Maybe the most difficult aspect of planning for retirement is deciding what it is you want to do. Implementing an investment strategy can often be simpler than deciding what you want the strategy to achieve. But both the strategy and target are vital in ensuring a successful, prosperous and happy retirement.

Investors also often overlook the bit in between – the period just before retirement where their asset allocation needs to be adjusted to meet the changes in their lives. At this point, rather than just watching your assets grow, you need to consolidate your gains and shape your investment strategy for the future.

Tailoring your asset allocation to meet your financial needs in retirement is essential because if you don't do this correctly there’s a high chance you will take too much or too little risk. This increases the probability of losing capital when you need it or your portfolio not growing enough to provide income to last for the rest of your life. You need to balance growing your self-invested personal pension (Sipp) with banking the gains to provide what you need.

Sipps can be used in different ways, for example to provide an income or lump sums, fund an annuity purchase, or be passed on as an inheritance or family support. Each different purpose requires a different asset allocation based on how soon you need the assets. The amount of time until you start cashing in the assets is the starting point for determining the appropriate asset allocation. The longer you have until you will need to draw from your Sipp, the more risk you can take with it. Below are some asset allocation strategies for different Sipp uses.

Income drawdown

Perhaps the most complicated Sipp investment strategy is the one required for income drawdown. You need a combination of assets that will produce income but also grow over the course of your retirement. Determining the right pre-retirement asset allocation for income drawdown depends on several factors.

You need to decide whether you are happy to erode the capital value of your savings during retirement. This is probably necessary if you want an income yield above what is naturally produced by your portfolio, you’re confident that your portfolio will last for the rest of your life in retirement and are not concerned about capital running out before you die. If you do not want to take this risk or are happy to live off the portfolio’s natural income and growth, leaving the original capital value intact, then your asset allocation should be changed.

The other factor is whether you take your 25 per cent tax-free pension entitlement from your Sipp. And you should have a cash safety net, adds Sophie Kilvert, private client manager at wealth manager Seven Investment Management. This does not necessarily need to be in your Sipp, but if it is you will need to adjust your asset allocation as you approach retirement. You should hold cash worth around two years' worth of your income so that in down markets you do not need to draw from your investment portfolio. Taking income from investments that are falling in value compounds losses, so it is better to leave them so they can partake in any subsequent market recovery.

Ms Kilvert says if you expect to use the portfolio’s natural yield and growth for income you should not need to make many changes to your asset allocation as your requirement for risk and return remains the same.

“Some argue that when you take income from your portfolio you need to reduce risk because of the life stage you’re now at," she says. "But if you start drawing your retirement income at 65, that money has got to last for maybe 25 years or more, which is a long time. If you de-risk it at that stage you may not be taking enough risk to ensure you have enough money until the end of your life.

You may also not need to shift the asset allocation to income stocks or funds at retirement.

“You don’t need high-yielding stocks or funds, you could take an income from the capital return," she explains. "You can take an income from a combination of capital growth and income."

This is because profits made on investments held within a Sipp are not subject to capital gains tax.

However, if you want your income to grow in line with inflation a diversified asset allocation designed for growth and income needs to factor in inflation expectations, and may require different and inflation-backed investments.

Iain McGowan, head of funds proposition at pensions provider Scottish Widows, says the default strategy they use for pension savers takes a slightly more risk-averse approach and reduces risk on the approach to retirement.

At 15 years from retirement, the allocation of 85 per cent equities and 15 per cent bonds is changed to 40 per cent equities and 60 per cent bonds until five years before retirement. The allocation over the five years before retirement is 25 per cent cash, 30 per cent equities and 45 per cent bonds. There is 25 per cent in cash, so investors can withdraw this as their tax-free lump sum.

However, the reduction in equities is not achieved by selling out of riskier areas, such as emerging markets, into more stable developed markets such as the US and UK. Rather this is done proportionally.

“The 30 per cent allocation to equities is split by region and we review this on an annual basis," says Mr McGowan. "We have in the past had slightly different allocations based on how close you are to retirement, but our modelling never threw up any major differences and doesn’t suggest having a different regional asset allocation depending on how far away from retirement you are. If someone remains invested in retirement, our core assumption is that they will remain invested for another 20 years or more, so we still regard it as quite a long-term investment. We never move from an assumption of being a long-term investor to a short-term investor.”

This is a simple model, but more complex ones with a similar risk level can be created, as demonstrated in chart 2. This is an example of an allocation of about 40 per cent to equities, with the remaining 60 per cent in other growth, income and capital preservation assets with the potential for diversified returns.

Annuities

If you plan to purchase a guaranteed income via an annuity you will need to change your asset allocation as you approach retirement. It is important to reduce risk, because if you have a high allocation to equities just before you cash in your Sipp to purchase an annuity and markets fall, the value of your Sipp will be less and you will not achieve as high an income as you would have before the fall. A sensible approach is to consolidate your Sipp into annuity-like assets to maximise your income and minimise risk.

