so-called stable coins that maintain a link in valuation with fiat hard currencies have a role in digital payments for consumer goods. “It’s important to have representation on blockchains of stable US dollar-type currency," says Bonello.

There has been controversy, however. The operators of the largest stable coin, tether, were described by the New York Attorney General as having lied about the digital currency being fully backed by US dollars. Now tether claims to maintain a 1:1 valuation but with money market cash equivalents used alongside dollars.

Stable coins will soon face stiff competition as central banks look to launch their own digital currencies (CBDCs). The power of running the monetary system is something central banks guard jealously and decentralised systems of currency are a threat to this major lever of power.

In authoritarian countries such as China and Russia, there is a desire for official digital currencies to supersede decentralised private options such as bitcoin. This may be an objective in the west, too, but bitcoin is probably becoming too embedded in the financial system to face being shut down in the US or Europe.

Regulators have given heavy scrutiny to ambitious projects, such as in 2019 when Facebook (US:FB) chief executive Mark Zuckerberg unveiled the Libra coin. On that occasion, Zuck bit off more than he could chew, but it’s clear why the possibilities for digital currency and blockchain are irresistible and inspire plans of Bond villain scale amongst those who are already super-rich.

For ordinary investors, too, the crypto revolution offers a whole world of opportunities. Given the difficulty in buying shares in the pioneer companies, buying a sensible stake in the coins is the best way to get exposure.

It’s worth keeping sight of the virtues of position management and staking only what you can afford to lose. The cynics who dismissed the person or group known as Satoshi Nakamoto who launched bitcoin are eating their words, but a dose of scepticism remains healthy. The future is bright, just don’t fly too close to the sun.