It’s been a bad time for investors in Alternative Investment Market (Aim) stocks. In the last six months the FTSE Aim index has lost more than 20 per cent while the All-Share index has moved sideways. This development is both odd and normal.

It’s odd because Aim shares have fallen in circumstances in which they have in the past often done well. There has been a tendency for Aim to outperform the All-Share index when sterling rises; when commodity prices rise; when inflation expectations rise; and when the FTSE 350 low yield index does well. There’s a simple reason for this. Aim shares are riskier than others and so benefit more than others when appetite for risk rises – which often happens during a cyclical upturn which sees commodity prices and inflation expectations rise.

Even before Russia invaded the Ukraine, however, we saw Aim shares underperform the main market despite support from these forces.

In part, there’s a simple explanation for this – albeit an odd one. Aim’s underperformance of the All-Share index has been exacerbated by the fact that the All-Share index has been flattered by the good performance of a handful of huge companies. Shell (SHEL) and HSBC (HSBA) have both risen more than 30 per cent in the past six months and even BP (BP.) is still 18 per cent up despite its loss from selling its stake in Rosneft (ROSN). This means the index has outperformed most stocks. In this sense, Aim has underperformed for the same reason that almost all fund managers have: in the last six months only 10 actively managed unit trusts in Trustnet's database of all companies funds have outperformed Scottish Widows UK tracker and only two have beaten Vanguard’s FTSE 100 tracker. If we compare Aim shares with the FTSE 250 or small cap index, the underperformance is smaller – although still significant.

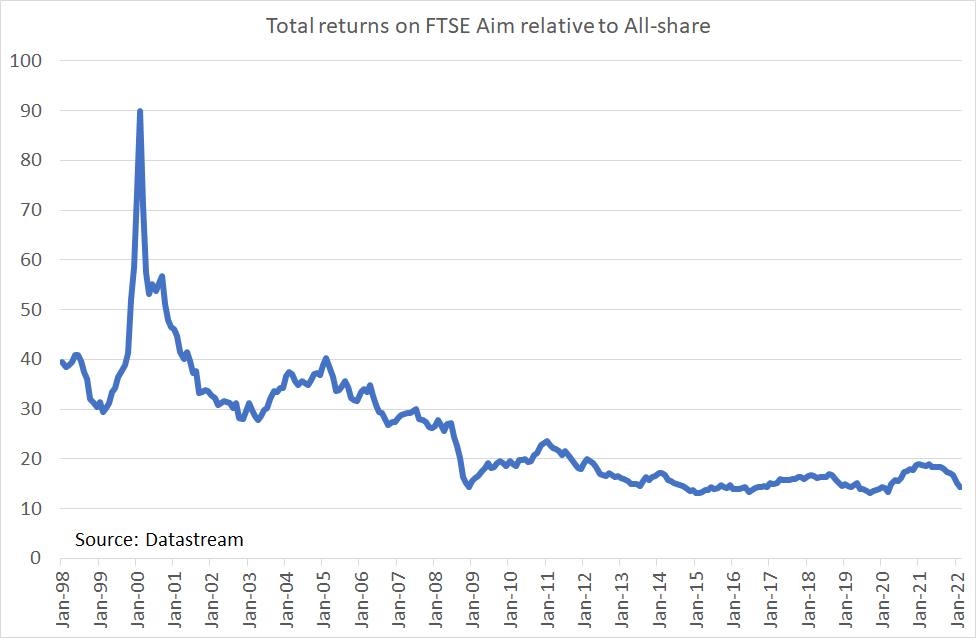

So far, so strange. In another sense, though, Aim’s recent underperformance represents a return to normality. My chart shows the point. It shows a long-term downtrend in Aim shares relative to the All-Share index. In the last 20 years the FTSE Aim index has given a total return of just 2.3 per cent a year – only 0.1 percentage points better than inflation. During this time the All-Share index has returned 6.4 per cent a year.

To put this another way, since January 1998 the Aim index has had a beta with respect to the All-Share index of one: Aim shares are riskier, but their risk is not only market risk. But they’ve had a monthly alpha of minus 0.2 per cent, implying that they underperform the All-Share index by 2.4 percentage points a year.

Recent events, therefore, fit the long-term pattern. But why is there such a pattern?

One reason lies in something we know from betting on horses and football. It’s the favourite-longshot bias. People make too many long-odds bets and so lose more money than they would if they backed favourites. They value the small chance of a big pay-off more than the large chance of a modestly decent one. This leads them to buy speculative stocks which have a small chance of becoming ten-baggers. In this sense, the poor long-term performance of Aim shares is the counterpart of the good long-term performance of defensives.

There’s something else – overconfidence. Aim shares tend to be highly valued: the dividend yield on them has averaged 1 per cent a year in the past 20 years compared with 3.5 per cent on the All-Share index. Such high valuations can be sustained only by expectations of high earnings growth. But investors are overconfident about their ability to predict this: as Alex Coad and Paul Geroski have shown, longer-term corporate growth is largely random. This means Aim shares are more likely to give disappointing earnings news.

Herein, however, lies a ray of hope for Aim investors. In the last few years Aim’s underperformance has stopped: in fact, it has slightly outperformed the All-Share index since early 2015. This isn’t terribly impressive: given their greater risks (such as the tendency to do badly in recessions) Aim stocks should outperform on average. But it might just be evidence that investors have wised up to the mistake they made in the 1990s and 2000s of paying too much for speculative shares. Investors do sometimes learn.

If this is the case, then there’ll come a time when Aim stocks will outperform the All-Share index. This, however, requires that investors’ appetite for risk increases – and predicting when this will happen is difficult. Doing so is a bet I am happy for others to take.