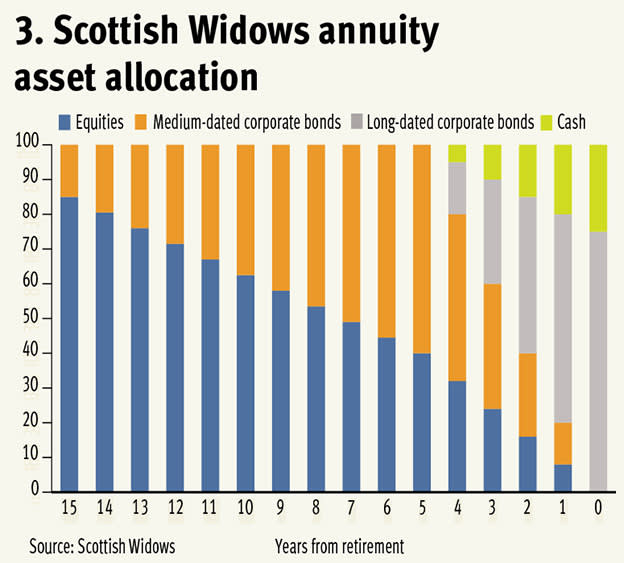

Mr McGowan says Scottish Widows does this in a similar way to its drawdown strategy, but with different assets. At 15 years from retirement, the asset allocation is 85 per cent equities and 15 per cent bonds. This would shift over the next 10 years to 40 per cent equities and 60 per cent medium-dated bonds. And over the five years before retirement, this would be moved to an allocation of 75 per cent long-dated corporate bonds and 25 per cent cash, as shown in chart 3. The cash allocation is for investors who wish to take their 25 per cent tax-free allowance, although is not necessary for those who do not want to do this.

Ms Kilvert says the main aim of shifting to lower-risk assets so far from retirement is to minimise the probability of being wrong. An annuity gives you less room for manoeuvre than income drawdown because it is a single, irreversible transaction.

However, bonds do not offer much value and are susceptible to falls at the moment, particularly long-dated ones. "It’s very tricky with the fixed income market, so you should probably choose someone to manage this risk for you," says Ms Kilvert. "Maybe consider an absolute return fund, as they have exposure to alternative assets and do not just rely on fixed income.”

However, there will be a mismatch of assets and this may cost you more in transaction fees when purchasing an annuity.

Cash and inflation

If you want to withdraw all your Sipp assets as your 25 per cent tax-free entitlement the process is simple. Move your Sipp into cash over a period of time, selling investments and banking the proceeds. However, things are slightly more complicated if you plan to use this cash to provide support to family members. In this instance you should not consider your time horizon but that of the recipients of the cash.

“The time period over which you de-risk the Sipp depends on when your benefactors might need the cash," says Ms Kilvert. “Start de-risking on the approach to executing that decision. Situations change, and you might want to do something but be unsure when you would like do it, in which case taking a staggered approach is very sensible. You might end up sitting on too much cash but have the security of knowing it's safe.”

Asset allocation becomes even more complex if you want this cash to maintain its real value and keep pace with inflation. National Employment Savings Trust (Nest), the UK’s largest pension fund, runs a pre-retirement fund for its members which aims to match inflation.

“Our inflation portfolio holds a plethora of asset classes," says Stephen O’Neil, head of private markets at Nest. "We don’t really mind about liquidity as much, for example we think a 65-year-old can hold real estate. We generally don’t move into assets [with a similar return to] consumer price inflation (CPI). You could argue the best assets for inflation are equities and real estate, but equities carry an enormous amount of other risks. The portfolio doesn’t look for an explicit linkage to inflation in the assets, but our models incorporate an assumption on CPI and the asset allocation is built around that. There is a portion of equities, alongside things such as high-yield bonds and investment-grade bonds. Asset classes like emerging market equities reduce over time. Infrastructure debt can have strong inflation linkage so that may feature in the consolidation phase as a more explicit hedge against inflation.”

Constructing a CPI matching portfolio is more complex. Nest’s fund, which aims to match CPI, can be seen in chart 4. However, this is on a much larger scale scale than the size of funds private investors have. So while Sipp investors should consider their diversification and risk tolerance, the dealing charges involved in allocating to so many asset classes and funds are unlikely to be appropriate for a smaller sized fund.

Finding the right timeline

One of the biggest decisions you need to make is when to start changing your asset allocation. Nest starts de-risking its members 10 years before retirement, and Scottish Widows 15 years. But de-risking your Sipp too early may mean you give up returns and de-risking it too late may mean you take too much risk. The period over which you de-risk should extend over a market cycle to reduce the risk of only de-risking in a downturn and consolidating losses, or only de-risking in a bull market and forgoing gains.

“If you look at the past 30 to 40 years, 7.5 years is the average timespan between market peaks and troughs, so we chose to de-risk over 10 years,” says Mr O’Neil.

However, he and Mr McGowan say these are conservative views as they are making decisions on behalf of other people so err on the side of caution.

“It’s a judgment call and dangerous if you get too scientific about it – you end up with a spurious rationale,” adds Mr O’Neil.

However, Ms Kilvert says: “I would give yourself two to three years, but it depends on the outlook for markets. You can’t predict this, but at the moment if I knew I was going to retire in three to four years I might want to be more cautious than I was two years ago. You can’t predict the future, but put reasoned thought into it. [For example] do you think things are going to be more difficult in the next two years than they have been in the past five?”

Any reduction should be gradual and uniform. “It should be a straight line,” says Mr O’Neil. “If you start with 55 per cent in equities and aim to reduce this to zero, take 55 and divide it by the number of years [over which you are going to do it] and you have the annual percentage reduction. We did some research on if there is a better approach. But when you have modelled it 10,000 times, the standard deviation of outcomes is far larger than any benefit you get by tweaking the average reduction in allocation.”

Find out more about Sipps with our special guide: