- Potential earnings upgrades to come from duo

- But previous forecasts of turmoil not yet

This time last year, Begbies Traynor (BEG) and FRP Advisory (FRP) looked poised for stellar growth. Interest rate rises, supply chain disruption, surging input costs and the withdrawal of pandemic support measures looked sure to wreak havoc on the corporate landscape, which meant one thing for the Aim insolvency specialists: lots of new business. Since then, however, both companies have suffered double-digit share price declines and underperformed the wider market.

What is going on?

Much of the answer lies in recent insolvency numbers. “Commentators were confident that the perfect storm of rapidly rising inflation, higher interest rates, accelerating labour and energy costs would lead to a surge in insolvencies,” FRP said in July. Begbies was one such commentator: its quarterly ‘red flag alerts’ have been flapping violently for well over a year now.

“In fact, for some of the past year, businesses proved this theory wrong and remained remarkably resilient to the external challenges they were facing,” FRP said, resulting in “a largely unfavourable market backdrop” for the firm.

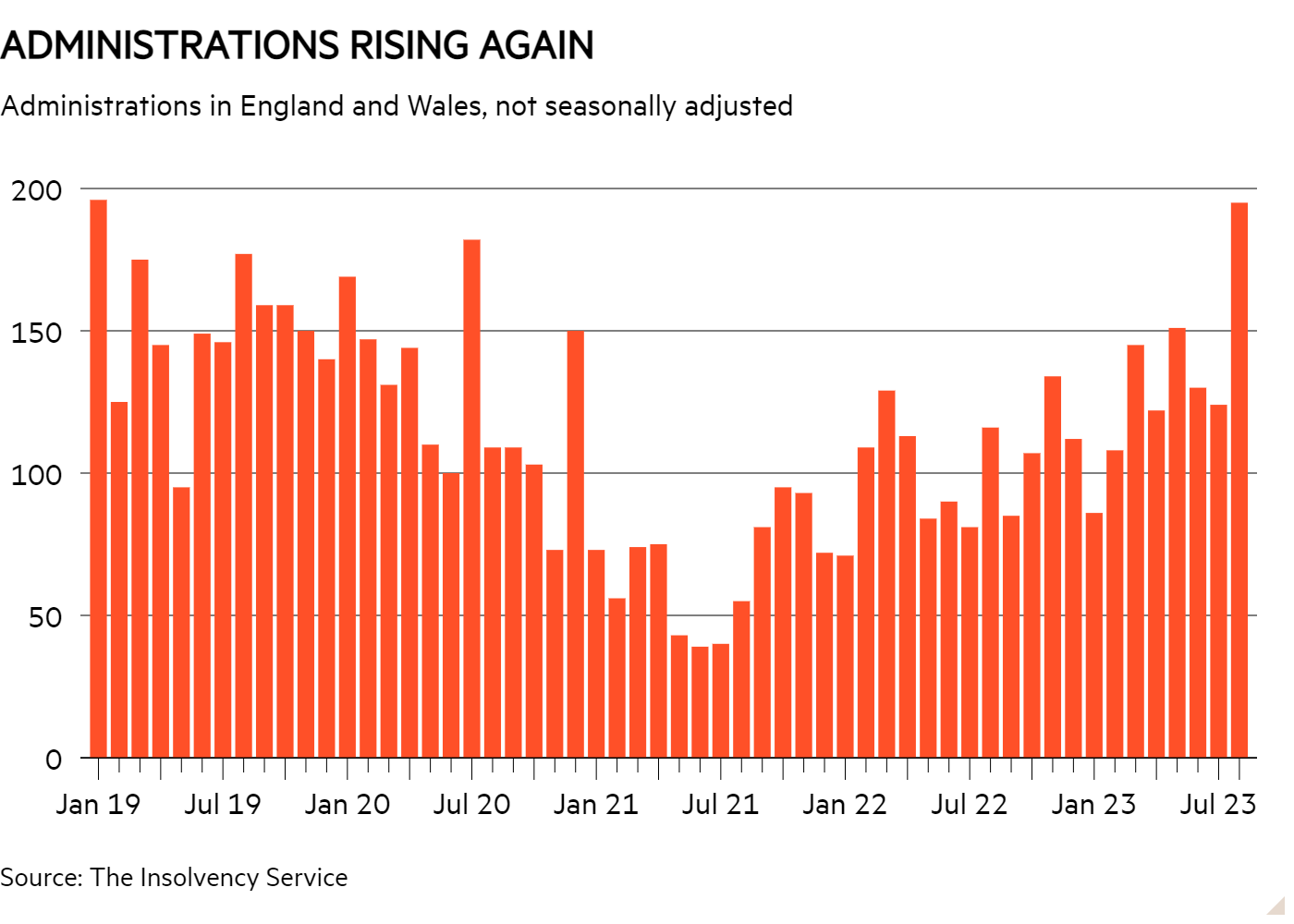

Government statistics show that total company insolvencies have been on the rise since 2021 and overtook pre-pandemic levels in 2022, but growth has been fuelled by liquidations. By contrast, administrations – which are typically twice as profitable for restructuring specialists, due to their size and complexity – only exceeded 2019 levels last month.

While Begbies and FRP met analysts’ expectations in the year to April 2023, therefore, growth did not necessarily come from where people expected. Begbies’ property advisory arm, for example, actually grew faster than its insolvency division in the 12-month period, delivering sales and operating profit growth of 12 per cent and 19 per cent, respectively, compared with the 10 per cent and 14 per cent delivered by the core business.

The market still isn't braced for a surge in demand, however. In fact, revenue growth is expected to decelerate between now and FY2026.

Several analysts have said, however, that their estimates may prove too conservative given the uncertainty over administrations. “If I were going to bet, I suspect we will have [earnings] upgrades, but they will be towards the latter end of Begbies’ FY2024,” said Shore Capital analyst Vivek Raja, whose firm is Begbies' broker. FRP hinted at this in its AGM update last week, saying the group would "at least deliver the current full-year market expectations".

