At the risk of anthropomorphising a digger of rocks, BHP (BHP) comes across as the most relaxed of the major miners.

- Stock looks cheap

- Incremental focus

- Better metals balance

- Strong balance sheet

- Nickel investment concerns

- Earnings down on 2022

While it is the sector’s largest by market capitalisation, the ‘Big Australian’ has kept to its antipodean roots while Rio Tinto (RIO) looks to massively expand its iron ore output with the Simandou mine in Guinea and Glencore (GLEN) shifts beyond its current coal, copper, cobalt and trading remit with a company split in two years.

BHP has used its healthy balance sheet to both buy smaller miners and build organically, but has kept to well-travelled paths. This year’s OZ Minerals buyout has added reserves near the Olympic Downs mine in South Australia, while its next mega-mine is the Jansen fertiliser project in Canada. Meanwhile, BHP plans to sell its stakes in two metallurgical coal mines in Queensland for $4bn (£3.14bn), following the spin-off of the remaining BHP Petroleum assets into Woodside Energy (AU:WDS).

Much of this action may have passed by UK investors, after BHP folded its UK plc legal structure into its Australian limited company entity two years ago, prompting its exit from the FTSE 100. Shorn of its index membership, but with a reshaped portfolio, BHP’s recent share price weakness belies a more compelling company later this decade (providing price forecasts for its major commodities support ongoing investments, of course).

Near-term hurt

Even with a strong – though flattening – iron ore price, investors have shied away from BHP and Rio Tinto this year. This points to scepticism that a price of more than $120 a tonne can hold, given shakiness in the Chinese construction sector.

For BHP, results for its June-end financial year did not give investors much to get excited about, given the fall in earnings and a decline in the final dividend to 80¢ a share, down from 175¢ in 2022.

Analyst forecasts are for sales to remain flat this year, at around $28bn each half – well short of the $35bn peak in the first half of the 2022 calendar year. This has been driven by both lower prices and some operational slowdowns. The Escondida mine in Chile, the world’s biggest copper mine, has seen production bounce around month on month. In October, the most recent period for which output is available, production was at the rate of 1mn tonnes a year, down a sixth in a month. Full-year guidance is currently slated for between 1.08mn and 1.18mn tonnes.

This comes after costs climbed 17 per cent last year, which chief executive Mike Henry has described as “a solid outcome in the context of what other producers are experiencing”.

Iron ore has been stronger. Henry cited “$5 more per tonne in free cash flow than that reported by our largest competitor” as an indicator of BHP’s relative performance. Expansion is also planned for the key Pilbara iron ore complex, with output for this year guided at 282mn to 294mn tonnes, on route to medium-term capacity of 305mn and eventually 330mn tonnes.

Growing plans

In the meantime, there is plenty on Henry’s desk already. On top of running the copper and iron ore units and fighting rising costs, there is the Jansen build and the various OZ Minerals additions in South Australia.

The company has hitched its wagon to four materials for the coming decade: iron ore, copper, nickel and potash. By contrast, Rio Tinto is moving into lithium, and is committed to finally building the sprawling Simandou project in Guinea.

It’s partly this asset that brightens BHP’s relative appeal. Rio Tinto will spend billions on funding a new railway to get the ore to port and has already experienced much grief operating in Guinea. The project’s partners, mostly Chinese, are pushing hard to get moving in a bid to ramp up non-Australian iron ore supply. First output is now expected in 2025, and could eventually produce 200mn tonnes a year – equivalent to 10 per cent of the market.

Bernstein believes the new supply would knock out higher-cost mines, resulting in a long-term cut to iron ore prices by $8 a tonne, or $91 by 2028. Investment bank Liberum’s long-term price assumption is $60 a tonne, based on weaker Chinese steel demand, rising availability of scrap and Simandou’s potential.

Such scenarios would probably be more painful for Rio. In its 2023 financial year, 59 per cent of BHP’s cash profits came from iron ore, with copper and metallurgical coal together providing the balance. By contrast, 72 per cent of Rio’s cash profits came from iron ore in 2022, with aluminium contributing 14 per cent and copper 9 per cent.

