China’s real estate crisis is a bit like a black hole. While government censorship and the opacity and unreliability of economic statistics make it difficult to see what lies at its centre, the way it has bent and mis-shapen the world is clear enough. What is now categorical is that a debt-fuelled property bubble has burst, leaving two of China’s largest real estate companies, Evergrande and Country Garden, on the brink of bankruptcy as rows of unfinished sky-high apartment blocks sit empty.

- Strong brand and history

- Non-transactional work holding up

- Global property downturn

- Rising costs

- Thinning cash flow

- Weaker balance sheet

The crisis is also causing waves for UK and European companies. While some are indirectly exposed to falling demand in the Chinese economy, others are directly sucked into the mess.

One of the biggest of these is estate agency Savills (SVS), which depends on the Asia Pacific region for 31 per cent of its revenue. The wounds are yet to be felt. In its most recent results, it was yet to record a hit from the Chinese housing downturn. Instead, Savills recorded an uptick in Asia Pacific residential fee income thanks to “renewed activity in mainland China”.

That seems unlikely to continue. Official Chinese data suggest house prices have fallen 2.4 per cent from an April 2021 high, but many western economists believe the government is massively underplaying the scale of the problem. Fitch Ratings is warning that annual new home sales in China could fall as much as 15 per cent.

China is not the only country Savills is exposed to. It makes 15 per cent of its income from continental Europe and the Middle East (CEME), 14 per cent in North America, and 40 per cent in the UK, where it is listed. While the situation in China’s residential market may not be as acute as elsewhere, global diversification may be less of a strength right now, given the raft of property markets facing difficulty for the foreseeable future.

Contagion or containment?

The worry for all businesses – not just Savills – is that a Chinese housing market crash will cause contagion in other sectors. The most immediate is the Chinese commercial property market, which some see as a potential point of failure should China’s biggest housebuilders struggle to pay bills owed to construction companies.

Then there are the geographically close markets. Hong Kong’s historically buoyant property market also faces a slowdown due to its proximity to and connection with mainland China. Sales values in Hong Kong slumped by 26.2 per cent between the first quarter of this year and the second, as the per-square-foot value of a new home fell 20 per cent over the year to June. Both a commercial property crash in China and wider contagion across Asia Pacific would be bad news for Savills.

In the UK, Savills’ biggest market, the situation is better but still sluggish. While some forecasters expect commercial property transactions to recover next year, continued pain for the office real estate market remains a live possibility, as the post-Covid debate over the future of work rumbles on. As for the residential market, house prices are predicted to continue falling until the end of 2024. In both markets, Savills recorded a steep drop in revenue – a third for commercial property and a quarter for residential – at its half-year results.

The outlook for CEME, where Savills’ focus is the commercial market, is more variable. Despite sharp reductions in transactional activity in Germany, France and the Nordics, the region posted a 9 per cent rise in revenue in the first six months of 2023. As with the UK and Asia, some CEME regions or asset classes may do better, but the region looks unlikely to roar back to life any time soon, which is a worry for a division that made an underlying loss of £12.3mn (against revenue of £150mn) in the first half of 2023.

As for North America, the biggest risk is the office market. Savills recorded a 5 per cent drop in revenue over the period, which it said would have been a 9 per cent drop were it not for the strong dollar against the pound. Strong performances in New Jersey, Philadelphia and southern California helped to “largely offset a substantial decline in revenue” from the New York office market.