A jump in sales could give profits an even bigger boost, as staff would be working harder but fixed costs would remain roughly the same.

This all makes the question of valuation rather tricky. The market has soured on these counter-cyclical plays because big companies haven’t been collapsing as expected, but grimmer times could be around the corner. Michael Donnelly at Investec flagged that, with a forward price/earnings (PE) ratio of roughly 14.7, FRP shares “sit towards their trough rating post the 2020 IPO, which we regard as incompatible with a significantly more hostile corporate environment where higher interest rates and inflation, economic stagnation and Covid loan repayments look set to drive the highest quarterly insolvency number since the global financial crisis".

Begbies, with its forward PE ratio of just 11, is also “wrongly priced at this point in the cycle”, according to Shore Capital. Both companies are cheaper than a year ago, with Begbies trading at 14 times forward earnings and FRP at 20 times.

Buy and build dilemmas

It’s notable, however, that Begbies remains cheaper than FRP, despite doing similar work and being a similar size. One possible explanation relates to acquisition concerns. Begbies has a buy-and-build strategy, and roughly half of its EPS growth since 2019 has come from the companies it has bought.

In the 2023 calendar year, however, Begbies made two property acquisitions: a firm of chartered surveyors and an online property auction group. It’s still early days, but the company could potentially dilute its counter-cyclical earnings just as administrations are picking up.

Then there’s the issue of Begbies’ numbers: there is a big discrepancy between its adjusted and statutory profits. In the year to 30 April 2023, for example, adjusted profit before tax came in at £20.7mn while its statutory profit before tax was just £2.9mn. Previous years display a similar pattern.

This is largely due to acquisition accounting – specifically IFRS 3, which rocked the results of fellow professional services firm Gateley (GTLY) earlier this month. The rules essentially mean that consideration paid for acquisitions is charged to profit, rather than appearing on the balance sheet. Shore Capital’s Vivek Raja described this as “unintuitive” and said it made it “hard to tell how much they ultimately pay for businesses”.

Begbies' track record is reassuring, however. And, after a disappointing year for their shares, both insolvency firms seem to offer defensive growth and potential earnings upgrades at a very reasonable price – even if it's hard to feel cheerful about the reasons why.