Key Characteristics:

- Thinking about inheritance planning

- Large pension pots

Towards the end of your life, if there is still plenty of money in your retirement portfolio, you’ll be thinking about how best to pass it on to your loved ones and mitigate inheritance tax (IHT) as much as possible.

This is primarily a financial planning issue – you’ll want to take advantage of your own and your spouse's IHT allowances, make use of potentially exempt transfers (PETs) and gifts where appropriate – and there are even ways to leave money to charity; a win-win situation whereby you can help good causes and lower the net amount from your estate that doesn’t go to loved ones. Remember though, tax planning is complex and personal, so you should seek professional advice.

At the security selection level, there are assets you can invest in with IHT benefits. Some of these are riskier and you should remember that the prime purpose of your portfolio is to make sure you have enough money for retirement and end-of-life care if it is needed.

Choosing an asset allocation primarily to avoid tax when you die is a bit like putting the cart before the horse. That said, if you're considering IHT for your investment portfolio on top of other wealth, the chances are that you have plenty of capital. After all, the first point of call in IHT planning is using up personal allowances and the extensions to these that cover family homes. In short, if these boxes are ticked and you’re not expecting to live for decades more, then maybe you can take a little more risk in your investment portfolio.

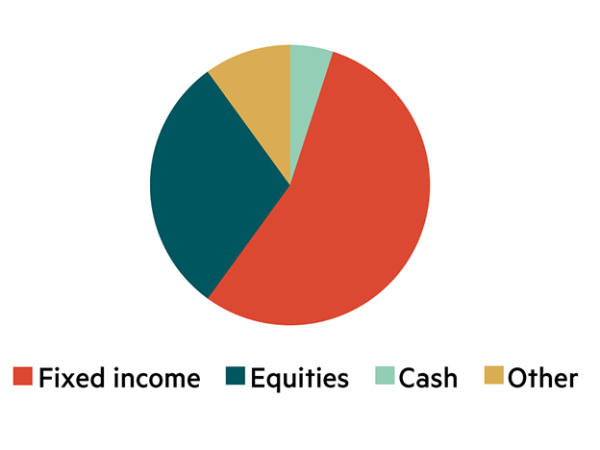

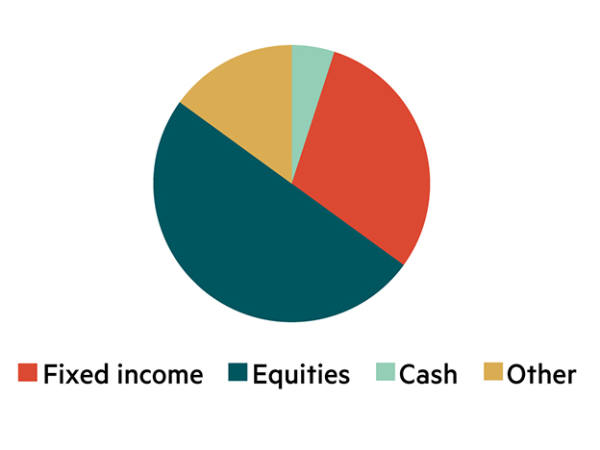

What's in it?

Cash – 2 per cent. It’s assumed that there is no need to hold a great deal of cash for defensive purposes, as the assets generate the income the portfolio owner needs.

Other – 20%

There is always a liquidity risk (ease of buying and selling) with alternatives, but there are some assets within this group that can be used to mitigate IHT. If you’re wealthy and liquidity is not an issue, it could be worth having a higher allocation to take advantage.

Fixed Income – 35%

As this is still a retirement pot, there is a need to mitigate the risk of big falls in equity markets and for a portfolio to provide income for the remainder of your life.

Equities – 43%

This portfolio has this additional risk because it is assumed that there is sufficient money for the portfolio owner not to be ruined by any market falls. Within this asset class, there are some options to invest in shares that are IHT efficient. For example, there are exemptions on some Aim-listed shares. These investments are high risk, but thanks to the tax exemptions, it may work out that you are just risking capital that would otherwise eventually be lost to the estate in IHT anyway. Although, safer blue chips should still make up the bulk of your share holdings.