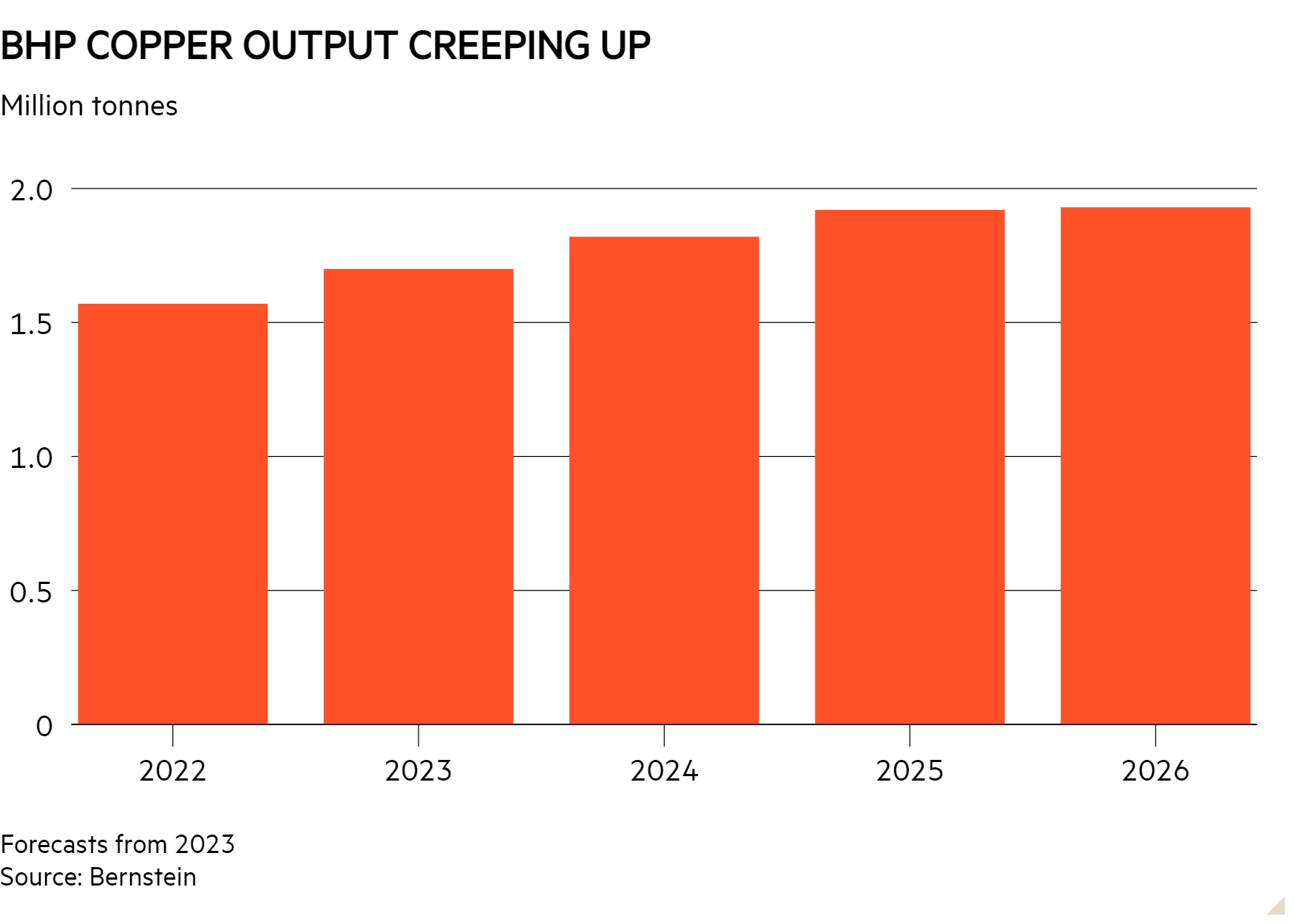

Regarding copper, the outlook here is more straightforward. Few mines have been built in recent years, and demand will climb thanks to electrification. Bernstein sees a significant deficit in supply from 2027, when it expects prices to average $10,000 a tonne. BHP’s growing copper output therefore looks well timed. It should grow thanks to the $5.9bn OZ deal, which could add around 200,000 tonnes of copper a year by 2030, if added investment is sanctioned.

Jansen is similar. While the return of Russian and Belarusian exports to the market this year pushed potash prices down, they are still well above BHP’s forecast production price ($115 a tonne) at the new Canadian mine. There are some worries in the market that the huge new mine will depress prices, but BHP will be hoping Russian supply drops off as demand rises.

Nickel growth

Mining is cyclical. To that end, a deep dive into BHP a year ago might have focused on its nickel growth options. The battery metal’s price was ripping ahead and BHP has plans to become the second-biggest producer in the world, behind Norilsk Nickel in Russia. Now, nickel is not so hot, as new Indonesian supply has tanked the price.

Despite this ramp-up, Henry is confident BHP can maintain a “margin advantage associated with the ease of translating nickel sulfides into battery precursor”. The Indonesian supply is all lower grade, so draws huge amounts of coal power to be processed into a product that can be used in lithium-ion batteries. For now, Chinese producers are very happy to use this nickel, given Chinese miners have built the operations in Indonesia.

But some buyers want premium, lower-carbon nickel. Given carmaker Ford (US:F) has signed up to fund an Indonesia high-pressure acid leach (HPAL) plant, sheer desperation for supplies may override environmental concerns.

While BHP does seem very focused on just a handful of metals, Anglo American (AAL) has shown recently that a very diversified portfolio can also bring challenges. There are risks in projects getting built, but feeding in to existing markets and working in easy jurisdictions means BHP has an advantage over competitors. Australia, Chile and Canada have thrown up challenges in the past through higher taxes, but from an investment angle we would take that over pouring billions into a mine in Guinea.

| Company Details | Name | Mkt Cap | Price | 52-Wk Hi/Lo |

| BHP Ltd (BHP) | £132bn | 2,611p | 2,881p / 2,157p | |

| Size/Debt | NAV per share* | Net Cash / Debt(-)* | Net Debt / Ebitda | Op Cash/ Ebitda |

| 753p | -£7.78bn | 0.3 x | 95% |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | EV/EBIT |

| 12 | 4.7% | 7.0% | 7.8 | |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 41.0% | 35.6% | 6.9% | 32.6% | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 1% | -7% | 10.6% | 12.3% |

| Year End 30 Jun | Sales ($bn) | Profit before tax ($bn) | EPS (c) | DPS (p) |

| 2021 | 60.8 | 27.5 | 301 | 200 |

| 2022 | 65.1 | 35.0 | 421 | 275 |

| 2023 | 53.1 | 21.8 | 261 | 156 |

| f'cst 2024 | 56.4 | 23.3 | 285 | 126 |

| f'cst 2025 | 54.5 | 21.4 | 266 | 120 |

| chg (%) | -3 | -8 | -7 | -5 |

| Source: FactSet, adjusted PTP and EPS figures converted to £ | ||||

| NTM = Next Twelve Months | ||||

| STM = Second Twelve Months (i.e. one year from now) | ||||

| *Converted to £ | ||||