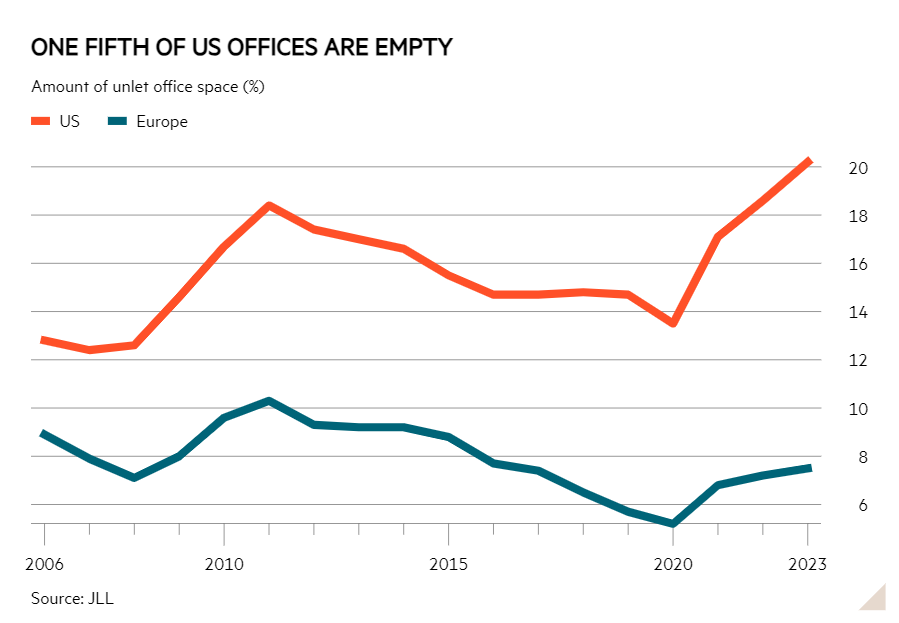

The slump in New York is a concern spreading across many major US markets amid growing questions around the use case for offices. While this trend is evident in the UK and Europe too, the US situation appears more acute: according to agency JLL, a much greater tendency to work from home across the pond has resulted in over one-fifth of US offices being unlet, compared with 7.6 per cent in Europe. Rather than an outlier, there are reasons for estate agents to fear that New York could be a lead indicator.

In short, there are many headwinds facing Savills’ business. Different regions have different real estate market problems – and some even have opportunities – but on balance these headwinds look sufficiently large and persistent as to hurt Savills’ income for the coming years.

Costs, crashes, and competition

In addition, costs are rising at the company, largely due to pay rises. Savills is a service business that employs more than 40,000 staff to advise real estate owners all over the world. Labour shortages and inflation in many of the geographies Savills operates in mean the company has had to pay extra to retain the best agents and dealmakers. As a spokesperson put it, the strategy is "to maintain bench strength at a time when clients need help and advice most". A wise move perhaps, but the result has been a drop in profit and margins – a trade-off that may be exacerbated further so long as pay inflation is still running high.

As well as increasing costs, Savills’ borrowings have grown sharply at a time of higher interest rates. In the year to June, thinning cash and cash equivalents, a £92mn leap in short-term debt and a £11.8mn increase in an overdraft facility conspired to thin the group’s headline net cash pile from £148mn to £12.9mn. Add in lease liabilities, and net debt has increased from £144mn to £245mn in a year, while shareholder equity has flatlined at £731mn. And while interest on cash holdings will offset some higher debt costs, the business is more constrained in its ability to compete for business when the market picks up. Although Savills did recover well from the last global property downturn, its balance sheet was in a stronger position, with £66.3mn in net cash at the end of 2009.

With earnings constrained and costs running high, Savills may need to make cuts. Operating cash flows thinned from £113mn to £61mn in the period, before factoring in negative movements in working capital. In addition, the 6.9p interim dividend was not covered by post-tax earnings. Although a Savills spokesperson told us a dividend cut would be "very unlikely [...] except in the most unexpectedly bad circumstances", this could still be an area to watch.

Then there’s competition. As a real estate agency, Savills has many rivals offering the same services in the same geographies. Any one of them could capitalise on Savills' relative lack of resources emerging from this downturn and outspend it to steal clients and deals.

Of course, the business has plenty of strengths. Although competition is fierce, its biggest rival, CBRE (US:CBRE), has also posted negative net cash from operating activities for the past six months. What’s more, Savills’ most recent results showed an ability to offset declines in transactional revenues and grow in other property services such as planning advice and building management.

Still, even if Savills can grow its less cyclical property revenue streams significantly, the company will have to contend with large negative trends beyond its control. Make no mistake, this is a solid business with a heritage brand. But set against bullish analyst expectations of a recovery over the next year (see table), it would not be surprising to see potentially painful slips in the share price.

| Company Details | Name | Mkt Cap | Price | 52-Wk Hi/Lo |

| Savills (SVS) | £1.29bn | 894p | 1,066p / 750p | |

| Size/Debt | NAV per share* | Net Cash / Debt(-) | Net Debt / Ebitda | Op Cash/ Ebitda |

| 593p | -£245mn | - | 67% |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | CAPE |

| 12 | 4.0% | 3.2% | 14.9 | |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| - | 11.7% | 7.5% | 8.1% | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 6% | 17% | 4.0% | -3.7% |

| Year End 31 Dec | Sales (£bn) | Profit before tax (£mn) | EPS (p) | DPS (p) |

| 2020 | 1.74 | 97 | 56 | 11.0 |

| 2021 | 2.15 | 198 | 111 | 40.1 |

| 2022 | 2.30 | 165 | 90 | 33.9 |

| f'cst 2023 | 2.28 | 117 | 61 | 33.6 |

| f'cst 2024 | 2.38 | 148 | 77 | 36.1 |

| chg (%) | +4 | +26 | +26 | +7 |

| source: FactSet, adjusted PTP and EPS figures | ||||

| NTM = Next 12 months | ||||

| STM = Second 12 months (ie one year from now) | ||||

| *Includes intangibles of £516mn, or 380p per share | ||||